For the 24 hours to 23:00 GMT, the USD strengthened 0.43% against the JPY and closed at 102.73, as Fed’s decision to taper its bond purchases continued to boost the greenback.

In the Asian session, at GMT0400, the pair is trading at 102.43, with the USD trading 0.30% lower from yesterday’s close.

In Japan, National consumer price index (CPI) rose 1.6% (YoY) in December, compared to a 1.5% rise in the previous month, adding to signs that Prime Minister Shinzo Abe’s efforts to end deflation are making headway. Unemployment rate dropped to 3.7% in December from 4.0% in November. Japanese manufacturing activity rose to an eight-year high level of 56.6 in January, from a reading of 55.2 reported in the preceding month, reported by Nomura/JMMA. Meanwhile, industrial production rose 1.1% in December, compared to a 0.1% drop in the previous month. Market expected industrial production to rise 1.2%. Construction orders rose 4.9% (YoY) in December, while housing starts rose 18.0% (YoY) in December, compared to a 14.1% rise in the previous month.

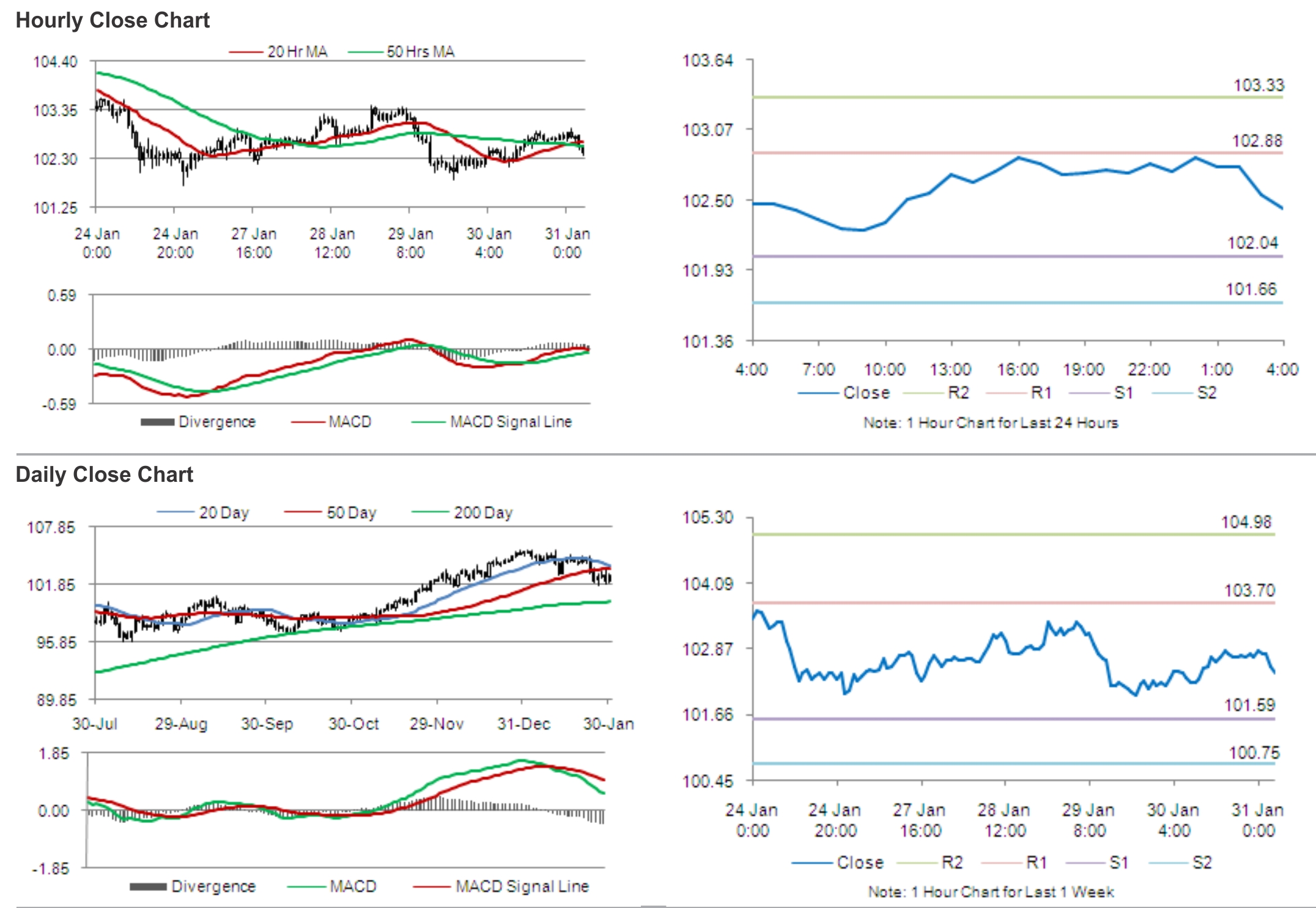

The pair is expected to find support at 102.04, and a fall through could take it to the next support level of 101.66. The pair is expected to find its first resistance at 102.88, and a rise through could take it to the next resistance level of 103.33.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.