For the 24 hours to 23:00 GMT, the EUR declined 0.10% against the USD and closed at 1.3912, as the latter benefitted from Fed Chief, Janet Yellen’s optimistic view on the future of the US economic growth. Janet Yellen, in her testimony before the Joint Economic Committee, pointed to the current healthy state of the US economy and added that it was on track to achieve “solid growth” in the second quarter, following an unusual harsh winter. However, at the same time, she opined that the world’s largest economy would still be in need of the Fed’s accommodative policy measures as housing market in the nation still posed a risk to the economy and conditions in job market remained “far from satisfactory.”

Meanwhile, in the Euro-zone, French Economy Minister, Arnaud Montebourg contradicted Germany’s view and stated that political leaders have a right to assess the whole issue of exchange rate policy. Furthermore, he highlighted his preference for a weaker Euro and projected a 10% drop in the currency to boost French GDP by 0.6 percentage points over a year and twice as much over three years.

On the economic front, data from the Euro-zone’s member nations showed that German factory orders unexpectedly dropped 2.8% (MoM) in March while France’s manufacturing production declined for the first time in six months in March. Separately, data from France showed that trade deficit in the nation widened to €4.94 billion in March as a rise in imports more-than-offset a slight increase in the nation’s export.

In the Asian session, at GMT0300, the pair is trading at 1.3919, with the EUR trading marginally higher from yesterday’s close.

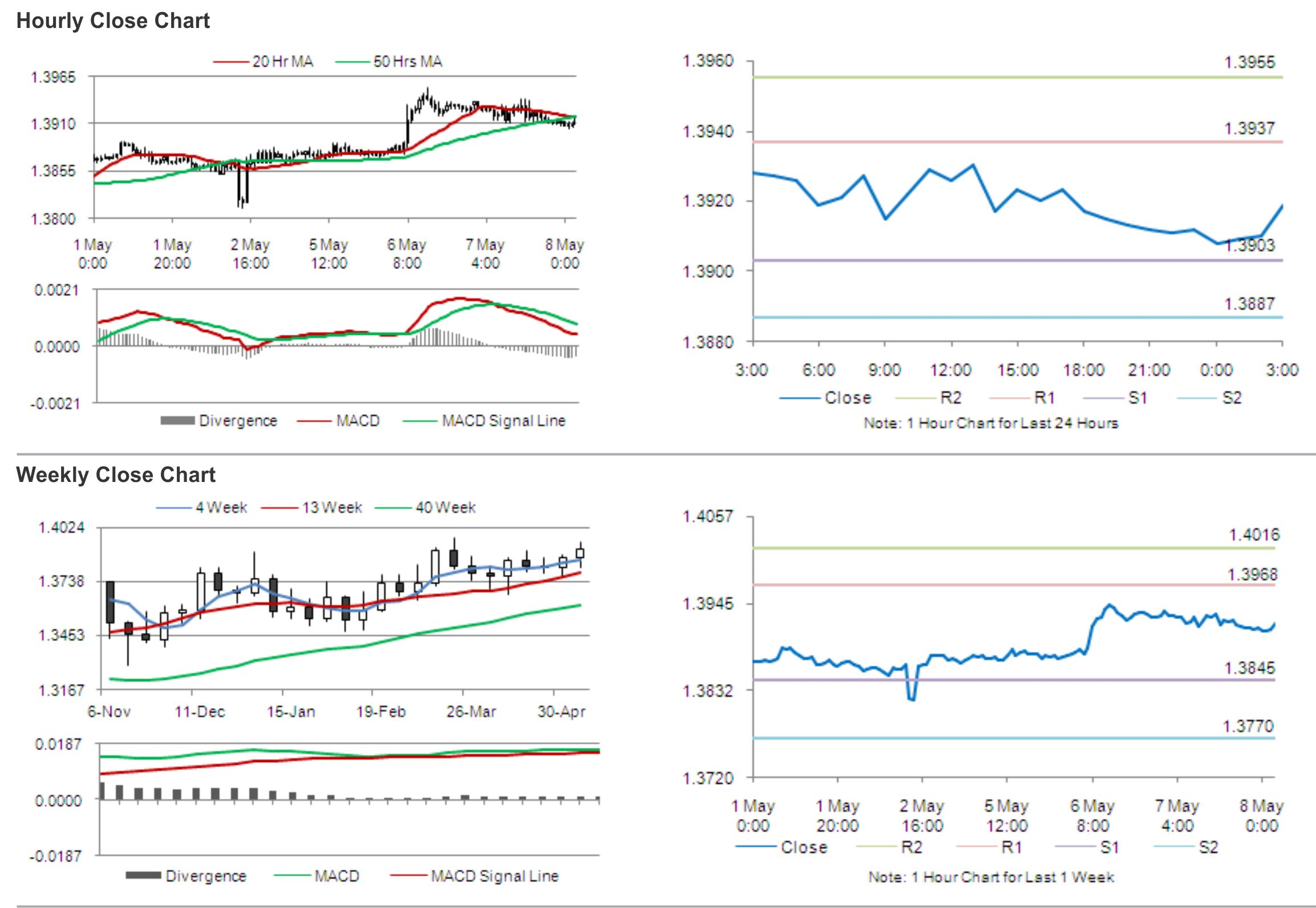

The pair is expected to find support at 1.3903, and a fall through could take it to the next support level of 1.3887. The pair is expected to find its first resistance at 1.3937, and a rise through could take it to the next resistance level of 1.3955.

Traders keenly await the ECB’s decision on its benchmark interest rate, along with Germany’s industrial production data, for further cues in the Euro.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.