Oil prices advanced 0.66% against the USD for the 24 hour period ending 23:00GMT, closing at 107.03, on speculation that demand for oil might rise after the European Central Bank allocated more than $500 billion of easy loans to the region’s banks. Additionally, concerns over supply disruption from Iran also pushed oil prices higher.

Yesterday, the US Energy Information Administration (EIA) Energy department reported that for the week ended 24 February, crude oil inventories climbed by 4.2 million barrels to 344.9 million barrels. Gasoline stockpiles declined 1.6 million barrels to 229.9 million barrels and distillate stocks, which include heating oil and diesel fuel, edged down 2.1 million barrels to 141.4 million barrels.

In the Asian session, at GMT0400, Crude Oil is trading at 107.07, 0.04% higher from yesterday’s close.

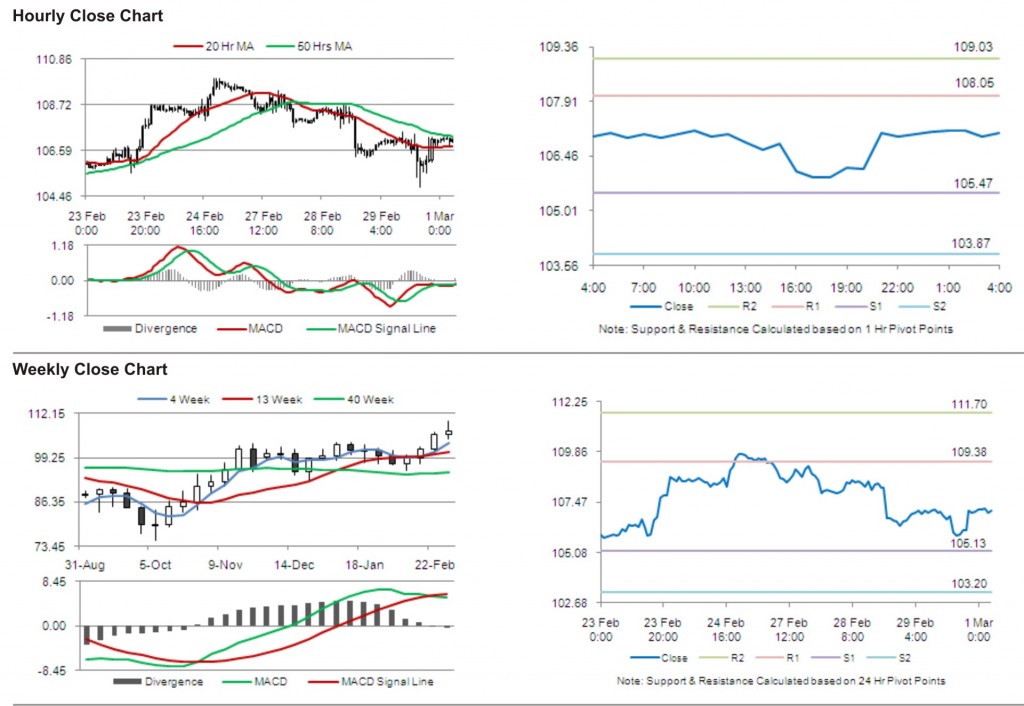

Crude oil is expected to find support at 105.47, and a fall through could take it to the next support level of 103.87. Crude oil is expected to find its first resistance at 108.05, and a rise through could take it to the next resistance level of 109.03.

Crude oil is trading between its 20 Hr and its 50 Hr moving averages.