For the 24 hours to 23:00 GMT, AUD strengthened 1.02% against the USD, on Friday to close at 1.0561.

The Federal Reserve Bank of Dallas President, Richard Fisher informed that the US Federal Reserve faces a “significant†risk of providing record stimulus for too long and should weigh curtailing its $600.0 billion bond-purchase plan.

In the US, on monthly basis, the wholesale inventories rose by 1% in February to $438.0 billion compared to the revised 1.0% rise posted in the previous month.

In the Asian session at 3:00GMT, the pair is trading at 1.0573, 0.11% higher from the New York session close.

LME Copper prices rose 1.3% or $126.0/MT to $9,822.5/ MT. Aluminium prices rose 0.4% or $11.8/ MT to $2,671.5/ MT.

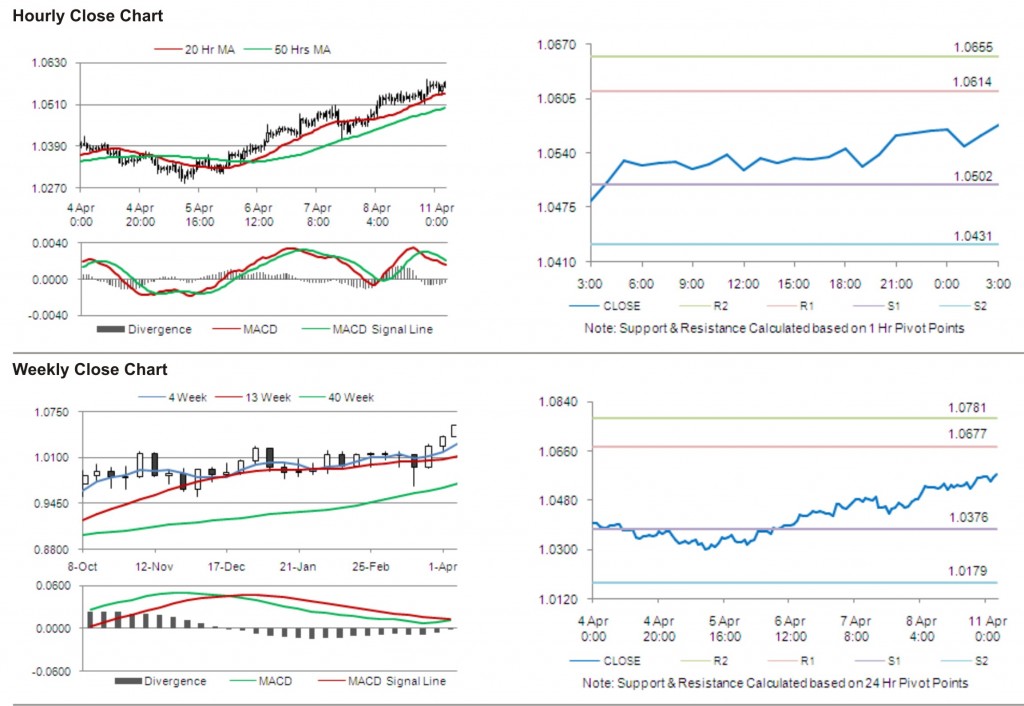

The pair is expected to find first short term resistance at 1.0614, with the next resistance levels at 1.0655 and 1.0767, subsequently. The first support for the pair is seen at 1.0502, followed by next supports at 1.0431 and 1.0319 respectively.

Investors are awaiting economic releases of NAB business confidence data in the Australia, later today.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.