For the 24 hours to 23:00 GMT, AUD weakened 0.27% against the USD to close at 1.0365, after its trade balance in Australia unexpectedly swung to a deficit in February for the first time in almost a year.

In Australia, the trade deficit totaled A$205 million ($212 million) in February, compared to A$1.433 billion surplus in January, as exports fell a seasonally adjusted 2% during the month, and imports rose by 5%. Additionally, Australia AiG performance of services index dropped to 46.5 in March, from 48.7 previously.

Moreover, the TD-MI inflation gauge rose 0.6% in March, following a 0.2% increase in February and 0.4% rise in January. On an annual basis, the inflation gauge rose 3.8% in March. Meanwhile, the monthly ANZ survey reported that total job ads climbed by 1.3% in March, following a downwardly revised 1.1% rise in February.

In the Asian session at 3:00GMT, the pair is trading at 1.0325, 0.39% lower from the New York session close.

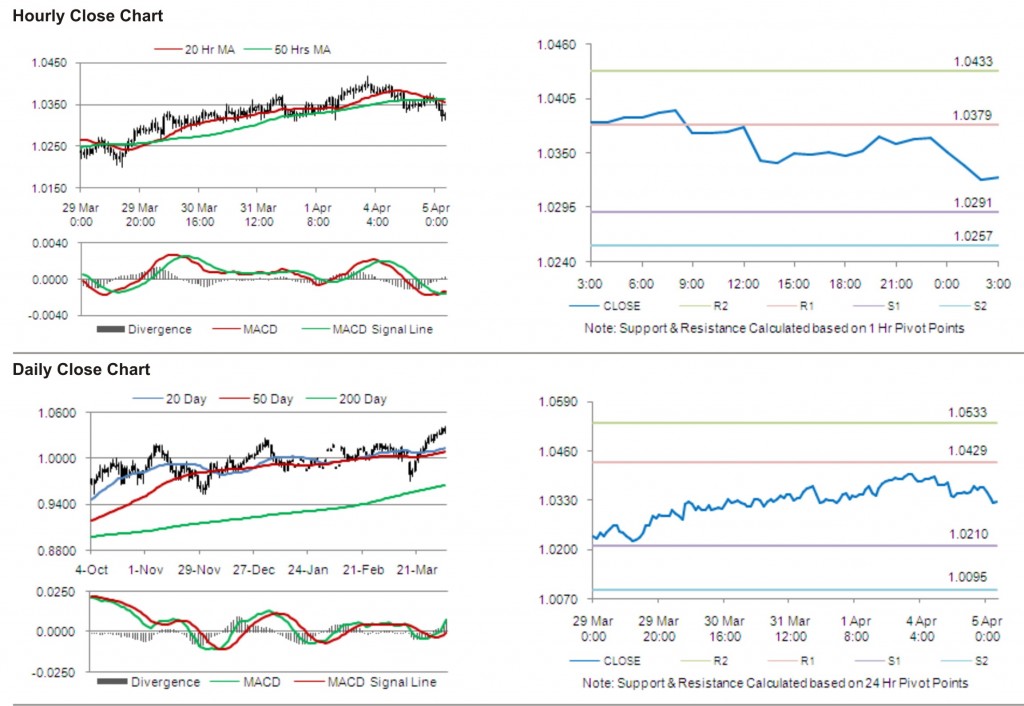

The pair is expected to find first short term resistance at 1.0379, with the next resistance levels at 1.0433 and 1.0521, subsequently. The first support for the pair is seen at 1.0291, followed by next supports at 1.0257 and 1.0169 respectively.

Trading trends in the pair today are expected to be determined by trade balance, home loans and Reserve Bank of Australia rate decision due to be released in Australia, later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.