Crude Oil prices advanced 0.72% against the USD for the 24 hour period ending 23:00GMT, closing at 97.34.

Yesterday, the Energy Information Administration (EIA) reported a 3.21 million barrels drop in the US distillate-fuel inventories, including heating oil and diesel. The EIA report also showed a 990,000 barrels rise in the US crude stockpiles, to 351.2 million, for the week ended January 17. Analysts had expected the US crude supplies to climb by 1.15 million barrels.

However, the gains in the prices of crude oil were capped after media reports indicated that TransCanada began shipping crude oil on Wednesday, through its Gulf Coast Pipeline from Cushing, Oklahoma, to customers in Nederland, Texas.

In the Asian session, at GMT0400, Crude Oil is trading at 97.57, 0.24% higher from yesterday’s close.

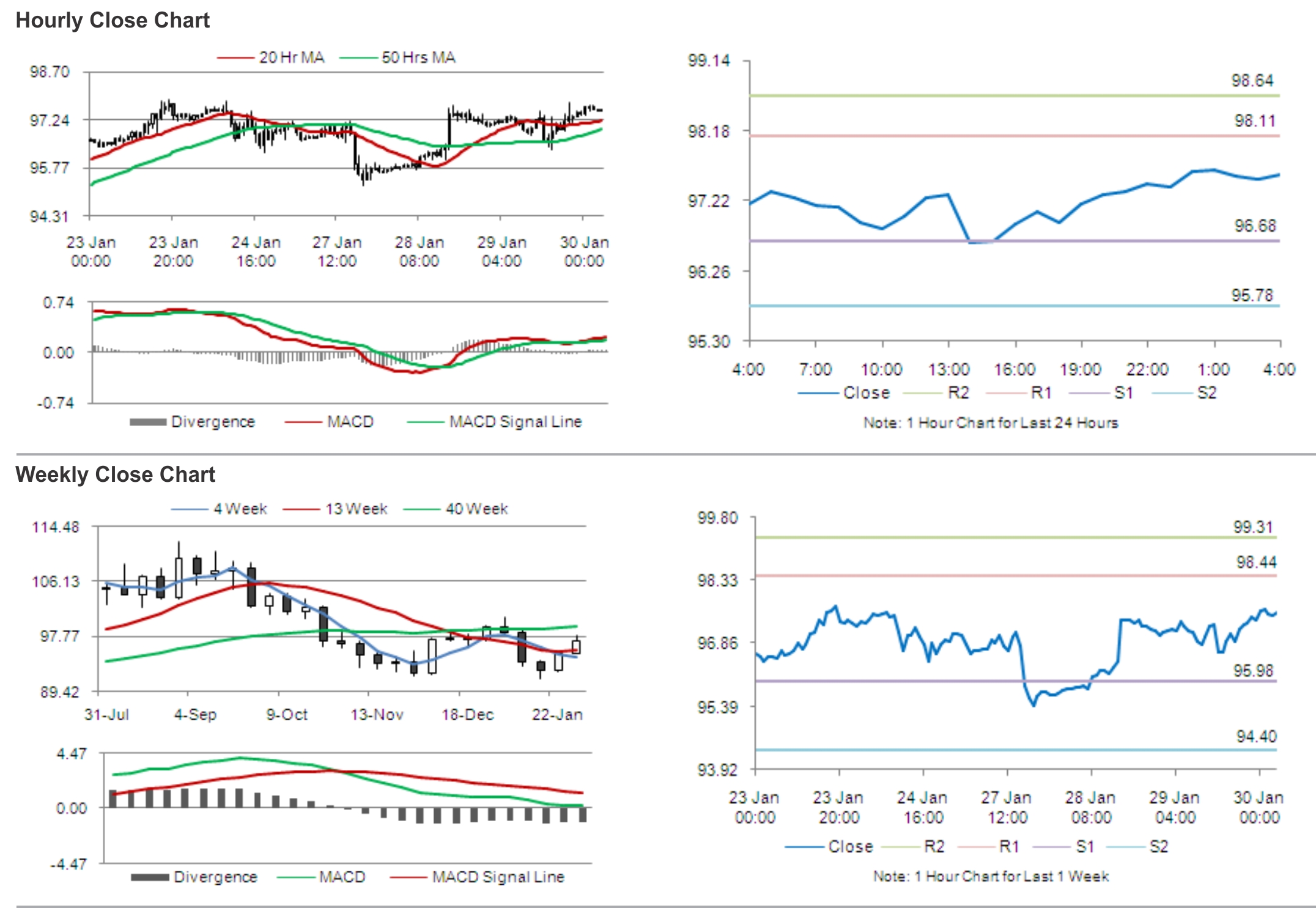

Crude oil is expected to find support at 96.73, and a fall through could take it to the next support level of 95.90. Crude oil is expected to find its first resistance at 98.12, and a rise through could take it to the next resistance level of 98.68.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.