For the 24 hours to 23:00 GMT, EUR declined 0.99% against the USD and closed at 1.3328, after key events including the European Central Bank’s cash injection passed without surprise. Meanwhile, the greenback rose, after the Federal Reserve Chairman, Ben Bernanke, gave no hint of further quantitative easing in his testimony before US lawmakers.

The ECB reported that 800 banks borrowed €529.5 billion ($713.4 billion) in three-year loans at the central bank’s refinancing rate of 1%.

A member of the ECB’s governing council, Ewald Nowotny, citing optimism in the region, stated that the Euro-zone may soon witness the “green shoots” of economic revival.

In economic news, the Consumer Price Index in the Euro-zone was revised down to 2.6% (YoY) for January, marking the lowest level in five month. In Germany, unemployment rate remained unchanged at 6.8% in February, unchanged from the revised rate for January, while the number of unemployed persons held steady at 2.87 million in February. Additionally, German import prices rose 1.3% (MoM) in January, marking the highest increase in a year.

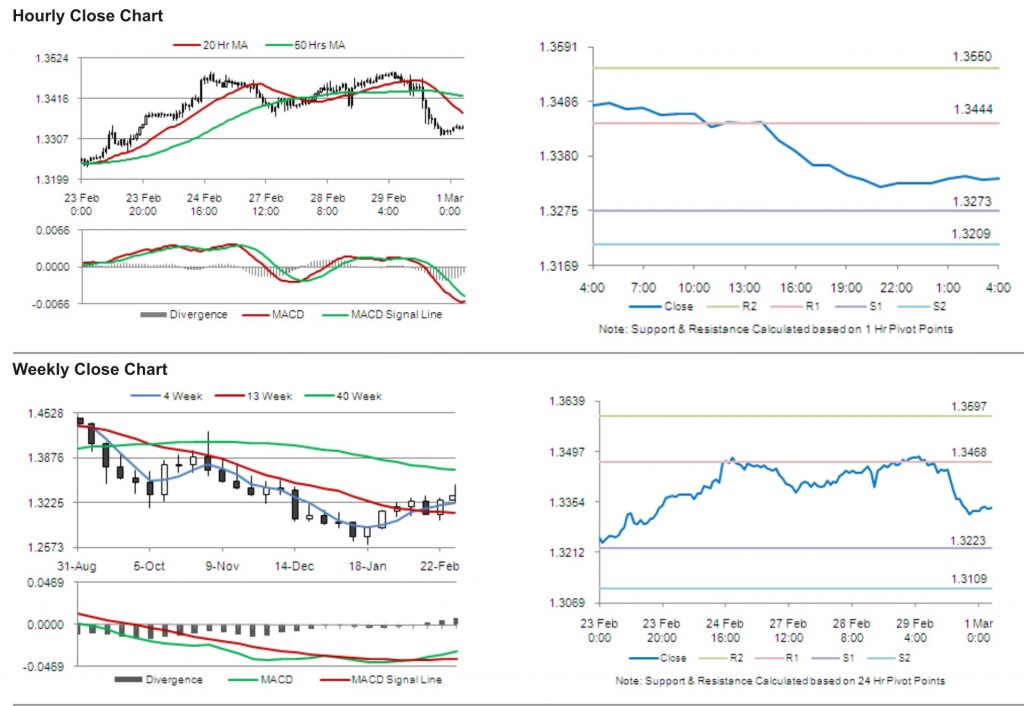

In the Asian session, at GMT0400, the pair is trading at 1.3338, with the EUR trading 0.07% higher from yesterday’s close.

The pair is expected to find support at 1.3273, and a fall through could take it to the next support level of 1.3209. The pair is expected to find its first resistance at 1.3444, and a rise through could take it to the next resistance level of 1.3550.

Trading trends in the pair today are expected to be determined by the release of unemployment rate and manufacturing Purchasing Manager Index data from the Euro-zone. Investors are also eying Spain and France bond auction due to be scheduled later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.