On Friday, the USD declined 0.39% against the CAD to close at 1.1070.

The Canadian Dollar rose after the data revealed that the Canadian inflation gained traction in December. The Statistics Canada indicated that the consumer price index (CPI) in Canada rose 1.2% on an annual basis in December, below market expectation for a 1.4% increase and compared to a gain of 0.9% reported in the preceding month. The monthly CPI in Canada fell 0.20% to a reading of 122.7 in December, following a flat change in the preceding month.

Meanwhile, the Bank of Canada (BoC) reported that its core CPI increased 1.3% on an annual basis in December, following a rise of 1.1% reported in November. The seasonally adjusted BoC core index dropped 0.4% on a monthly basis in December, following a decline of 0.1% recorded in November.

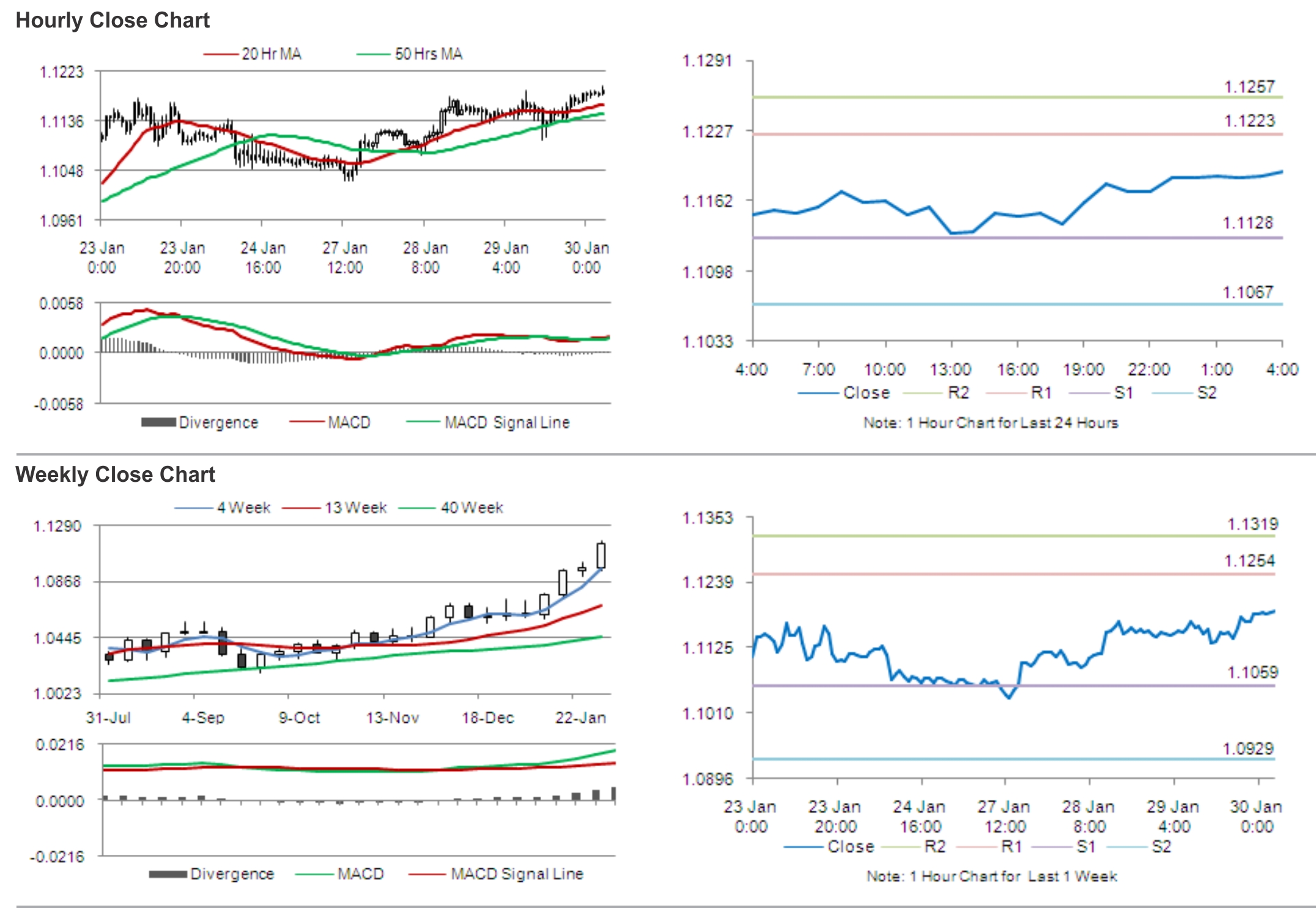

In the Asian session, at GMT0400, the pair is trading at 1.1061, with the USD trading 0.08% lower from yesterday’s close.

The pair is expected to find support at 1.1029, and a fall through could take it to the next support level of 1.0997. The pair is expected to find its first resistance at 1.1116, and a rise through could take it to the next resistance level of 1.1171.

The gross domestic product (GDP) data, which is to be released at the end of the week, would be closely tracked by investors for further direction in the Canadian Dollar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.