For the 24 hours to 23:00 GMT, EUR declined 0.47% against the USD and closed at 1.3681.

The US Dollar advanced against the Euro after data showed that new homes sales in the US jumped 9.6% to a seasonally adjusted annual rate of 468,000 units in January, the highest level since July 2008 and compared to a rate of 427,000 recorded in the previous month.

Adding to the bullishness over the USD, Dallas Fed President, Richard Fisher, hinted that the central bank would continue tapering the size of its asset-purchase programme by $10 billion per meeting even if a “significant correction” occurs in the nation’s stock markets. Separately, Cleveland Fed President, Sandra Pianalto applauded the central bank’s stimulus measures to revive growth in the US economy and opined that the central bank should keep reducing its stimulus package as long as job gains continue and growth in the economy meets expectations. However, the Boston Fed Chief, Eric Rosengren, urged the US Fed to be “very patient” in scaling back its bond-buying programme as, according to him, the US labour markets still remains in “slack” condition despite the recent drop in the nation’s unemployment rate.

In the Euro-zone, Germany’s Gfk consumer confidence index for March rose more-than-expected to a reading of 8.5, the highest level seen in 7 years, from a level of 8.3 recorded in the previous month. Meanwhile, the ECB Executive Board member, Yves Mersch indicated that policymakers are “reflecting 360 degree” on the ECB’s monetary policy stance ahead of its policy meeting next week.

In the Asian session, at GMT0400, the pair is trading at 1.3686, with the EUR trading slightly higher from yesterday’s close.

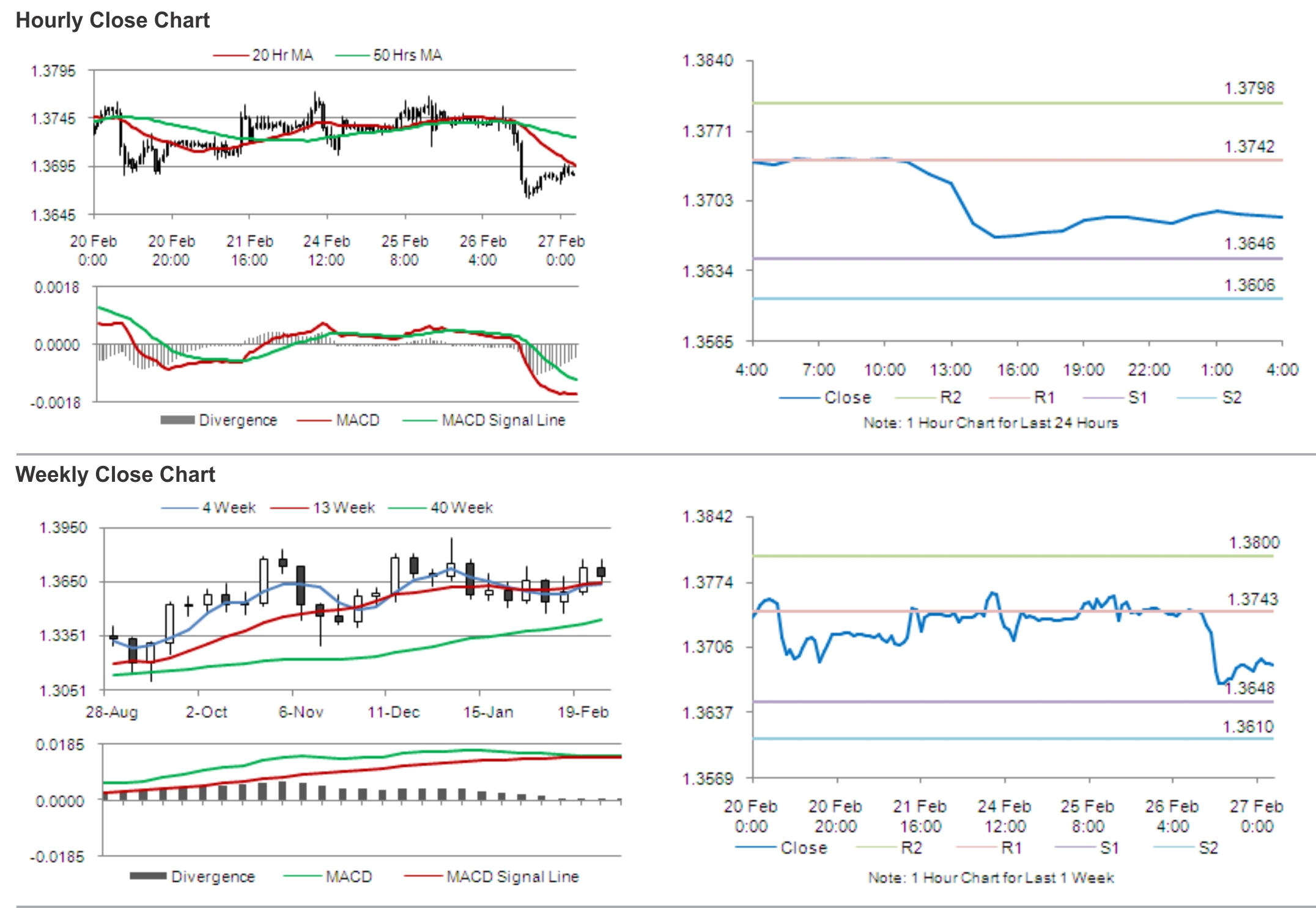

The pair is expected to find support at 1.3646, and a fall through could take it to the next support level of 1.3606. The pair is expected to find its first resistance at 1.3742, and a rise through could take it to the next resistance level of 1.3798.

Amid a slew of economic data from the Euro-zone, traders would eye the European Commission’s report on the Euro-zone’s consumer confidence and economic confidence, along with Germany’s unemployment and consumer inflation data. Traders would also keenly await a planned speech from the Fed Chief, Janet Yellen, due later today, for further cues in the greenback.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.