For the 24 hours to 23:00 GMT, EUR declined 1.29% against the USD and closed at 1.4231, after the European debt crisis deteriorated, as Irish banks were downgraded to junk status, Greece was rumored to be struggling to pay back its loans and Portugal’s planned bailout was threatened with a veto from Finland.

The Bundesbank in its monthly report stated that the positive underlying economic trend in Germany would continue in the second quarter.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4224, 0.05% lower from the levels yesterday at 23:00GMT.

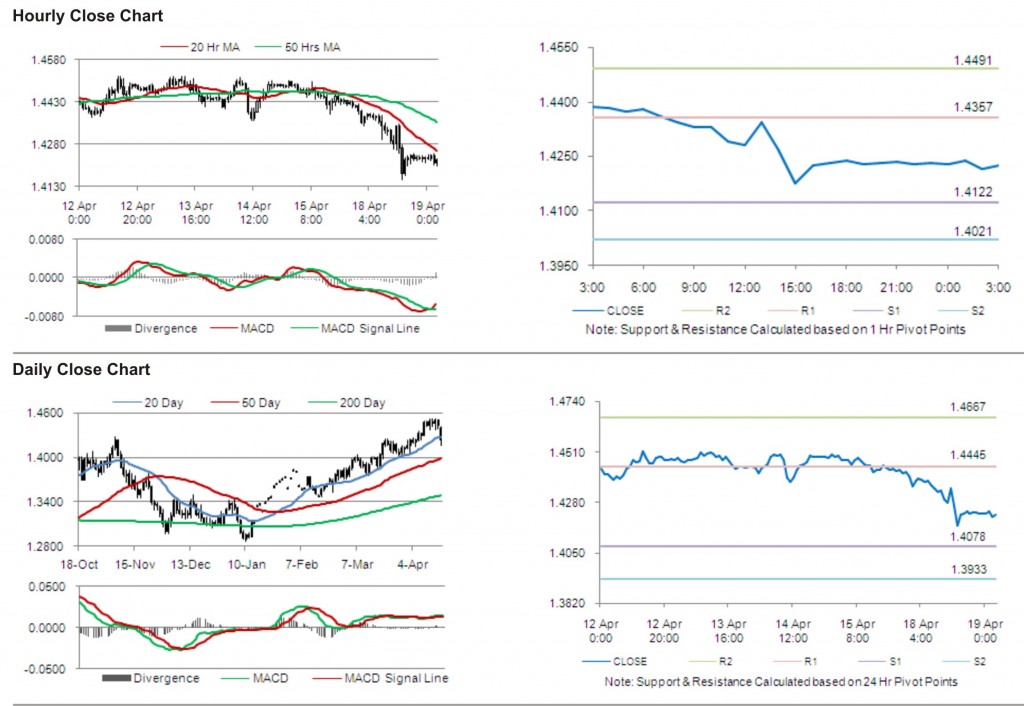

The pair has its first short term resistance at 1.4357, followed by the next resistance at 1.4491. The first support is at 1.4122, with the subsequent support at 1.4021.

With a series of Euro zone economic releases today, including current account and construction output, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading just below its 20 Hr moving average and well below its 50 Hr moving average.