For the 24 hours to 23:00 GMT, USD declined 0.62% against the CHF and closed at 0.9165.

In the US, National Association of Realtors (NAR) reported that the pending home sales index rose 2.1% (M-o-M) in February, following a 2.8% decline in the previous month.

The Federal Reserve Bank of Dallas reported that its general business activity index fell to 11.5 in March, following a reading of 17.5 in February. Meanwhile, the production index jumped to 24.1 in March, following a reading of 9.7 posted in the previous month.

In the Asian session, at 3:00GMT, the pair is trading at 0.9168, 0.03% higher from the New York session close.

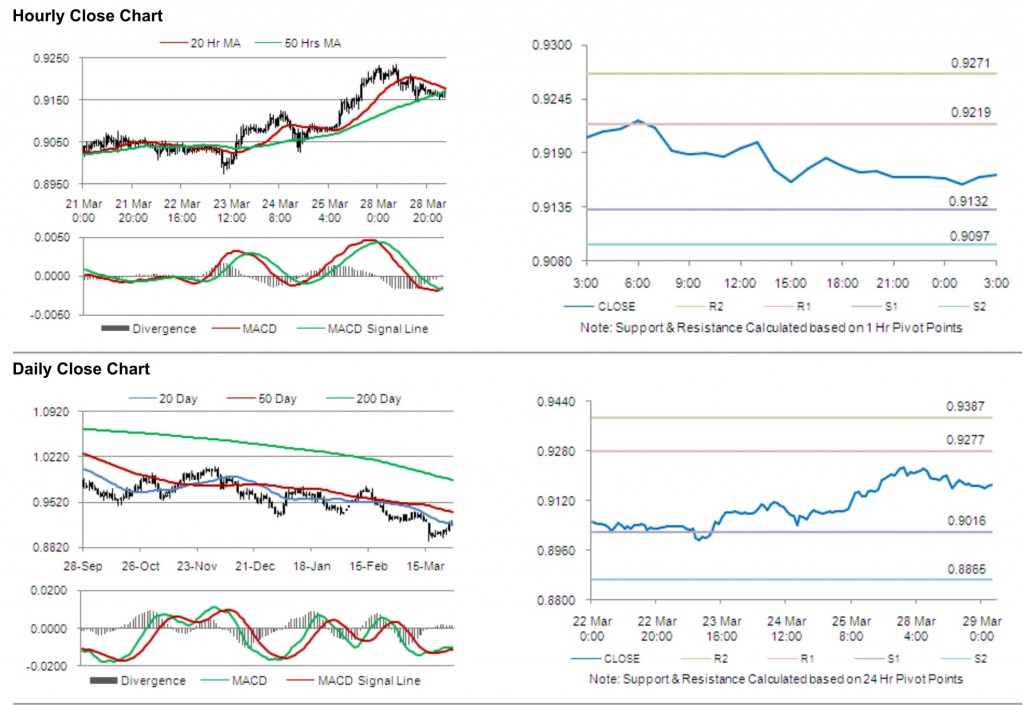

The pair has its first short term resistance at 0.9219, followed by the next resistance at 0.9271. The first area of support is at 0.9132 levels, with the subsequent support at 0.9097.

Trading trends in the pair today are expected to be determined by release of UBS consumption indicator in Switzerland.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.