For the 24 hours to 23:00 GMT, AUD strengthened 0.70% against the USD to close at 1.0935. The Australian dollar rallied past $1.09 for the first time since it was floated on speculation the central bank would raise interest rates earlier than the Federal Reserve to contain inflation.

In Australia, the private sector credit, on monthly basis, rose by 0.6% in March compared to 0.5% rise in the previous month.

LME Copper prices rose 0.2% or $22.0/MT to $9,370.3/ MT. Aluminium prices advanced 1.2% or $31.8/MT to $2,771.3/ MT.

In the Asian session at 3:00GMT, the pair is trading at 1.0902, 0.30% lower from the New York session close.

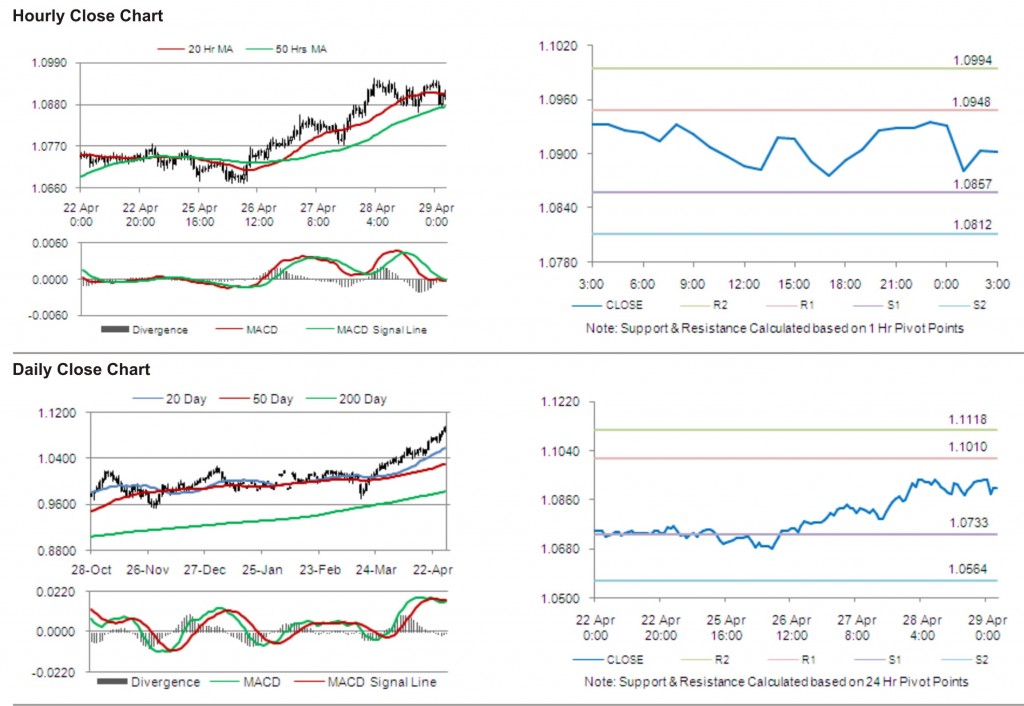

The pair is expected to find first short term resistance at 1.0948, with the next resistance levels at 1.0994 and 1.1085, subsequently. The first support for the pair is seen at 1.0857, followed by next supports at 1.0812 and 1.0721 respectively.

Trading trends in the pair are expected to be determined by data release on private sector credit in Australia.

The currency pair trading just above its 20 Hr moving average and its 50 Hr moving average.