Crude Oil prices declined 0.62% against the USD for the 24 hour period ending 23:00GMT, closing at 101.97, after data revealed an increase in the US crude inventories and on growing concerns that the weakening Chinese Yuan would hinder growth in China, the second-largest oil-consuming country.

Late Tuesday, the American Petroleum Institute (API) reported 822,000 barrels rise in the US crude supplies last week. Analysts had expected the US crude inventories to rise by 1.5 million barrels.

However, forecasts for another wave of cold weather across the US Midwest and the Great Plains along with supply disruptions in Libya, South Sudan and Nigeria, provided some support to oil prices.

In the Asian session, at GMT0400, Crude Oil is trading at 101.81, 0.16% lower from yesterday’s close.

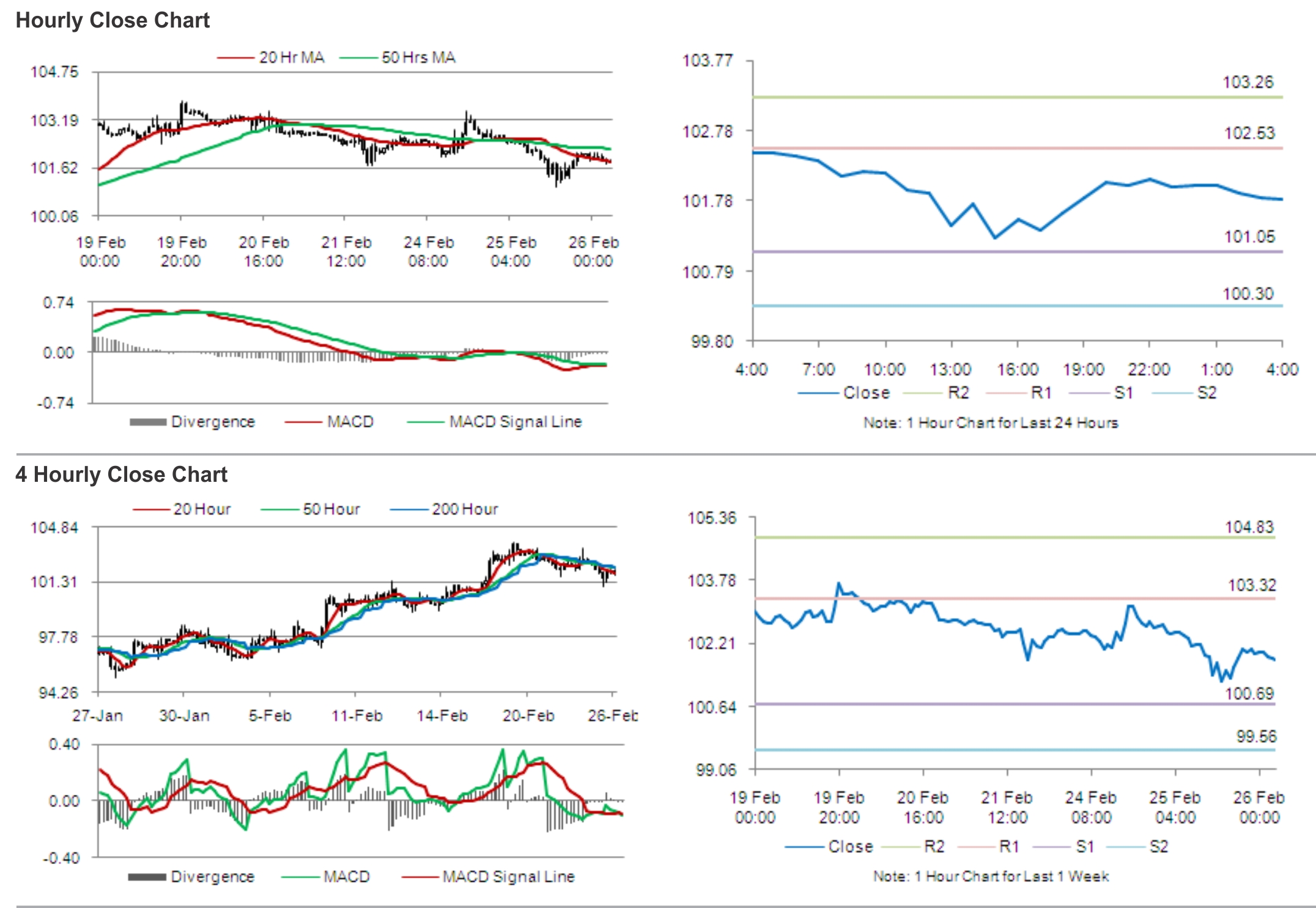

Crude oil is expected to find support at 101.05, and a fall through could take it to the next support level of 100.30. Crude oil is expected to find its first resistance at 102.53, and a rise through could take it to the next resistance level of 103.26.

Traders await the Energy Information Administration (EIA) report on the US crude supplies for further cues in the crude oil prices.

Crude oil is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.