For the 24 hours to 23:00 GMT, EUR rose 0.43% against the USD and closed at 1.3592, after the European Central Bank (ECB) President, Mario Draghi rejected the possibility of deflation in the Euro-zone economy.

Mario Draghi, following the ECB’s decision to keep its key interest rate unchanged at 0.25%, suggested that the market should dispense the idea of deflation in the Euro-zone economy. However, at the same time, he also highlighted the possibility for the Euro-bloc to experience a low level of inflation for a prolonged period of time.

Meanwhile, the ECB policymaker, Christian Noyer too supported his stance and further added that the region witnessing a fragile recovery and low inflation is “not normal, but not alarming”, as well.

On the economic front, a report showed that, on a non-seasonally adjusted basis, factory orders in Germany rose 6.0% (YoY) in December, following a 7.2% rise registered in the preceding month.

Meanwhile, the US Dollar came under pressure after data indicated that the trade deficit in the nation widened to $38.7 billion in December from a revised deficit of $34.56 billion in the preceding month, defying analysts’ forecasts of an increase to $36 billion. However, the initial jobless claims in the nation declined more than market expectations in the previous week. Separately, Boston Fed President, Eric Rosengren, expressed concerns over the US labour market conditions and suggested the central bank to be “quite patient” in removing its stimulus measures.

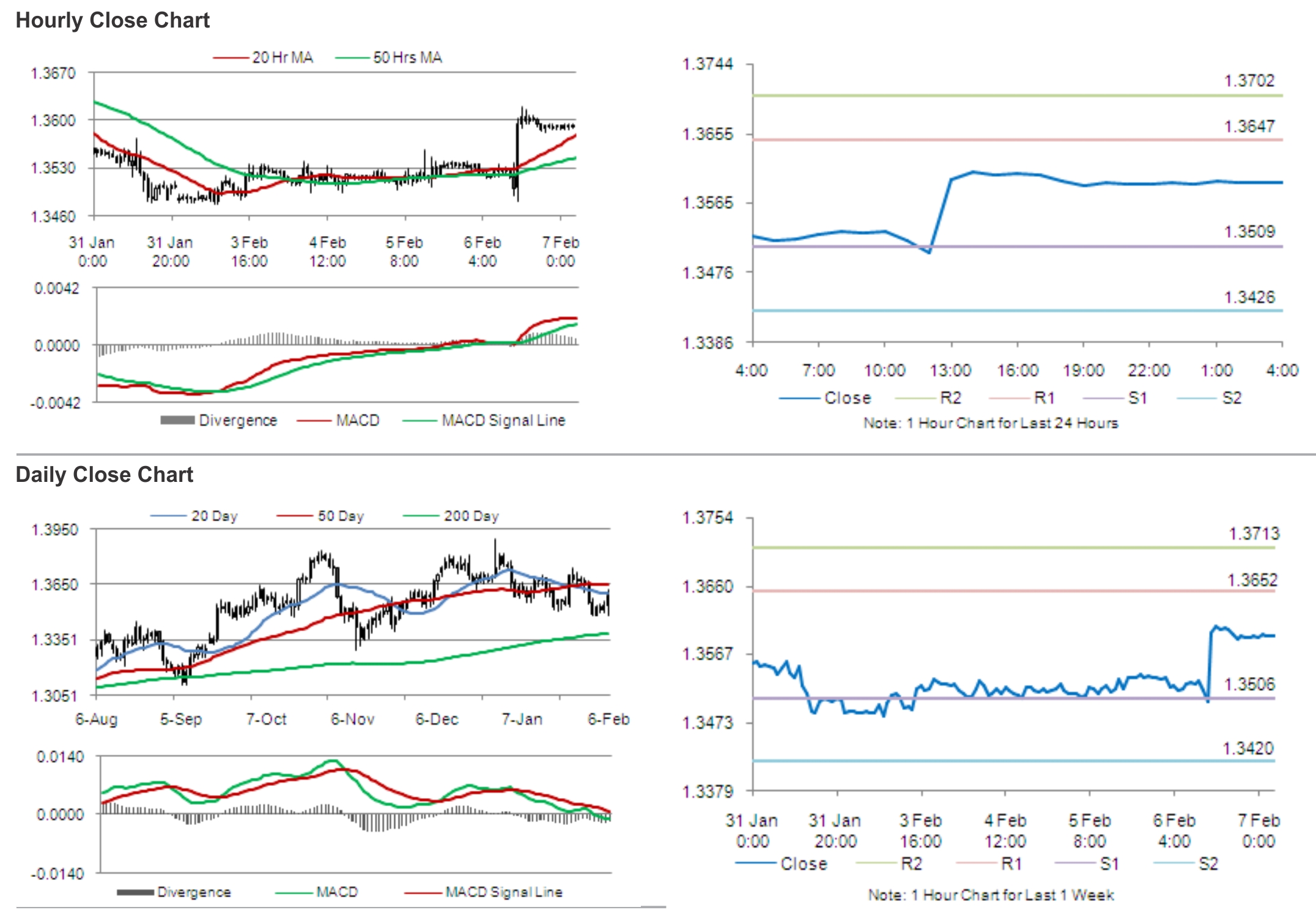

In the Asian session, at GMT0400, the pair is trading at 1.3591, with the EUR trading tad lower from yesterday’s close.

The pair is expected to find support at 1.3509, and a fall through could take it to the next support level of 1.3426. The pair is expected to find its first resistance at 1.3647, and a rise through could take it to the next resistance level of 1.3702.

Later today, traders would eye German trade balance and industrial production data for further cues in the Euro. Additionally, the important non-farm payrolls report and other jobs data from the US to be released later today, would provide insights on the health of the US labour market

The currency pair is trading above its 20 Hr and 50 Hr moving averages.