For the 24 hours to 23:00 GMT, EUR declined 0.20% against the USD and closed at 1.4430., as investors continued to assess the mixed signals being sent by the European Central Bank (ECB) and Federal Reserve.

Euro gained last week, after the ECB hiked interest rates for the first time in three years, but ECB President, Jean-Claude Trichet commented that April’s hike would not mark the start of a series of further hikes.

In France, on a monthly basis, industrial production rose by 0.4% in February, compared to a downwardly revised 0.7% increase recorded in January. Additionally, the manufacturing production increased by 0.7% in February, compared to a downwardly revised 1.5% gain recorded in the previous month.

In the US, Federal Reserve Vice Chairman, Janet Yellen indicated that there is no reason for the US Federal Reserve to reverse course from its current easy monetary policy stance given the rise in commodity prices.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4397, 0.23% lower from the levels yesterday at 23:00GMT.

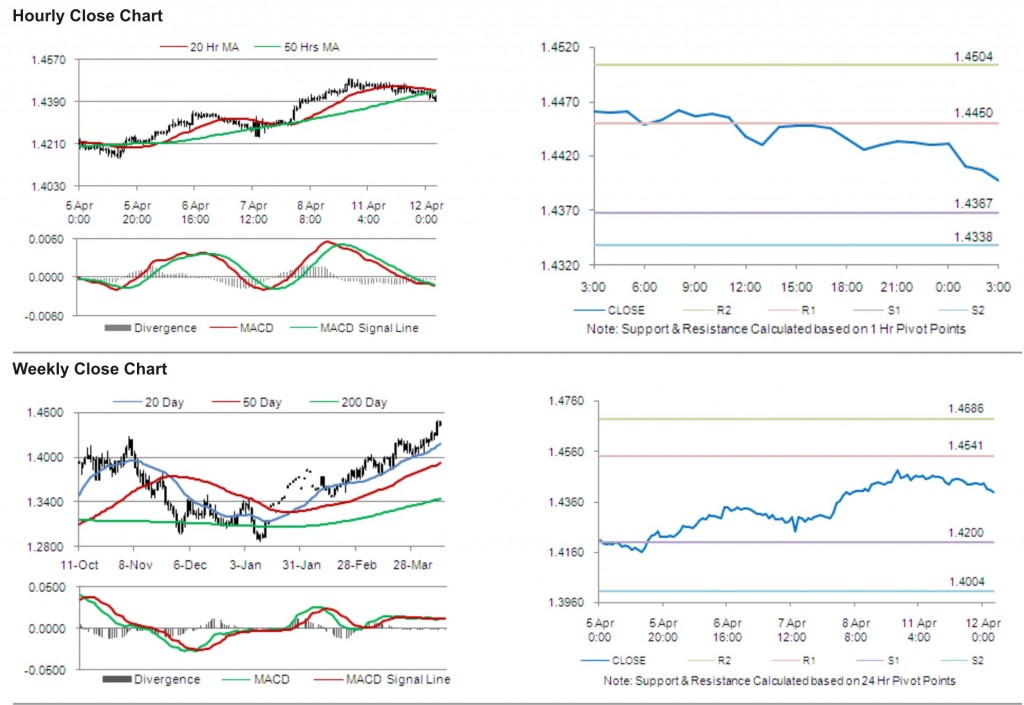

The pair has its first short term resistance at 1.4450, followed by the next resistance at 1.4504. The first support is at 1.4367, with the subsequent support at 1.4338.

Trading trends in the pair today are expected to be determined by data release on Consumer Price Index, ZEW Survey – economic sentiment in the Euro Zone.

The currency pair is trading just below its 20 Hr moving average and its 50 Hr moving average.