For the 24 hours to 23:00 GMT, the USD rose 0.89% against the CHF and closed at 0.8995, after upbeat US manufacturing PMI data fuelled fresh speculation for a further winding-down in the pace of Fed’s stimulus measures.

In the Asian session, at GMT0400, the pair is trading at 0.8994, with the USD trading tad lower from yesterday’s close.

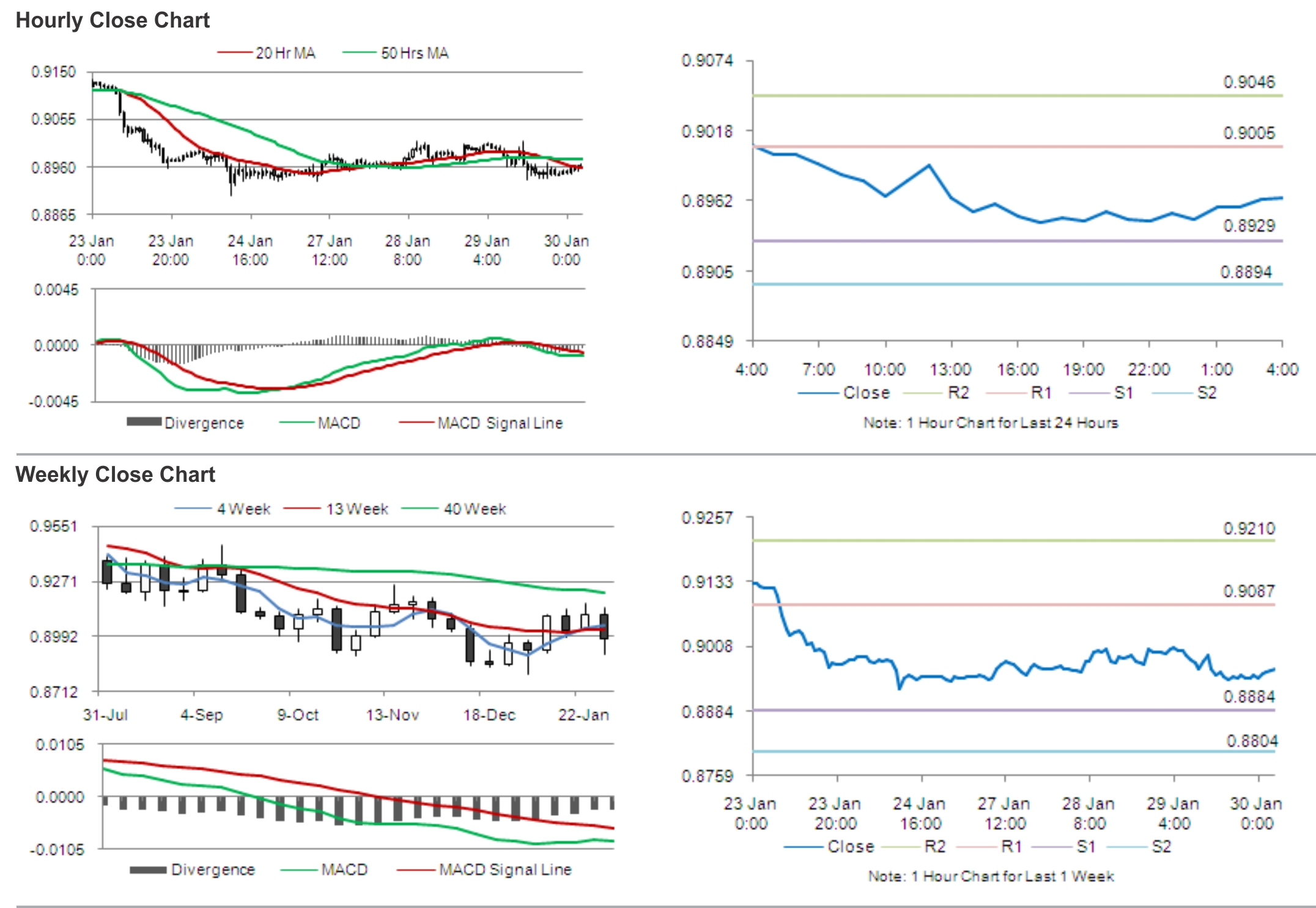

The pair is expected to find support at 0.8927, and a fall through could take it to the next support level of 0.8860. The pair is expected to find its first resistance at 0.9046, and a rise through could take it to the next resistance level of 0.9098.

Traders keenly await the release of Switzerland’s KOF leading indicator and SVME – Purchasing Managers’ Index (PMI) data, for further cues in the Swiss Franc.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.