For the 24 hours to 23:00 GMT, USD declined 0.22% against the CHF and closed at 0.9160.

In the US, the total outstanding consumer credit increased by $7.62 billion in February, following a $4.45 billion increase in January.

Richmond Fed President, Jeffrey Lacker stated that the US economy is recovering well, raising inflation risks that could force the Federal Reserve to raise interest rates before the end of the year.

In the Asian session, at 3:00GMT, the pair is trading at 0.9136, 0.26% lower from the New York session close.

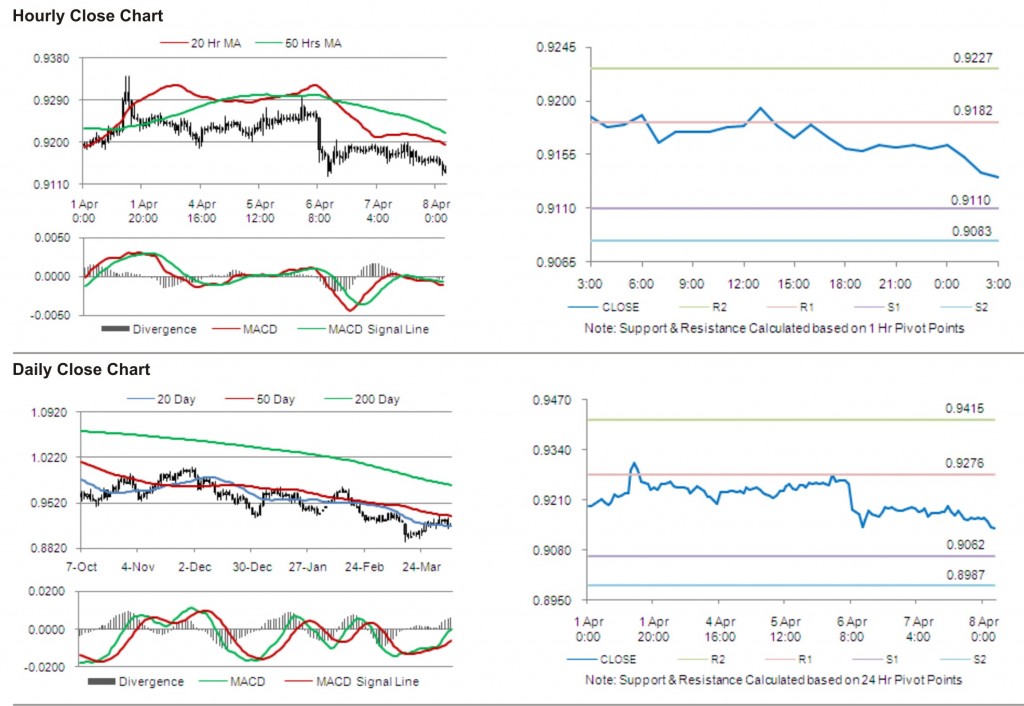

The pair has its first short term resistance at 0.9182, followed by the next resistance at 0.9227. The first area of support is at 0.9110 levels, with the subsequent support at 0.9083.

Investors are awaiting release of unemployment rate data in the Switzerland later today.

The pair is trading well below its 20 Hr moving average and its 50 Hr moving average.