For the 24 hours to 23:00 GMT, the USD weakened 0.22% against the JPY and closed at 101.47, after data showed that the US private sector added fewer-than-expected jobs in the month of January.

In the Asian session, at GMT0400, the pair is trading at 101.60, with the USD trading 0.13% higher from yesterday’s close. Earlier today, the Bank of Japan (BoJ) Deputy Governor, Kikuo Iwata hinted that the central bank would not stop easing abruptly, even if the economy manages to achieve its 2% inflation target. However, at the same time he mentioned that the BoJ’s bond purchases amounts could change from month to month. Additionally, he reiterated that the central bank would continue pursuing its current framework and readily make changes, if need arises in the near future.

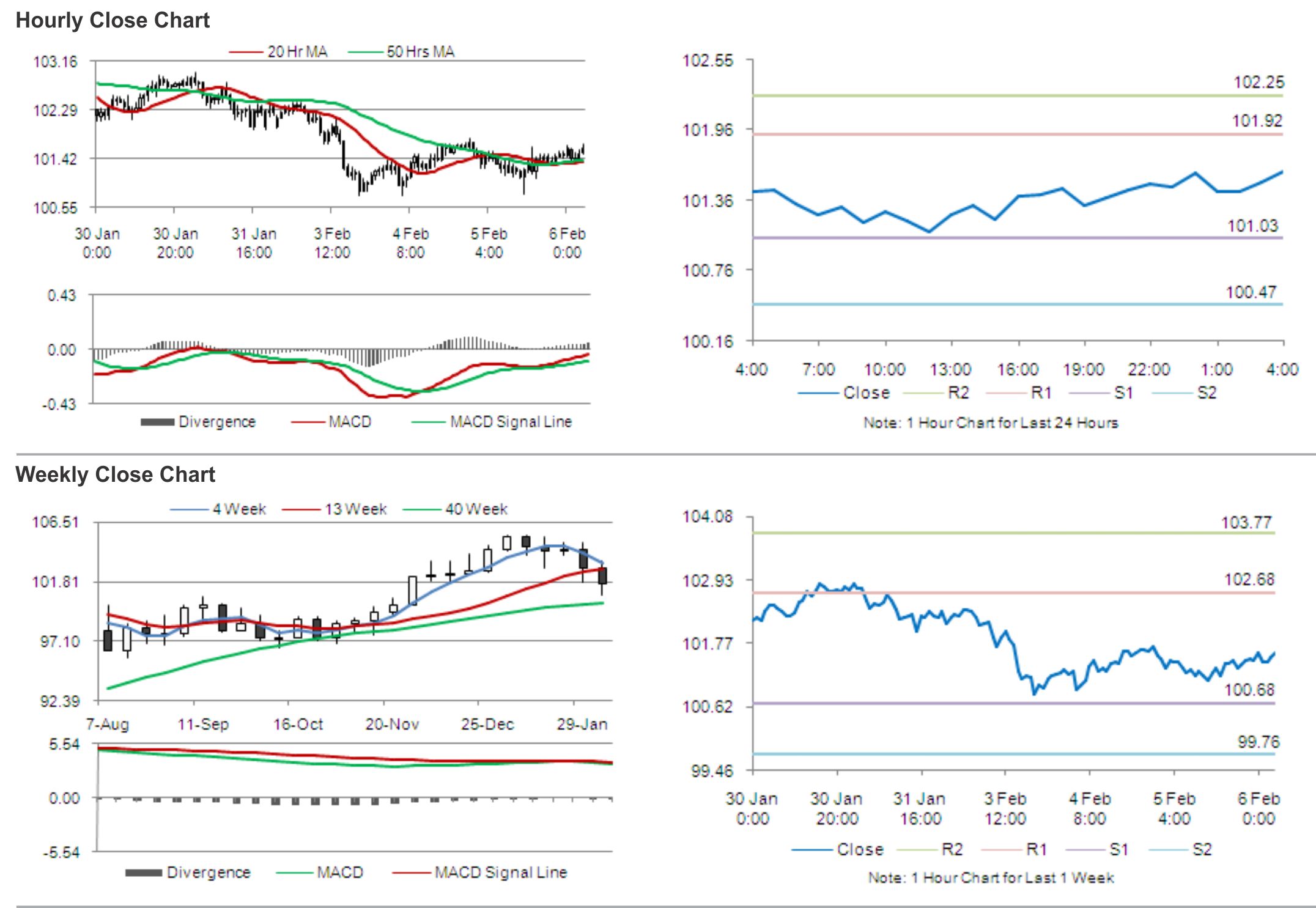

The pair is expected to find support at 101.03, and a fall through could take it to the next support level of 100.47. The pair is expected to find its first resistance at 101.92, and a rise through could take it to the next resistance level of 102.25.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.