For the 24 hours to 23:00 GMT, the USD strengthened 0.37% against the JPY and closed at 102.53, after the Fed Chef, Janet Yellen assured that the central bank at present would not change the pace of tapering its stimulus measures.

In the Asian session, at GMT0400, the pair is trading at 102.55, with the USD trading marginally higher from yesterday’s close.

Earlier today, the Bank of Japan board member, Takahide Kiuchi’s opined that an additional stimulus measure might be detrimental for the Japanese economy. He further cast doubts on whether the additional policy easing would help the central bank meet its 2% inflation target.

However, the BoJ Governor, Haruhiko Kuroda stated that the central bank would not think twice to adjust its quantitative easing if upside or downside risks to the economy and prices appear.

On the economic front, data showed that machinery orders in Japan fell more-than-expected 15.7% (MoM) in December, compared to a 9.3% (MoM) rise registered in the preceding month. Another report showed that Japan’s tertiary industry index declined 0.4% in December, more than analysts’ call for a 0.3% drop and compared to a 0.8% rise recorded in the previous month.

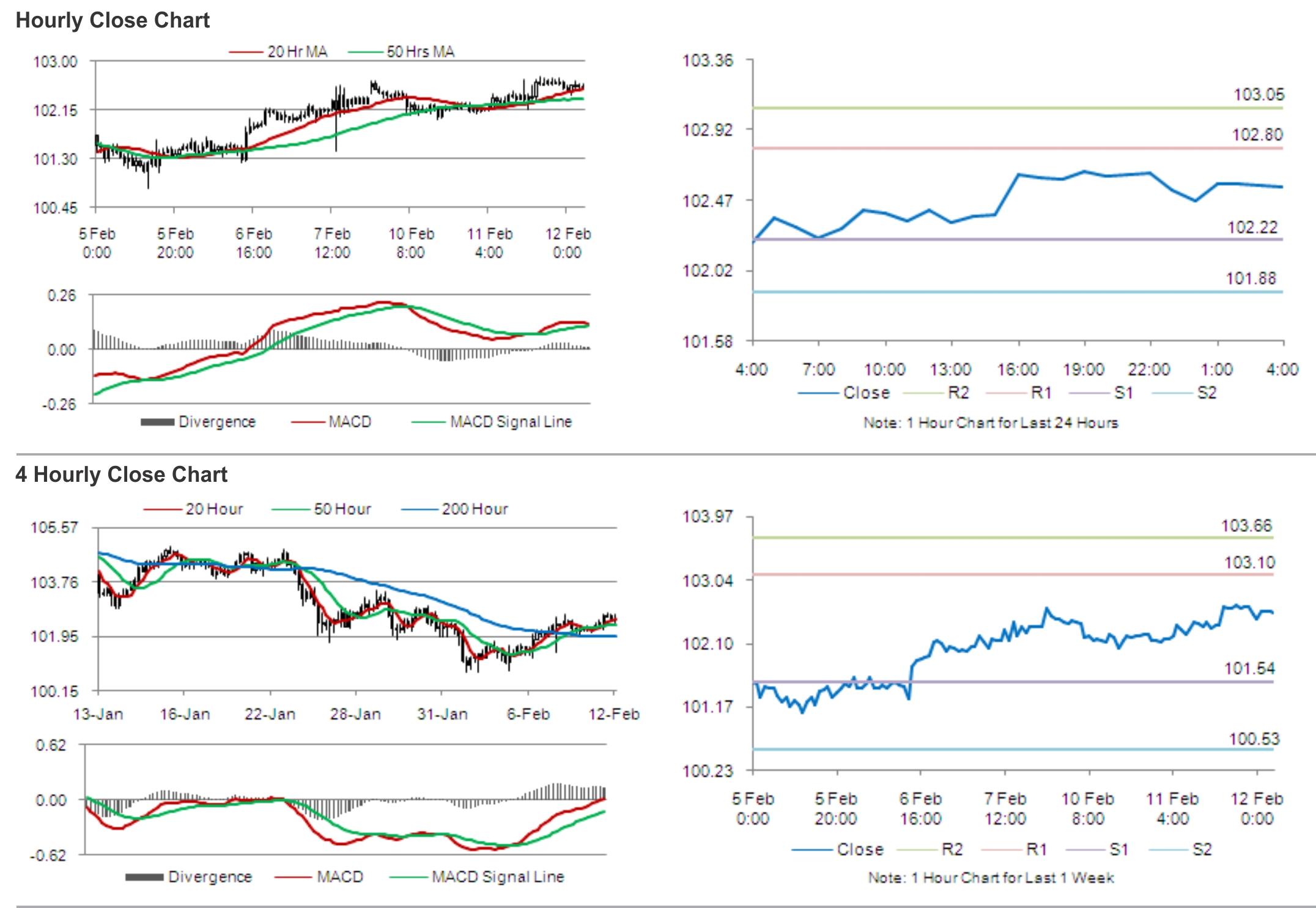

The pair is expected to find support at 102.22, and a fall through could take it to the next support level of 101.88. The pair is expected to find its first resistance at 102.80, and a rise through could take it to the next resistance level of 103.05.

Later today, the Japan machine tool builders’ association is scheduled to release a report on Japan’s machine tool orders.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.