For the 24 hours to 23:00 GMT, the USD rose 0.20% against the CHF and closed at 0.8850, as traders cheered an upbeat US durable goods orders data for February.

In Switzerland, the UBS consumption indicator rose to a reading of 1.57 in February, from a revised reading of 1.49 in January, led by higher number of tourists and new car registrations.

In the Asian session, at GMT0400, the pair is trading at 0.8854, with the USD trading slightly higher from yesterday’s close.

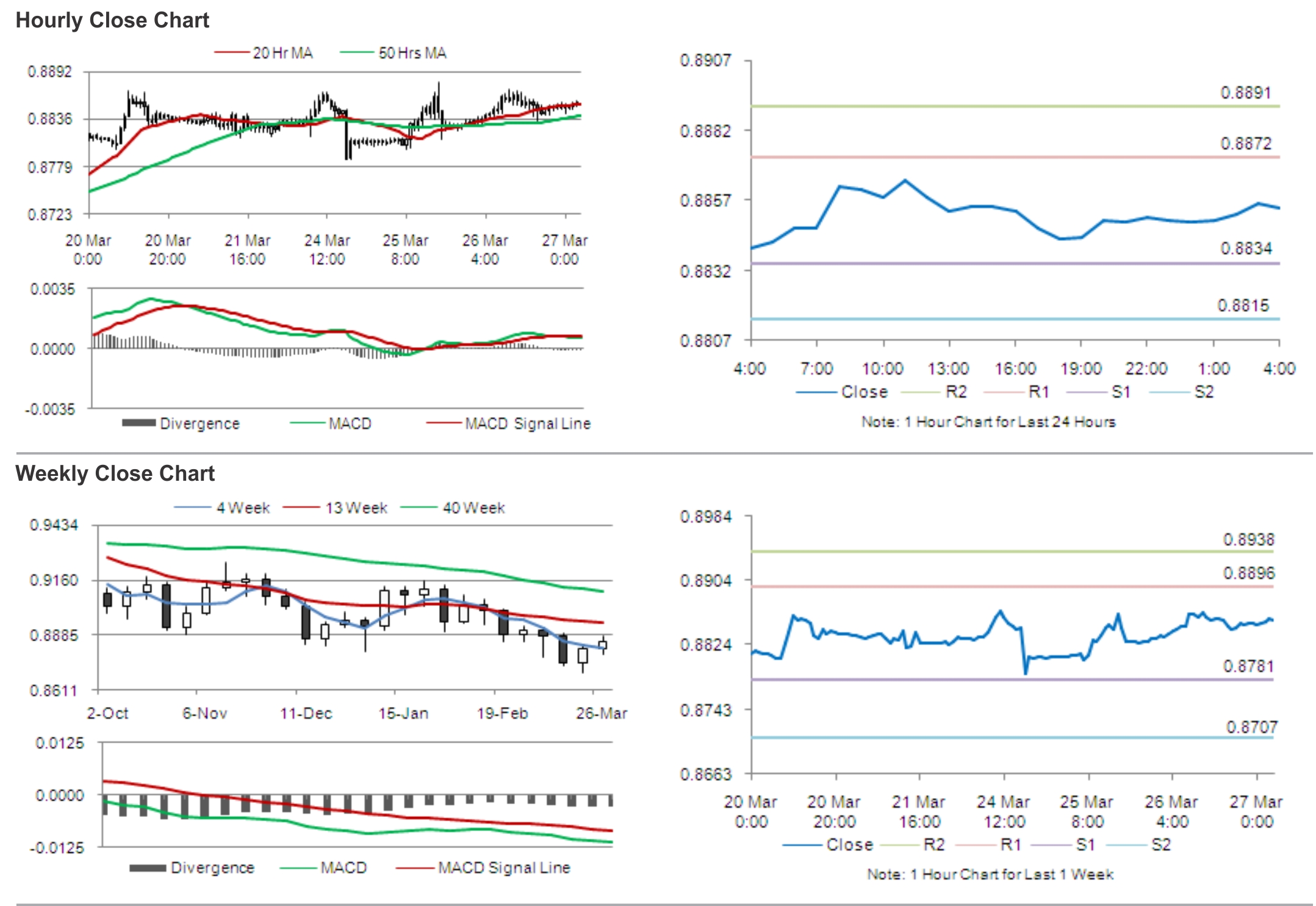

The pair is expected to find support at 0.8834, and a fall through could take it to the next support level of 0.8815. The pair is expected to find its first resistance at 0.8872, and a rise through could take it to the next resistance level of 0.8891.

Amid lack of economic releases from Switzerland, traders would eye US GDP and weekly jobless claims data for further guidance in the pair.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.