On Friday, EUR declined 0.40% against the USD and closed at 1.3504, as an unexpected fall in the Euro-zone’s consumer inflation rate spurred fresh speculations for an additional monetary easing measure by the European Central Bank (ECB). Data showed that Euro-zone’s consumer inflation rate declined to 0.7% (YoY) in January, defying market expectation for a rise to 0.9%, from previous month’s level of 0.8%. Separately, another report showed that unemployment rate in the Euro-zone stood pat at 12.0% in the month of December, defying analysts’ estimate for a rise to 12.1%. Negative sentiment was also fuelled after a report revealed that retail sales in Germany unexpectedly fell 2.5% (MoM) in December, following a 0.9% (MoM) rise registered in the preceding month.

Meanwhile, the US Dollar advanced against the Euro after data confirmed that personal spending of US families rose above analysts’ estimates in December and after another report revealed that the US consumer sentiment index declined less than market expectations for January.

In the Asian session, at GMT0400, the pair is trading at 1.3484, with the EUR trading 0.15% lower from Friday’s close.

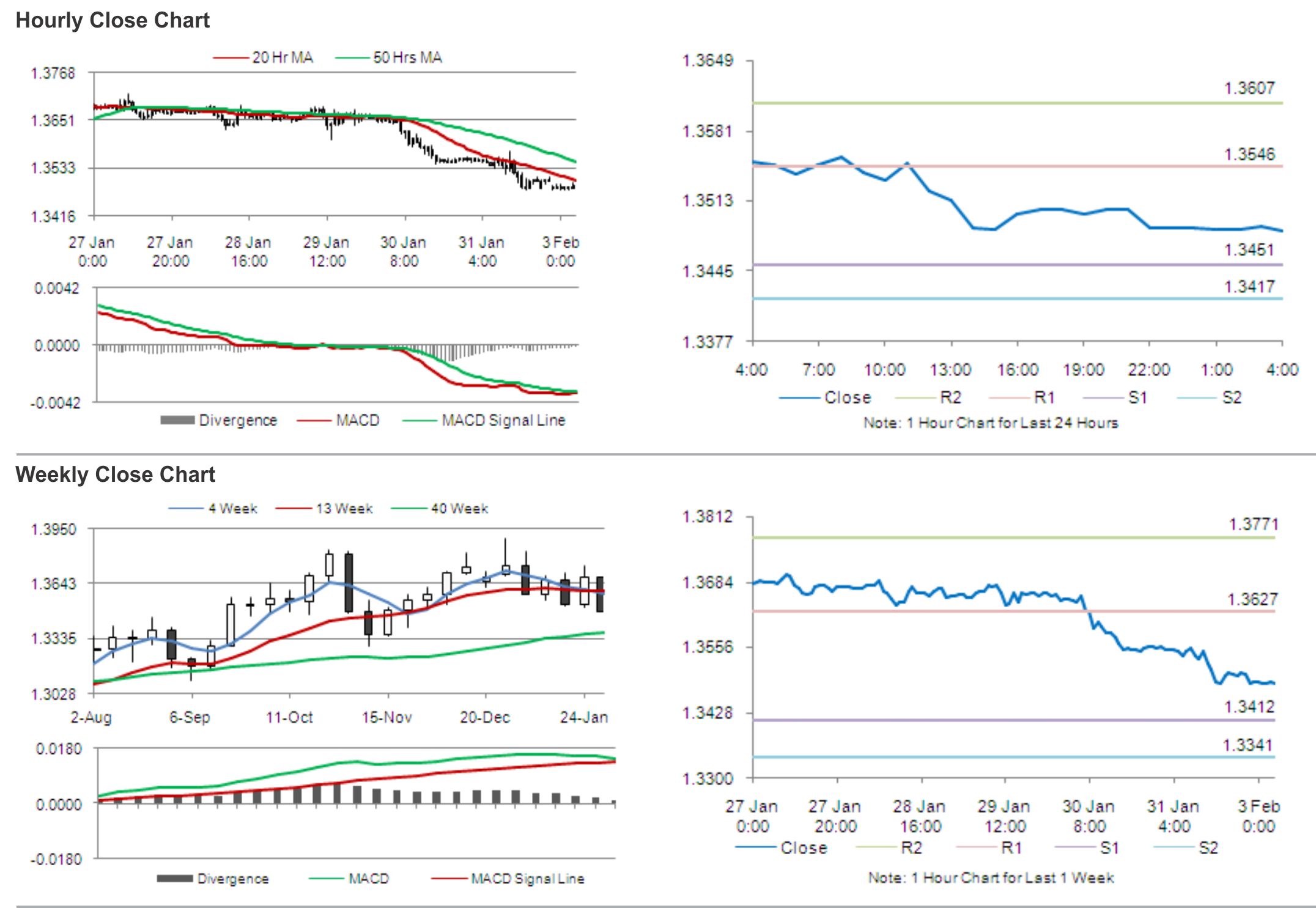

The pair is expected to find support at 1.3451, and a fall through could take it to the next support level of 1.3417. The pair is expected to find its first resistance at 1.3546, and a rise through could take it to the next resistance level of 1.3607.

During the later course of the day, traders would eye the release of Markit manufacturing data from the Euro-zone and its periphery nations.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.