For the 24 hours to 23:00 GMT, the USD strengthened 0.51% against the JPY and closed at 101.70, after two eminent Fed policymakers hinted their support for a continuation in scaling back the central bank’s stimulus measures.

In Japan, Prime Minister, Shinzo Abe stated that the central bank is carrying out appropriate measures to attain its 2% inflation target. He further added that the nation was on its way out of deflation.

In the Asian session, at GMT0400, the pair is trading at 101.44, with the USD trading 0.26% lower from yesterday’s close.

Data released in the Asian hours today morning, revealed that labour cash earnings in Japan rose for the second straight month by 0.8% (YoY) in December, following a 0.6% increase recorded in the previous month.

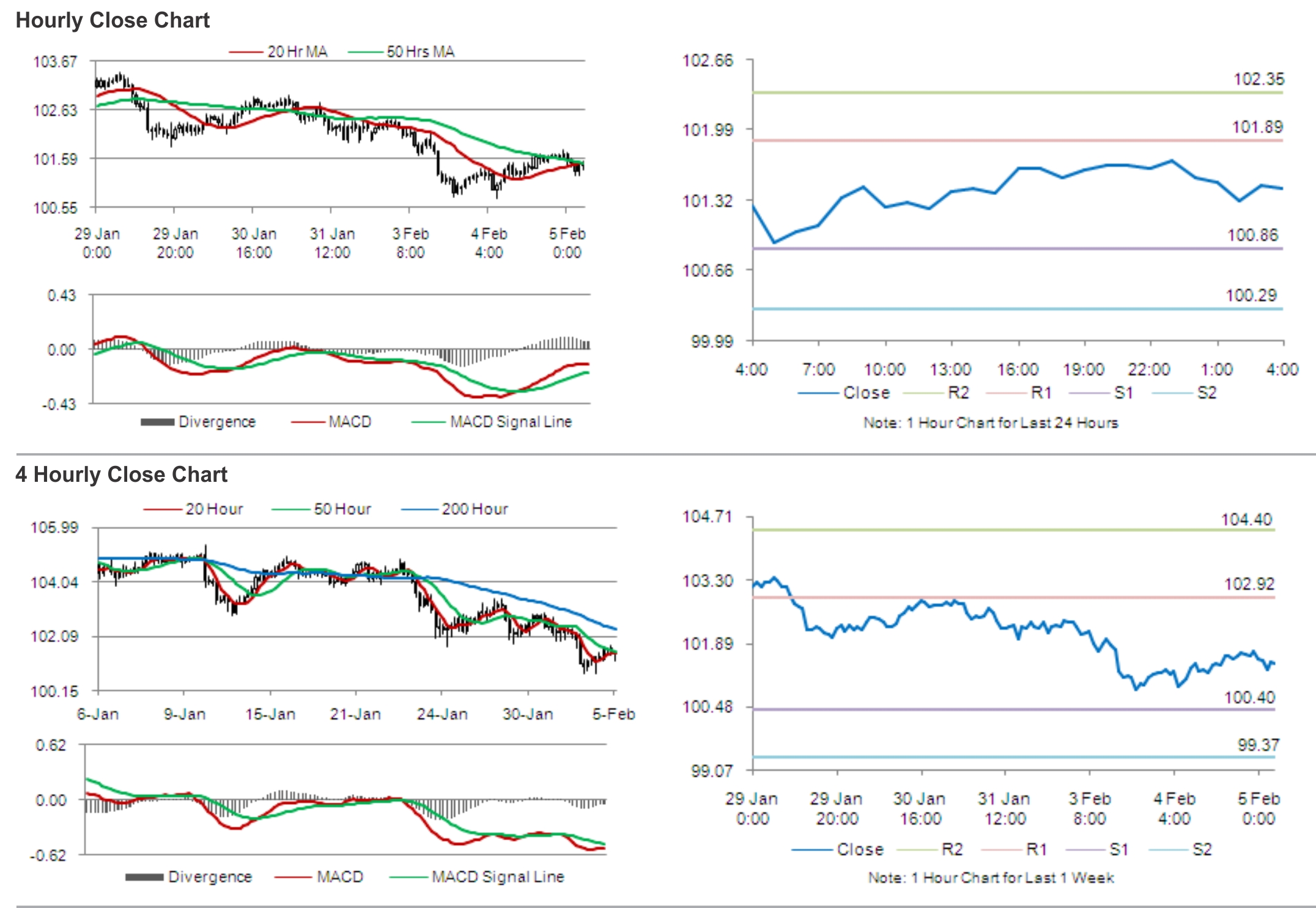

The pair is expected to find support at 100.86, and a fall through could take it to the next support level of 100.29. The pair is expected to find its first resistance at 101.89, and a rise through could take it to the next resistance level of 102.35.

In the absence of any economic data from Japan, traders would keep a tab on global economic news for further guidance in the pair.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.