For the 24 hours to 23:00 GMT, USD rose 1.13% against the CAD to close at 0.9852.

In the US, The Federal Reserve left its benchmark rate unchanged in the range of 0.0% to 0.25% and maintained its plan to buy $600.0 billion in longer-term treasuries through June to support the economy.

In the US, the housing price index rose to 17.0 in March. Also, the net long-term TIC flows dropped to $51.5 billion in January, while the total net TIC flows stood at $32.5 billion in January, from $49.7 billion in December. The general business conditions index in New York edged up to 17.5 in March, from 15.4 in February. Moreover, import prices rose 1.4% (MoM) in February.

In Canada, labor productivity rose by 0.5% in 4Q2010 from 0.4% rise in 3Q2010.

In the Asian session at 4:00GMT, the pair is trading at 0.9857, 0.05% higher from the New York session close.

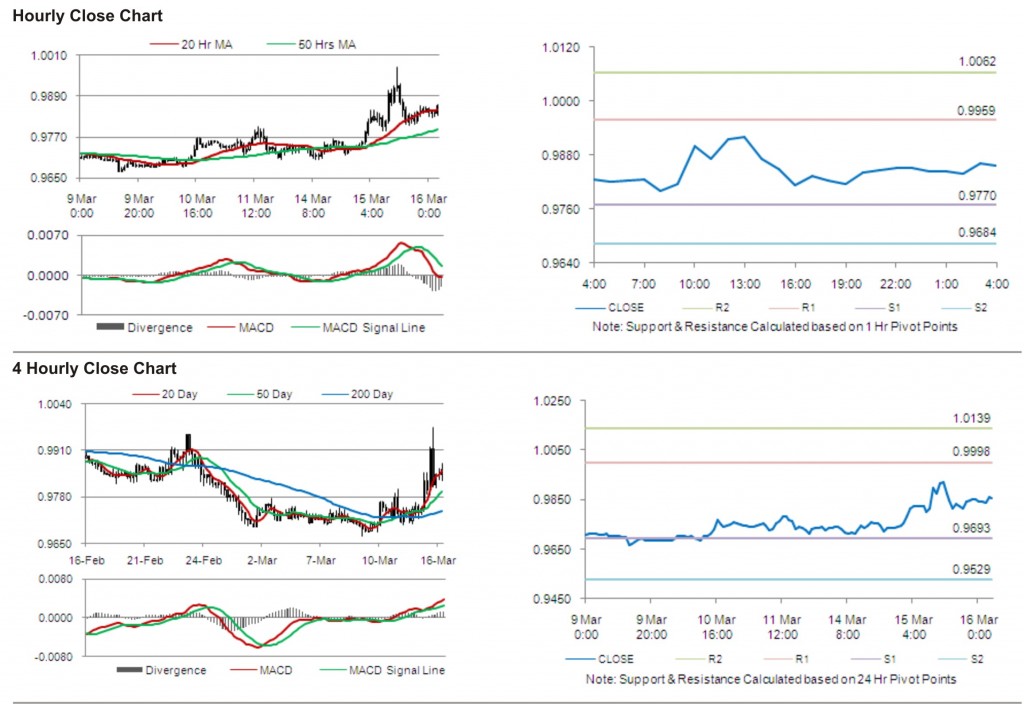

The first area of short term resistance is observed at 0.9959, followed by 1.0062 and 1.0251. The first area of support is at 0.9770, with the subsequent supports at 0.9684 and 0.9495.

The pair is expected to trade on the cues from the release of data on manufacturing shipments in Canada.

The currency pair is showing convergence with 20 Hr moving average and is trading above its 50 Hr moving average.