For the 24 hours to 23:00 GMT, EUR rose 0.25% against the USD and closed at 1.3887. However, gains in the Euro-zone’s shared currency were capped after the European Central Bank (ECB) President, Mario Draghi indicated that the central bank is keeping a close watch on the impact of geopolitical risks and exchange rate developments on the region’s inflation rate and that the ECB stands ready to start quantitative easing to keep prices from staying too low for a prolonged period of time. However, he noted that at present inflation expectations were anchored at the central bank’s target.

Separately, an ECB Executive Board member, Peter Praet projected the Euro-zone economy to witness economic slackness until 2017 and reiterated that the central bank would maintain its monetary policy well into the future. Meanwhile, the ECB’s Vice President, Vitor Constancio stated that central bank’s Governing Council was firm in its commitment to use unconventional policy tools to cope with a too-prolonged period of low inflation.

Additionally, at the outset of the annual spring meeting of the IMF and World Bank, IMF Chief, Christine Lagarde appreciated the ECB’s stance of using any policies necessary, including unconventional monetary policies, to combat low inflation which could threaten growth if it continues. But, at the same time she expressed uncertainty over its timing of doing so.

On the economic front, the ECB’s monthly bulletin indicated that inflation expectations for the Euro-zone over the medium to long term continue to remain firmly anchored below, but close to 2.0%. Furthermore, the central bank also opined that the current slackness in the region’s economy could likely dampen upward pressure on inflation.

The US Dollar received some support after data showed that initial jobless claims in the nation fell more-than-expected to a seven year low level of 300,000 for the week ended 5 April while budget deficit in the nation narrowed to the lowest level for the month since 2000 in March.

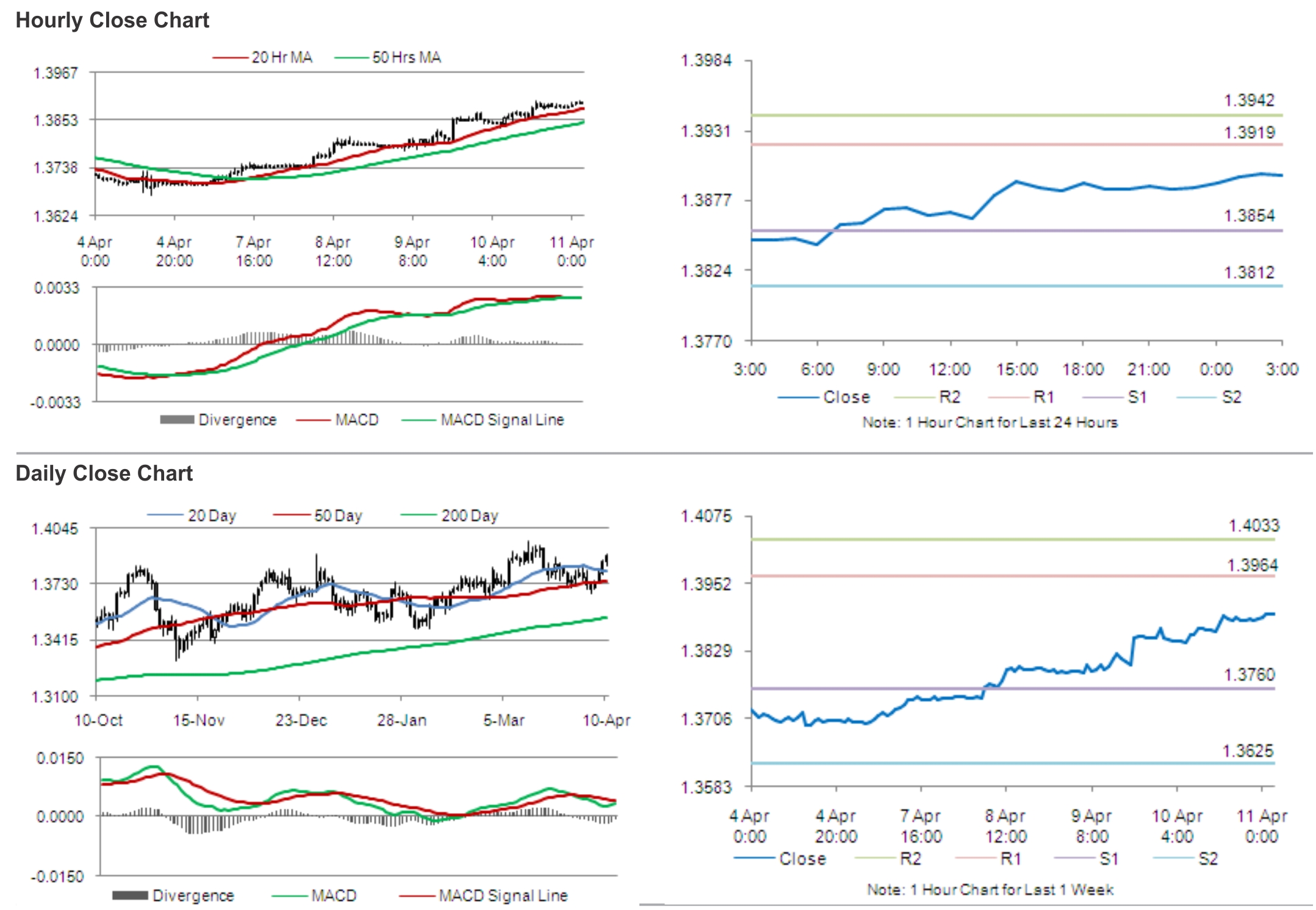

In the Asian session, at GMT0300, the pair is trading at 1.3896, with the EUR trading 0.06% higher from yesterday’s close.

The pair is expected to find support at 1.3854, and a fall through could take it to the next support level of 1.3812. The pair is expected to find its first resistance at 1.3919, and a rise through could take it to the next resistance level of 1.3942.

Later today, market participants would eye Germany’s consumer inflation and Reuters/Michigan US consumer sentiment data for further cues in the currency pair.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.