For the 24 hours to 23:00 GMT, GBP marginally fell against the USD and closed at 1.6666, as the US Dollar advanced following a surge in the US new home sales data for January.

The British Pound came under pressure after two of the Bank of England (BoE) policymakers, David Miles and Spencer Dale downplayed concerns of an interest rate hike in the near future. Separately, another BoE policymaker, Ben Broadbent, noted that at present there was excessive focus on an interest rate hike, however the BoE “would not give any time-specific guidance” on when the interest rates in the nation would rise.

However, earlier during the day, the Pound rose against its US counterpart after an official report confirmed that the UK GDP rose in-line with market estimates by 0.7% (QoQ) in the fourth-quarter, following a 0.8% increase recorded in the preceding quarter. Another report showed that total business investment in the UK rose 2.4% (QoQ) in the fourth quarter, more than analysts’ expectations for a rise of 1.3% and compared to a 2.0% increase registered in the previous quarter.

In the Asian session, at GMT0400, the pair is trading at 1.6668, with the GBP trading tad higher from yesterday’s close.

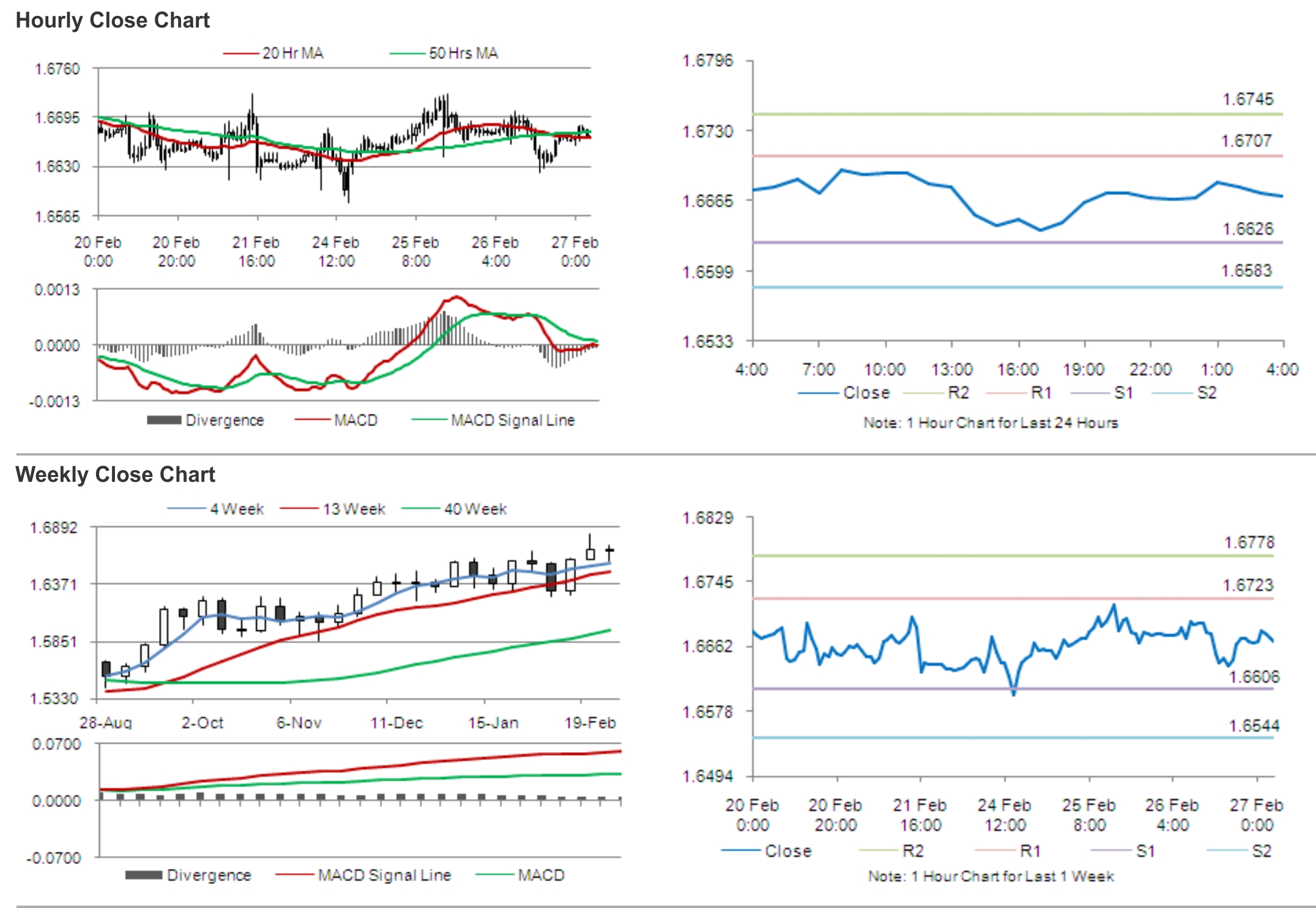

The pair is expected to find support at 1.6626, and a fall through could take it to the next support level of 1.6583. The pair is expected to find its first resistance at 1.6707, and a rise through could take it to the next resistance level of 1.6745.

Amid lack of major economic releases from the UK, traders would eye the Fed Chief, Janet Yellen’s speech for further guidance in the pair.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.