For the 24 hours to 23:00 GMT, the USD rose 0.15% against the CAD to close at 1.0986, following the release of a strong US consumer inflation data for March.

In Canada, data showed that manufacturing shipments in February jumped 1.4% (MoM) to the highest level since their pre-recession peak in July 2008.

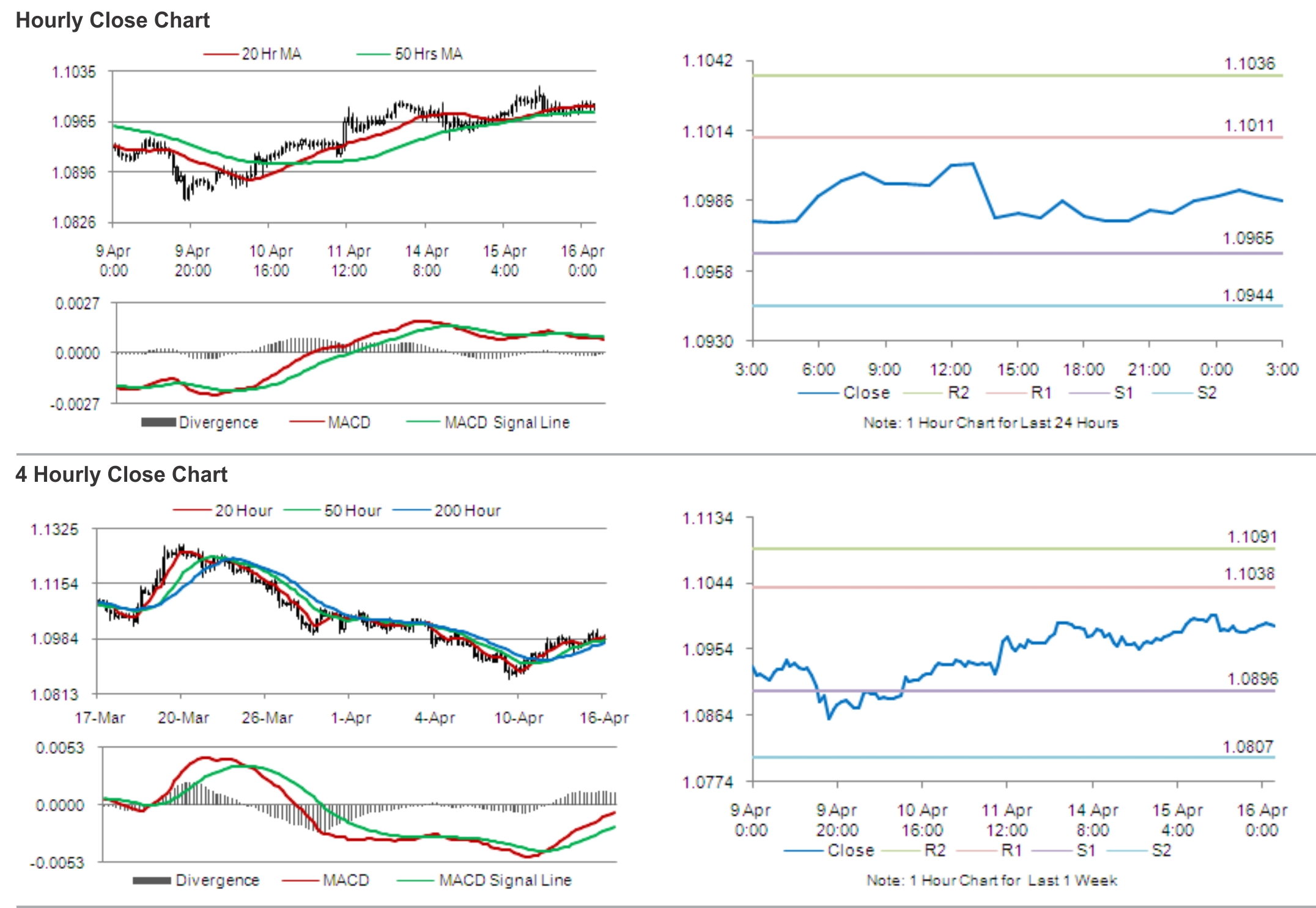

In the Asian session, at GMT0300, the pair is trading at 1.0986, with the USD trading flat from yesterday’s close.

The pair is expected to find support at 1.0965, and a fall through could take it to the next support level of 1.0944. The pair is expected to find its first resistance at 1.1011, and a rise through could take it to the next resistance level of 1.1036.

Market participants keenly await the Bank of Canada’s (BoC) interest rate decision, due later today, for further cues in the Loonie.

The currency pair is showing convergence with its 20 Hr moving average and is trading just above its 50 Hr moving average.