For the 24 hours to 23:00 GMT, the USD declined 0.08% against the CAD to close at 1.1070.

The Canadian Dollar gained momentum despite data indicating that the international merchandised trade deficit in Canada unexpectedly widened for a third consecutive month to $1.7 billion in December, compared to a revised deficit of $1.5 billion recorded in the previous month. The Loonie further received support after another report revealed that, Canada’s Ivey purchasing managers index (PMI) bounced back to expansionary territory and rose to a level of 56.8 in January, surpassing analysts’ call for a rise to 51.0, from previous month’s reading of 46.3.

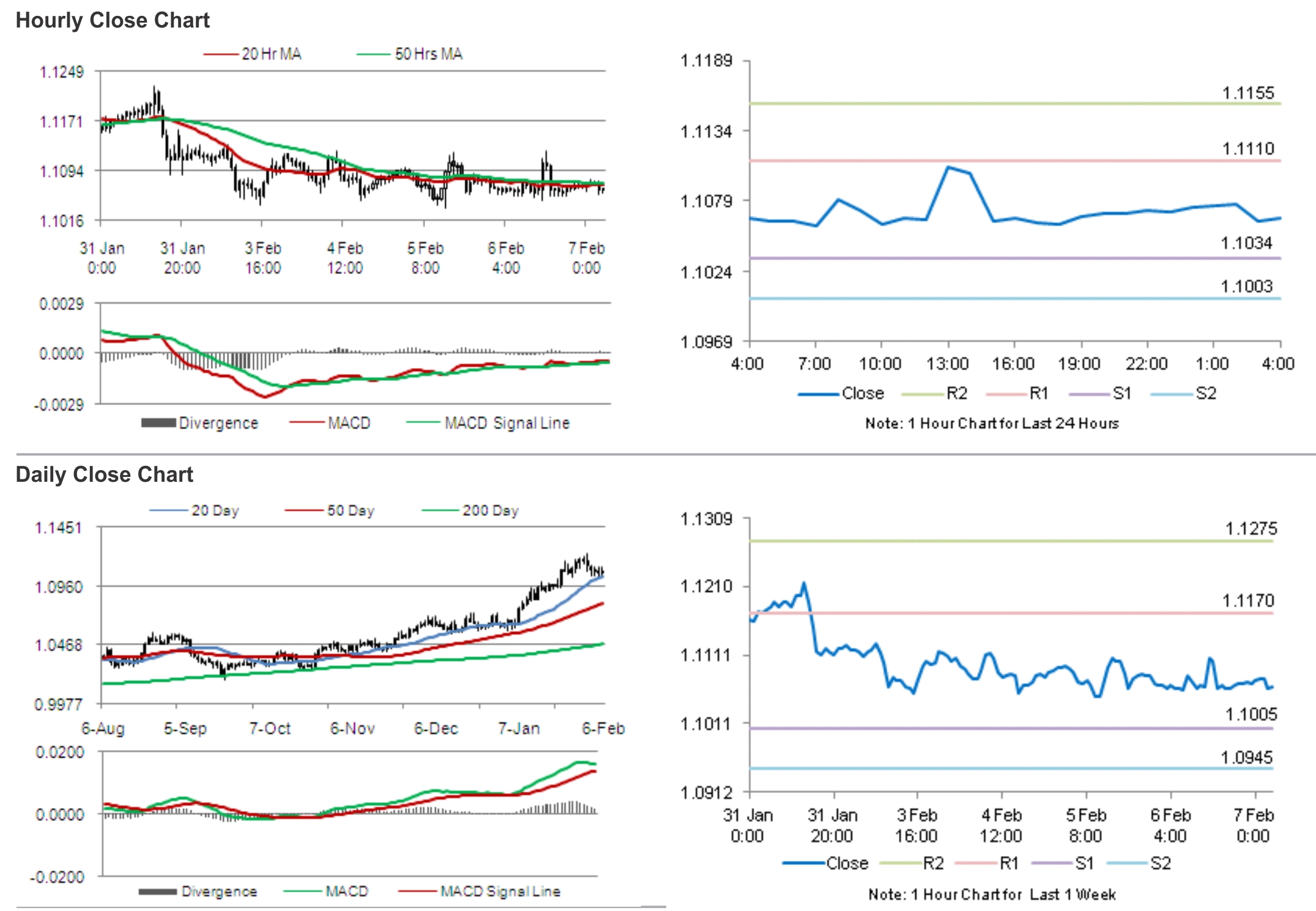

In the Asian session, at GMT0400, the pair is trading at 1.1065, with the USD trading slightly lower from yesterday’s close.

The pair is expected to find support at 1.1034, and a fall through could take it to the next support level of 1.1003. The pair is expected to find its first resistance at 1.1110, and a rise through could take it to the next resistance level of 1.1155.

Later today, the Statistics Canada is expected to release a report on the unemployment level in Canada.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.