On Friday, EUR declined 0.08% against the USD and closed at 1.3678.

The European Central Bank (ECB), President, Mario Draghi, at the World Economic Forum annual meet in Davos, indicated that the recovery of the Euro-zone is still “fragile” and that the region cannot afford to let go its structural reforms, as the region still continues to witness uneven growth. He further reiterated his earlier stance that the inflation rate is likely to stay at current level for the next two years and would gradually move to the ECB’s 2% target.

Meanwhile, the woes for the Euro-zone continue to emerge as the Organisation for Economic Cooperation and Development (OECD) reported that the banks in Europe have a combined capital shortfall of about €84 billion. Furthermore, the OECD highlighted the risks of deflation in the region. Against this background, International Monetary Fund (IMF) Managing Director, Christine Lagarde, at the World Economic Forum in Davos, cautioned that the inflation in the region is “way below target” and deflation is a potential risk for the bloc.

Meanwhile, the EU Economic and Monetary Affairs Commissioner, Olli Rehn, urged the central bank to take proper steps for its 2% inflation target, warning that very low inflation in the region does not support the bloc’s nascent economic recovery. However, the German Finance Minister, Wolfgang Schaeuble, dismissed Olli Rehn’s opinion and insisted that the Euro-zone has emerged from the years of crisis and is no longer the “centre of worries about the stability of the global economic development.”

Moreover, the ECB Governing Council Member, Ignazio Visco, indicated that the central bank could cut its key interest rates further and engage in asset purchases, provided the outlook of the region deteriorates.

Separately, the Moody’s Investors Service affirmed France’s “Aa1” credit rating, however maintaining the “Negative” outlook, citing the continued reduction in the competitiveness of the economy along with a risk of a further deterioration in government financial strength.

In the Asian session, at GMT0400, the pair is trading at 1.3682, with the EUR trading marginally higher from yesterday’s close.

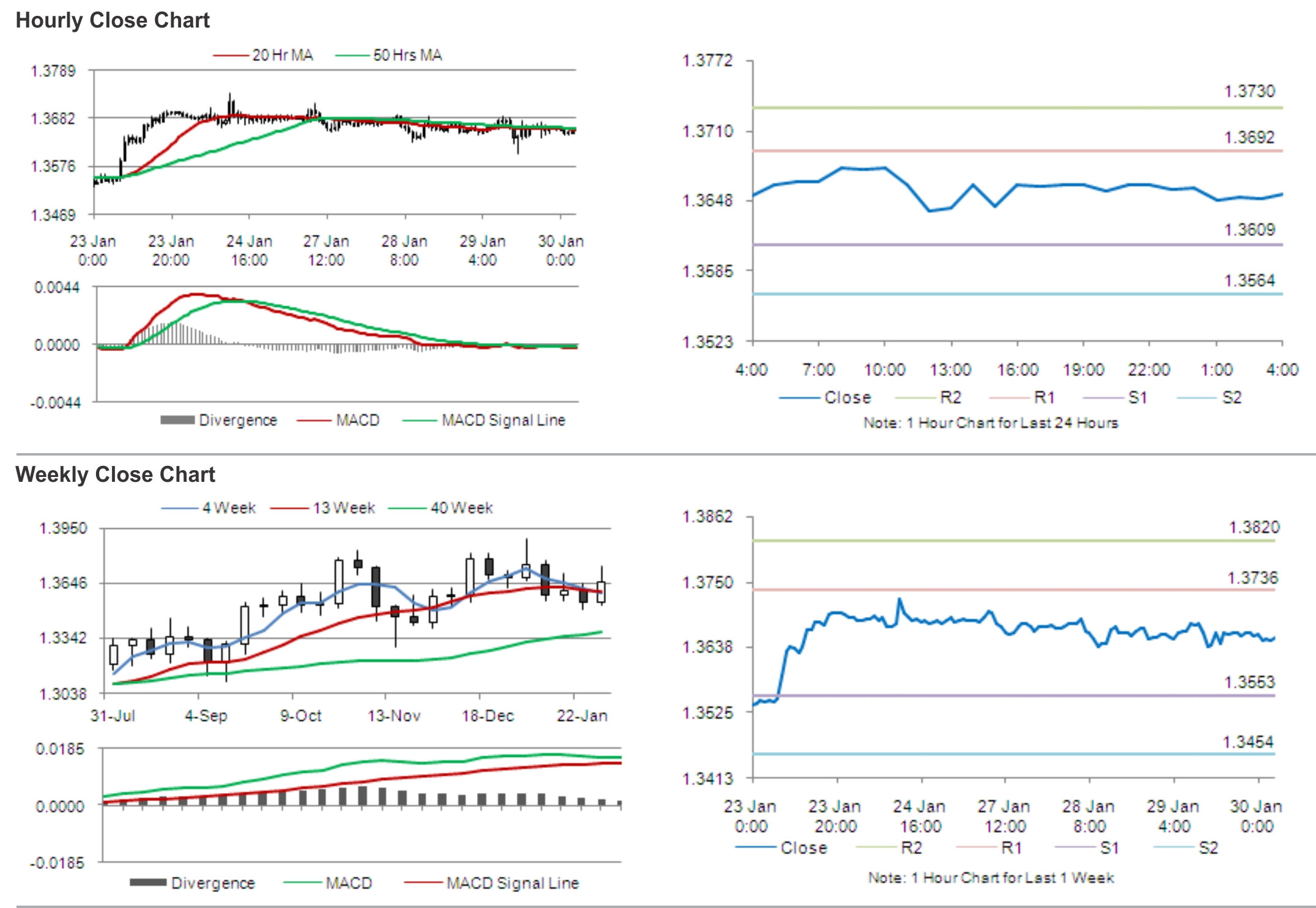

The pair is expected to find support at 1.3649, and a fall through could take it to the next support level of 1.3617. The pair is expected to find its first resistance at 1.3727, and a rise through could take it to the next resistance level of 1.3773.

Ahead this week, traders would keenly await US durable goods orders, before the crucial Federal Reserve’s monthly monetary policy meeting and the US fourth quarter GDP numbers. Meanwhile, in the Euro-zone, the various sentiment indicators along with the inflation numbers would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.