Gold prices traded higher by 1.33% against the USD in the 24 hour period ending 23:00GMT, at 1266.85 per ounce, on safe haven demand from investors amid an ongoing turmoil in emerging markets. Earlier, India, Turkey and South Africa hiked their respective bank interest rates to support their currencies, which rekindled fears that an end to monetary policies in the US and elsewhere would make riskier-assets in emerging markets less attractive.

Yesterday, the Federal Reserve announced it would trim its monthly bond purchases by another $10 billion as it stuck to a plan to wind down its economic stimulus.

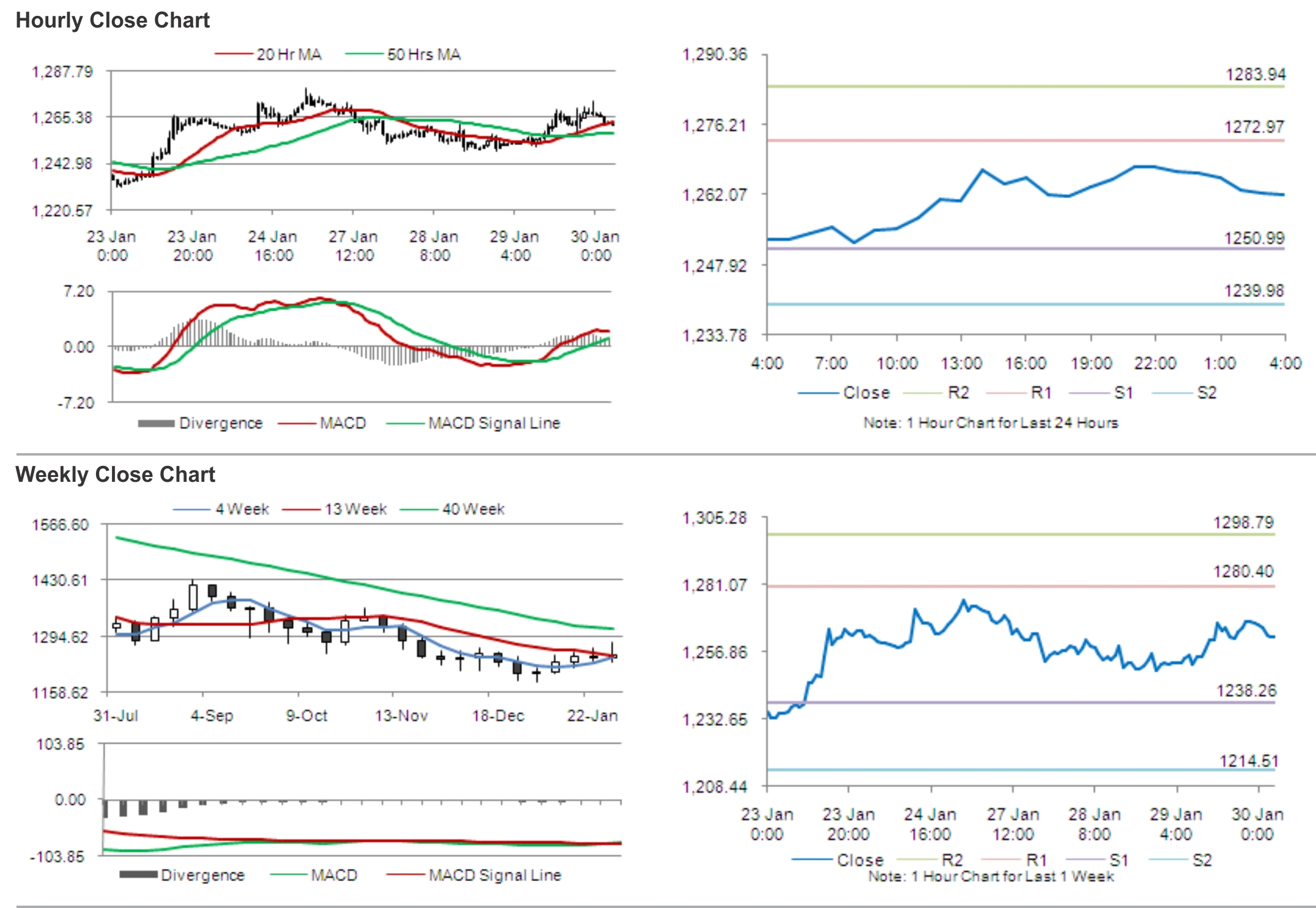

In the Asian session, at GMT0400, Gold is trading at 1262.01, 0.38% lower from yesterday’s close.

Gold is expected to find support at 1250.99, and a fall through could take it to the next support level of 1239.98. Gold is expected to find its first resistance at 1272.97, and a rise through could take it to the next resistance level of 1283.94.

The yellow metal is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.