For the 24 hours to 23:00 GMT, GBP rose 0.14% against the USD on Friday and closed at 1.6076.

BoE Governor King stated that leading nations must agree on a “grand bargain” to rebalance the world economy to prevent the repeat of financial crisis again.

In the UK, PPI for input prices rose 1.1% (M-o-M), lower than the previous rise of 2.3%, while PPI for output prices rose 0.5% (M-o-M) in February, less than 1.1% in previous month. In the US, retail sales grew 1.0% in February. On a monthly basis, the business inventories rose by a seasonally adjusted 0.9% in January. Meanwhile, consumer sentiment index in the US fell to a reading of 68.2 in March.

The pair opened the Asian session at 1.6087, and is trading at 1.6055 at 4.00GMT. The pair is trading 0.13% lower from the New York session close.

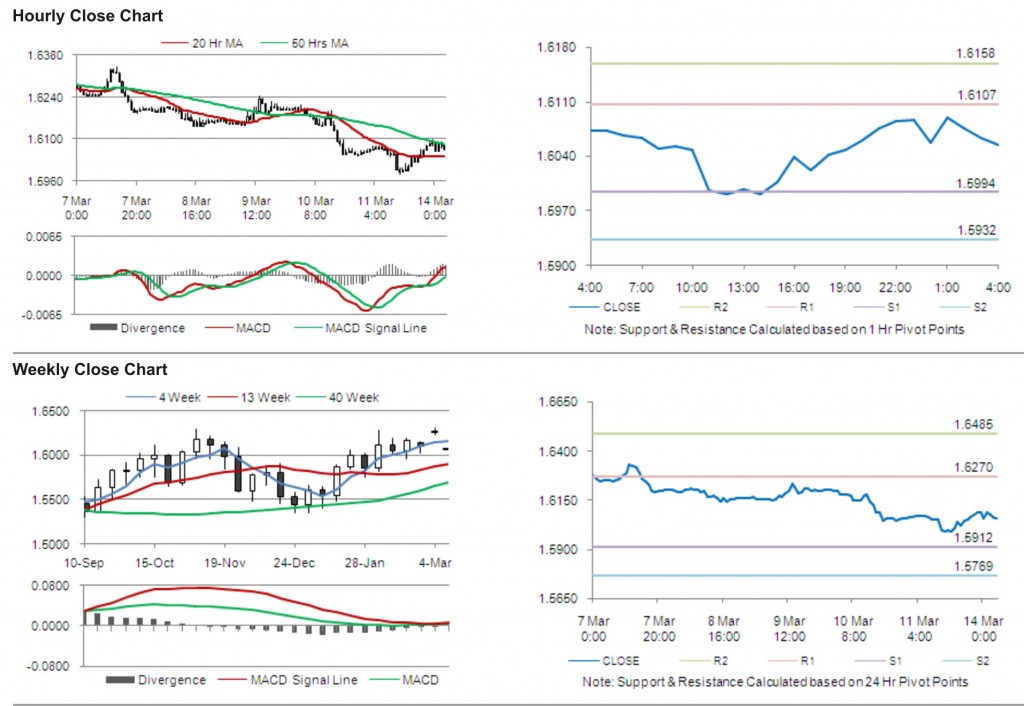

The pair has its first short term resistance at 1.6107, followed by the next resistance at 1.6158. The first support is at 1.5994, with the subsequent support at 1.5932.

Trading trends in the pair today are expected to be determined by release of data on nationwide consumer confidence in the UK.

The currency pair is showing convergence with its 50 Hr moving average and is trading just above its 20 Hr moving average.