For the 24 hours to 23:00 GMT, EUR declined 0.93% against the USD on Friday and closed at 1.3193, after weak German retail sales data and disappointing news from Spain.

In Spain, unemployment reached 4.7 million in February, an increase of 112,269 from the prior month. To add to concerns, the Spanish government raised its budget deficit target to 5.8% of Gross Domestic Product for 2012, compared with a previous target of 4.4%, indicating that the nation would not meet spending reduction targets for 2012.

Additionally, Euro declined, as concerns regarding adequacy of the firewall against sovereign defaults accelerated after the European Council President, Herman Van Rompuy, stated that Euro-zone leaders are likely to reassess the adequacy of the overall ceiling of the EFSF and the ESM only by the end of March 2012.

Further sentiments were dented after Luxembourg’s Prime Minister and Eurogroup President, Jean-Claude Juncker was reported saying that Greece may need a third bailout.

On Friday, Moody’s Investors Service downgraded Greece’s local- and foreign-currency bond ratings to ‘C’ from ‘Ca’.

Meanwhile, early Friday, European Union leaders have signed the region’s new fiscal pact, which has set strict new rules on deficits and debts. German Chancellor, Angela Merkel stated that the pact was necessary for stability and growth in the region and added that it represents a milestone for the European Union. However, the UK and the Czech Republic refused to sign the deal.

On the economic front, retail sales in Germany declined 1.6% (MoM) in January, while the Euro-zone producer price inflation eased to a rate of 3.7% (YoY) in January.

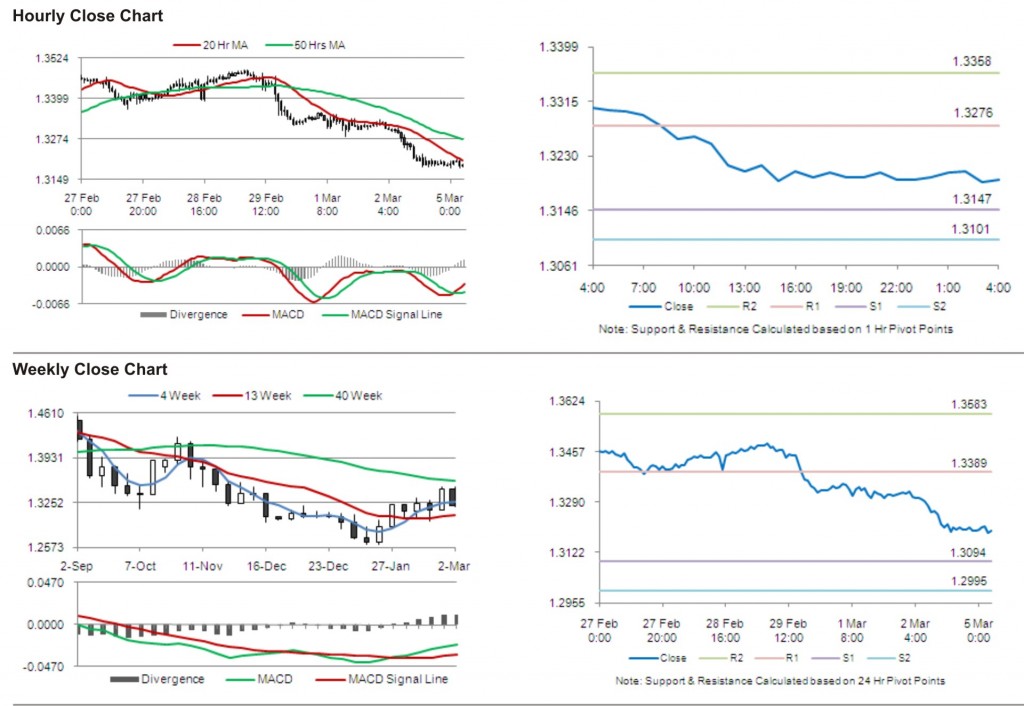

In the Asian session, at GMT0400, the pair is trading at 1.3194, with the EUR trading steady from Friday’s close.

The pair is expected to find support at 1.3147, and a fall through could take it to the next support level of 1.3101. The pair is expected to find its first resistance at 1.3276, and a rise through could take it to the next resistance level of 1.3358.

Trading trends in the pair today are expected to be determined by the release of Sentix investor confidence, retail sales and services Purchasing Manager Index in the Euro-zone.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.