For the 24 hours to 23:00 GMT, EUR declined 0.10% against the USD and closed at 1.3616, following lower than expected consumer inflation in the Euro-zone. The US Dollar advanced against the Euro amid mixed signals from key Fed officials. President of San Francisco Fed, John Williams, hinted the possibility of the central bank to gradually reduce its massive bond-buying programme and eventually eliminate it over this year. Separately, Boston Fed President, Eric Rosengren, who dissented the Fed’s last month’s decision to taper its monthly bond buying by $10 billion, stated that he is “comfortable with the current approach”, but at the same time also warned that the central bank should not take any “dramatic steps” to wind down asset purchases.

Meanwhile, in the Euro-zone, consumer inflation edged down to 0.8% (YoY) in December, defying market expectations for the inflation rate to remain unchanged at previous month’s level of 0.9%. Separately, an official report from Germany showed that the number of unemployed people in the nation fell by 15,000 in December, compared to the November figure, when the number of unemployed had risen by 9,000 people. Another report revealed that retail sales in Germany rose 1.6% (YoY) in November, following a 0.1% (YoY) drop registered in the preceding month.

In the Asian session, at GMT0400, the pair is trading at 1.3625, with the EUR trading 0.07% higher from yesterday’s close.

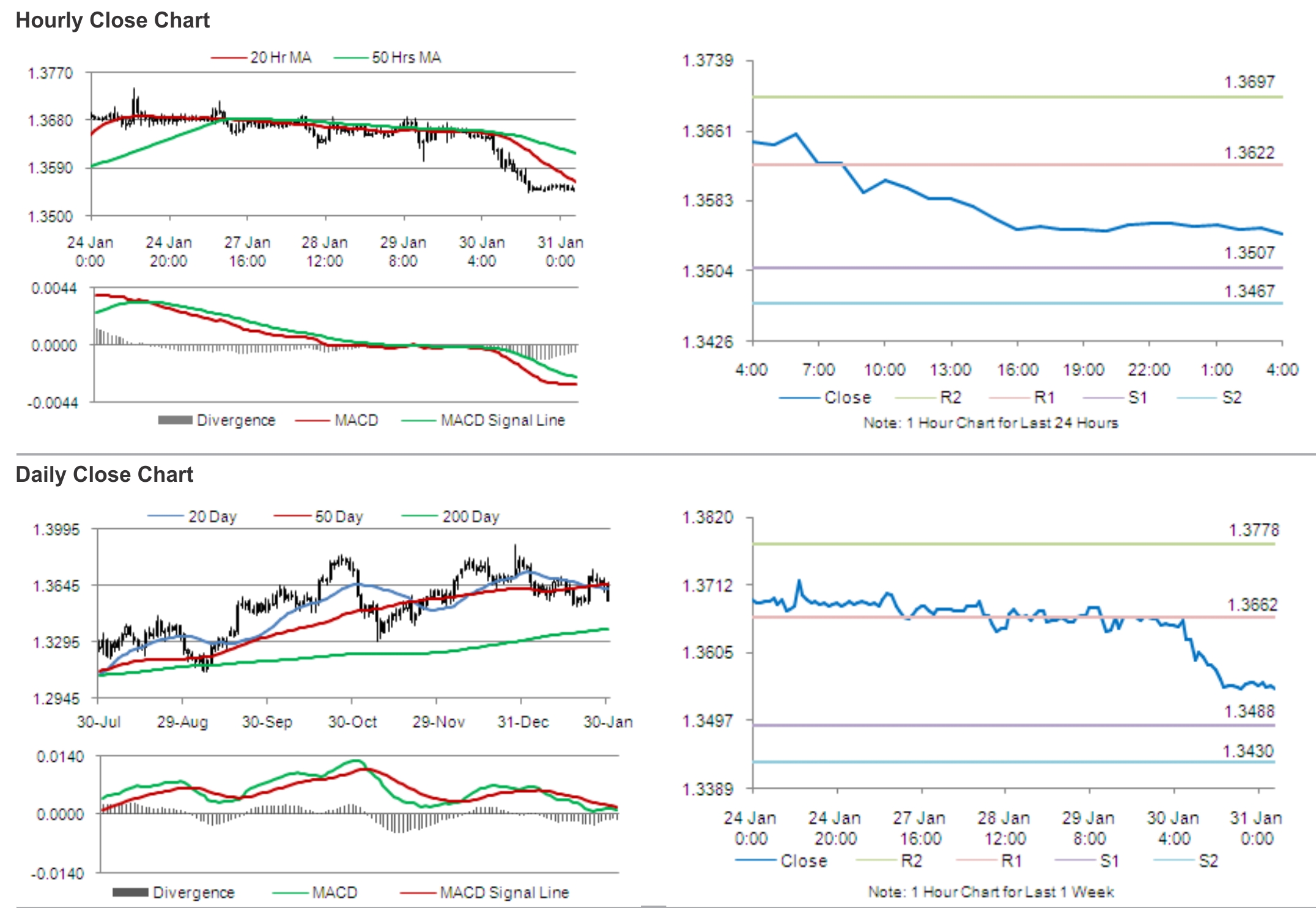

The pair is expected to find support at 1.3596, and a fall through could take it to the next support level of 1.3566. The pair is expected to find its first resistance at 1.3656, and a rise through could take it to the next resistance level of 1.3686.

Traders keenly await Germany’s trade balance, factory orders and Euro-zone’s unemployment data, scheduled for release later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.