For the 24 hours to 23:00 GMT, GBP fell marginally against the USD and closed at 1.6321.

Yesterday, the Bank of England (BoE) kept its interest rate unchanged at 0.5% and maintained the size of its asset-purchase programme at £375 billion, broadly in-line with market expectations.

Separately, Halifax reported that house prices in the UK economy rose more-than-expected 7.3% (YoY) for the three month period ended January, compared to an increase of 7.5% recorded in the preceding three months.

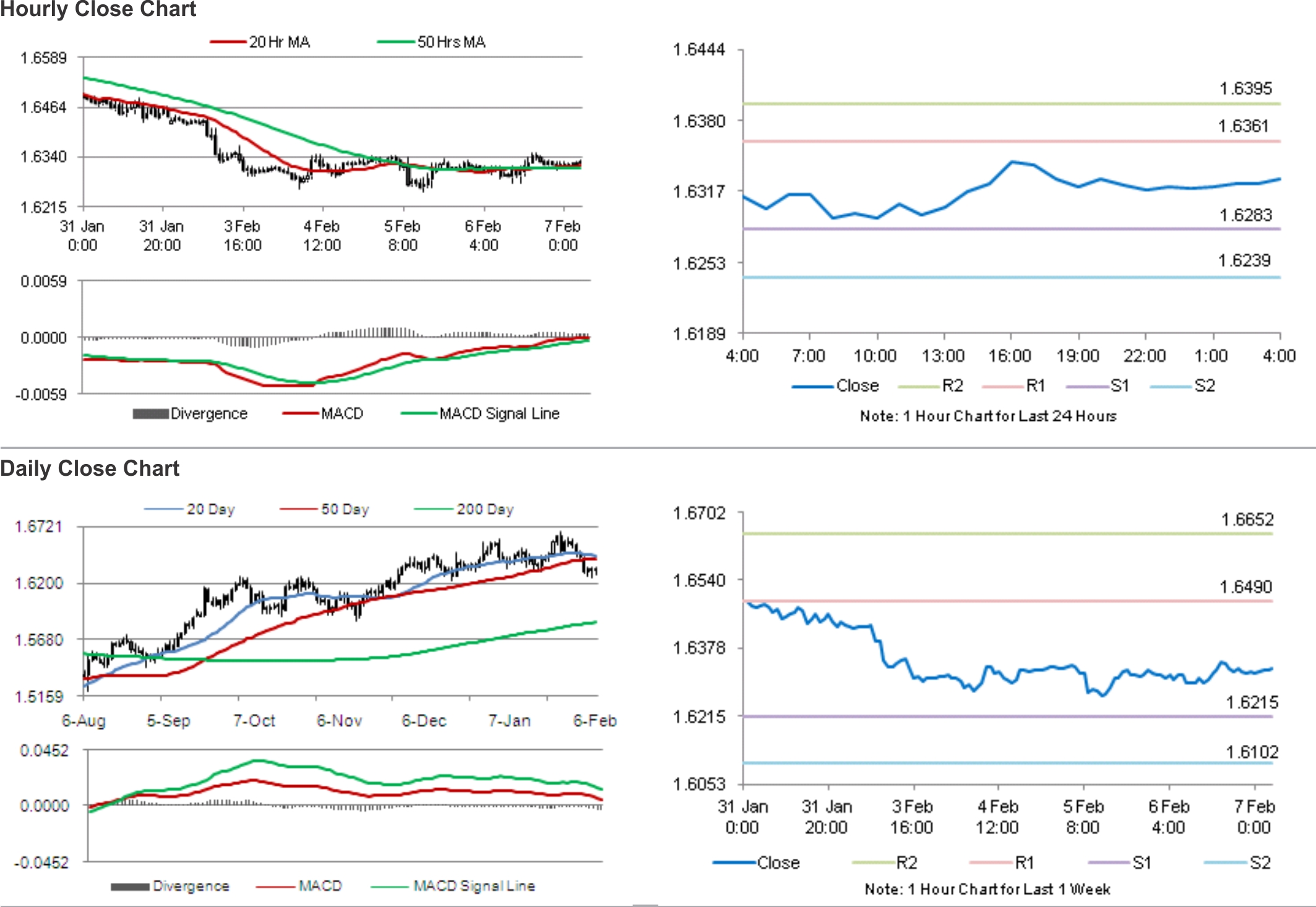

In the Asian session, at GMT0400, the pair is trading at 1.6328, with the GBP trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.6283, and a fall through could take it to the next support level of 1.6239. The pair is expected to find its first resistance at 1.6361, and a rise through could take it to the next resistance level of 1.6395.

Market participants keenly await the UK’s industrial production, manufacturing production and trade balance data, slated for release later today. Also later during the day, the National Institute of Economic and Social Research (NIESR) would provide its estimate for the UK GDP for the period of three months ended January.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.