For the 24 hours to 23:00 GMT, the USD rose 0.26% against the CAD to close at 1.0647.

The US Dollar continued its upward trend yesterday, as data released on Tuesday indicated that the US consumer confidence bounced back in December, amid a better outlook for hiring and overall growth, supporting other signs that show the economy could accelerate in 2014. Additionally, the S&P/Case-Shiller Home Price Index indicated that home prices in the nation rose at their fastest rate since February 2006. On the flipside, Chicago PMI decelerated in December, however it had muted effect on the currency pair.

In the Asian session, at GMT0400, the pair is trading at 1.0636, with the USD trading 0.10% lower from yesterday’s close.

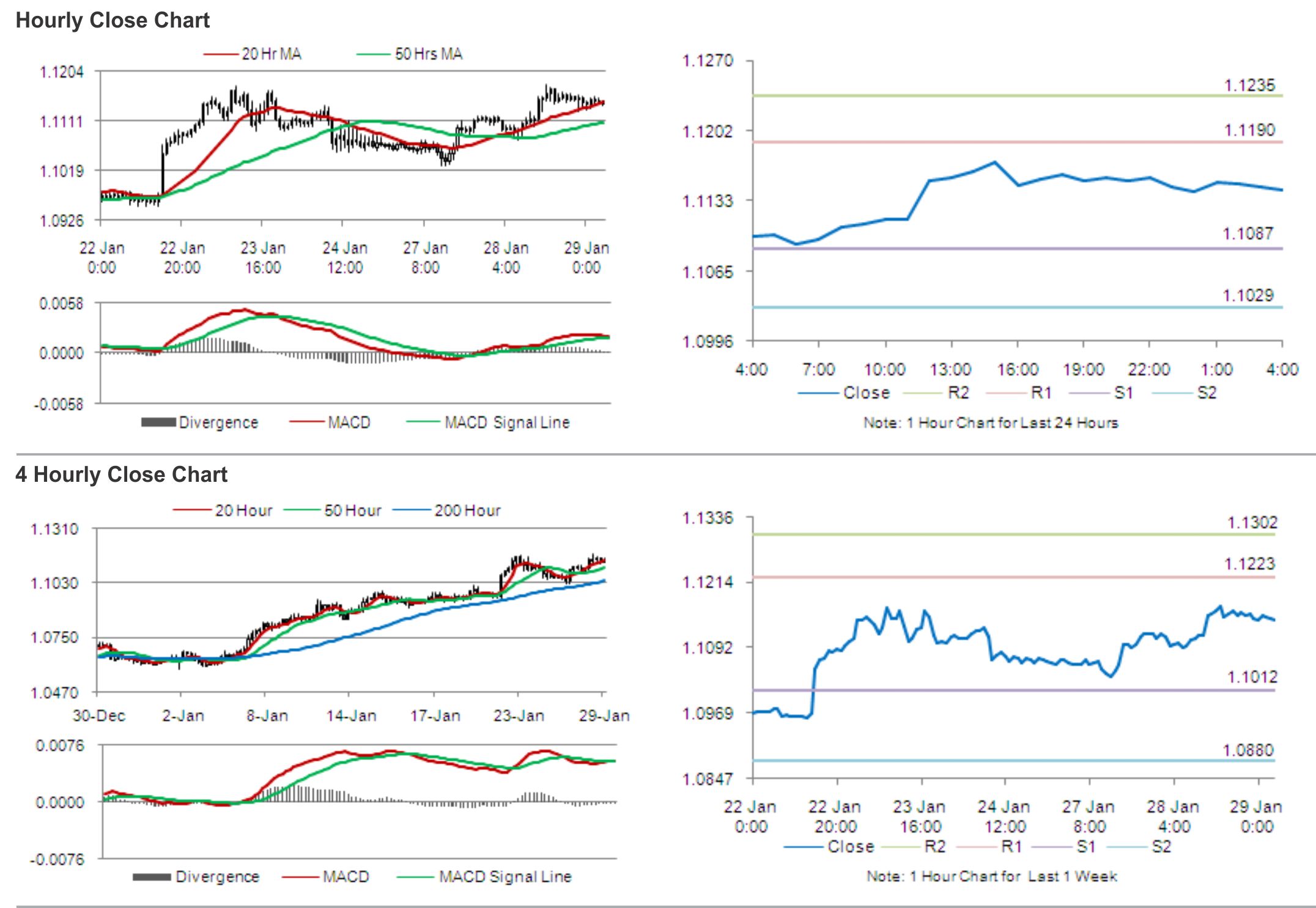

The pair is expected to find support at 1.0619, and a fall through could take it to the next support level of 1.0602. The pair is expected to find its first resistance at 1.0651, and a rise through could take it to the next resistance level of 1.0666.

With no major releases from Canada this week, economic releases from the US including manufacturing activity, jobless claims and construction spending, would gain considerable market interest, especially in the aftermath of the recent upbeat data.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.