For the 24 hours to 23:00 GMT, GBP rose 0.14% against the USD and closed at 1.5923, after the release of positive economic data in the UK.

Data released in the UK showed that the mortgage approvals advanced to 58,728 in January, their highest level since December 2009. Moreover, M4 money supply rose 1.6% (MoM) in January.

Moreover, speculation of additional easing faded after the Bank of England Deputy Governor, Paul Tucker, stated that policy makers must be ready to withdraw stimulus when the UK economy strengthens.

In the Asian session, at GMT0400, the pair is trading at 1.5920, with the GBP trading 0.02% lower from yesterday’s close.

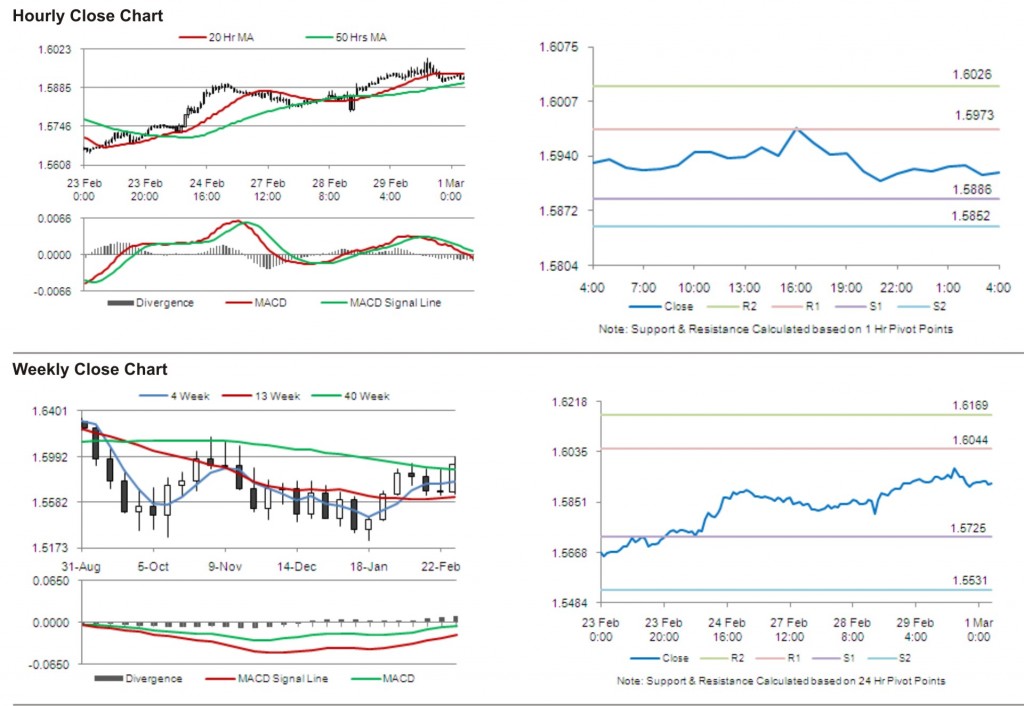

The pair is expected to find support at 1.5886, and a fall through could take it to the next support level of 1.5852. The pair is expected to find its first resistance at 1.5973, and a rise through could take it to the next resistance level of 1.6026.

Investors are awaiting Nationwide House Prices and manufacturing Purchasing Manager Index data in the UK later today.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.