On Friday, Crude Oil prices declined 0.42% against the USD for the period ending 21:00GMT, closing at 96.93, as persistent concerns over the economic outlook in emerging markets dampened the appeal of the commodity.

Meanwhile, prices received support to some extent after the supply bottleneck at a key storage hub in the US was eased, as the Keystone XL pipeline linking Cushing, Oklahoma, to the US Gulf Coast began making deliveries this week.

In the Asian session, at GMT0400, Crude Oil is trading at 96.69, 0.25% lower from yesterday’s close.

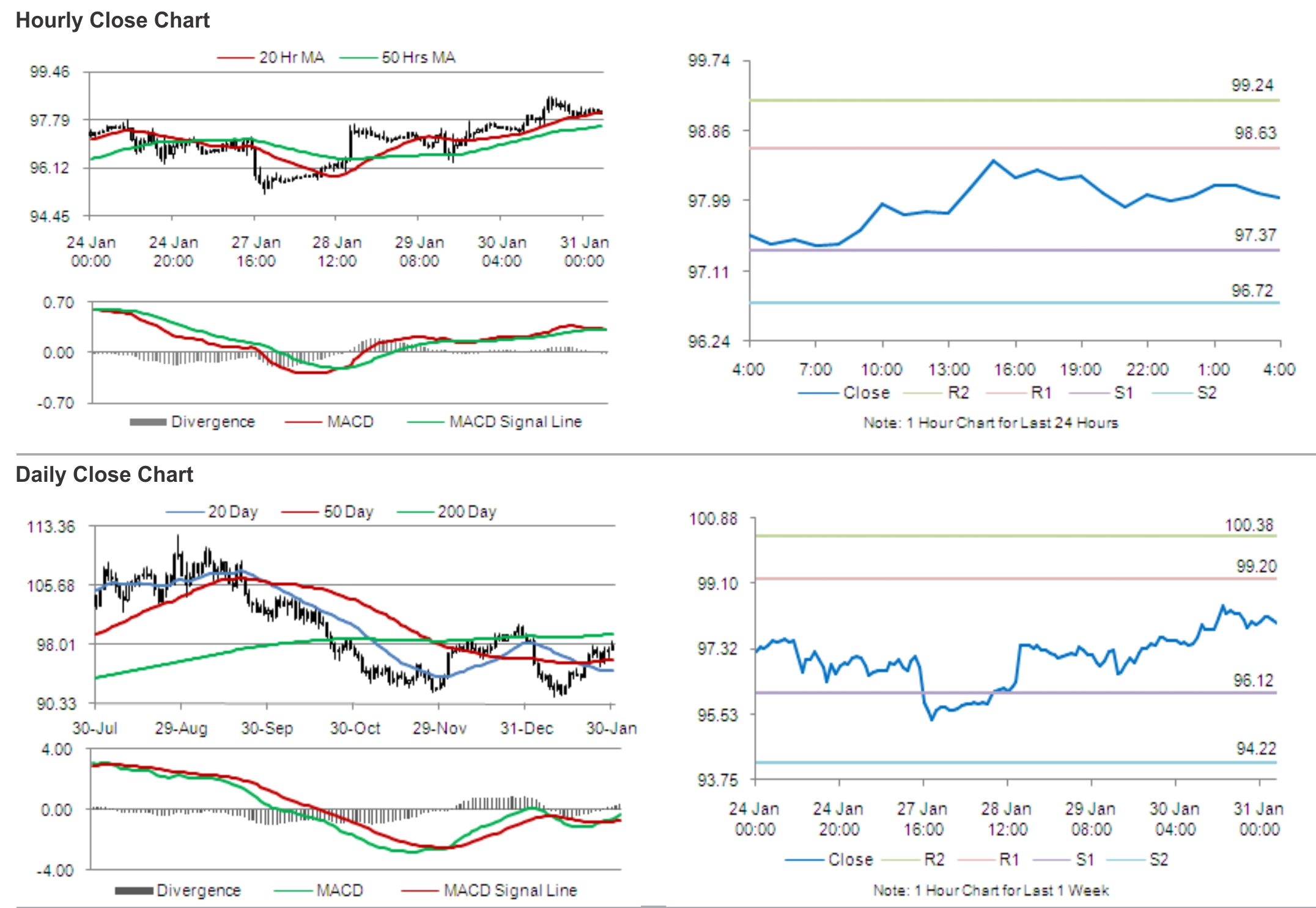

Crude oil is expected to find support at 96.03, and a fall through could take it to the next support level of 95.36. Crude oil is expected to find its first resistance at 97.58, and a rise through could take it to the next resistance level of 98.46.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.