For the 24 hours to 23:00 GMT, the EUR declined 0.52% against the USD and closed at 1.3840, after the ECB President, Mario Draghi, following the central bank’s decision to keep its interest rate intact at a record-low 0.25%, hinted that policymakers might consider additional stimulus measures in the Euro-zone economy as early at its June policy meeting if needed. Furthermore, he highlighted the adverse impact of a stronger Euro on the Euro-zone economy and reiterated the central bank’s commitment for using unconventional instruments within its mandate to shore up economic growth and put an end to the prolonged period of low inflation in the economy.

On the economic front, data from Euro-zone’s member nations showed that industrial production in Germany fell for the first time in five months in March while unemployment in Greece eased for fifth straight month in February. Data also showed that Spain’s industrial production rose at a slower annual rate of 0.6% in March.

Meanwhile, in the US, the Fed Chief, Janet Yellen, in her testimony to a Senate panel, stated that central bank was in no hurry to shrink the size of its balance sheet, which had become bloated at $4.5 trillion from about $800 billion in 2007. Additionally, she opined that, if the US Fed decides to reduce the size of its balance sheet, it could take more than 5-8 years to get it back to pre-crisis level. Separately, the Philadelphia Fed President, Charles Plosser, expressed concerns on the 0.1% growth in the US GDP during the first quarter, but at the very same time, also stated that he remains confident that the economy could achieve a growth of 3.0% in 2014, despite the slowdown caused by a harsh winter.

In economic news, the US Labor Department reported that jobless claims in the nation declined by 26,000 numbers to a seasonally adjusted 319,000 for the week ended 3 May 2014.

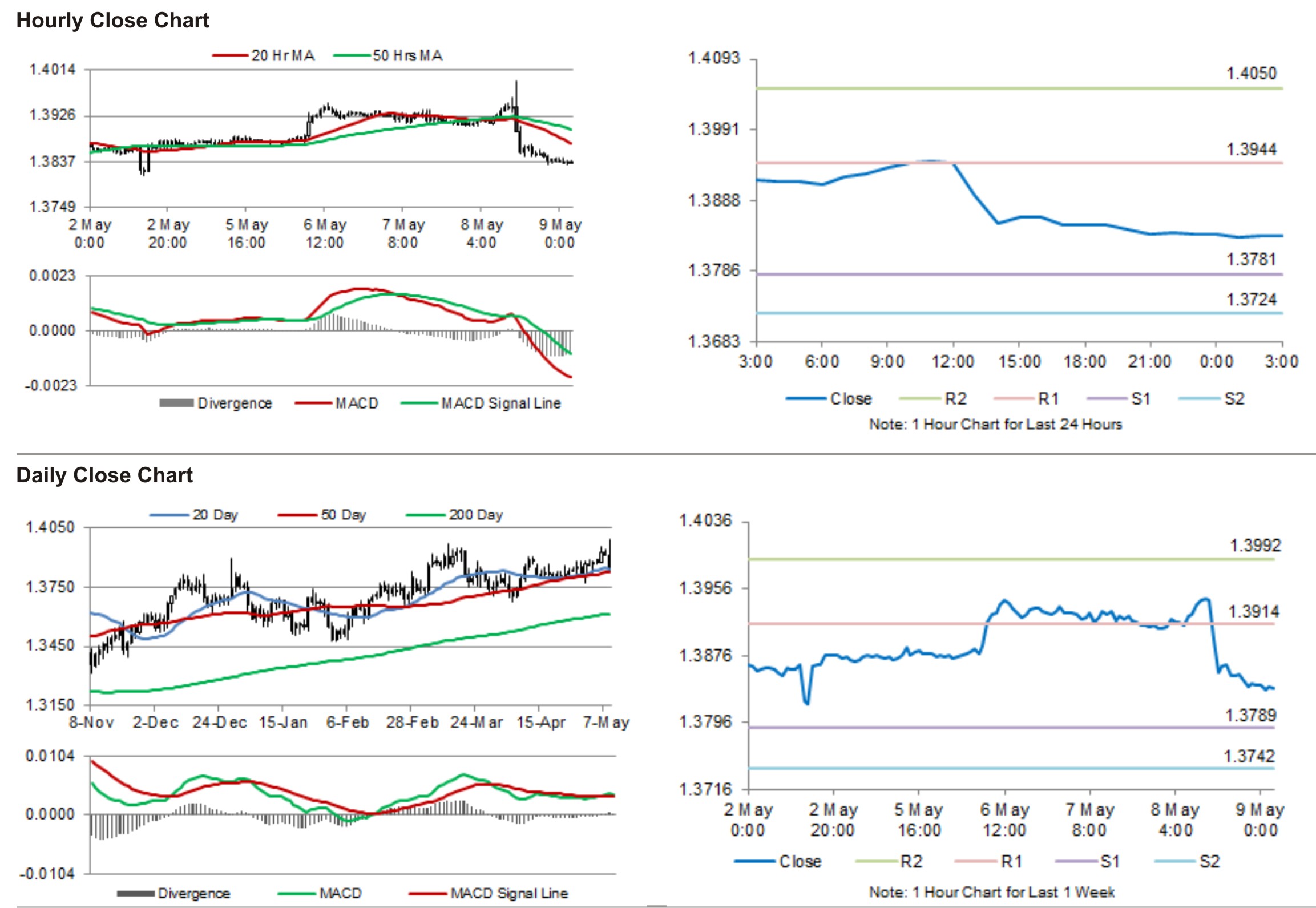

In the Asian session, at GMT0300, the pair is trading at 1.3837, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.3781, and a fall through could take it to the next support level of 1.3724. The pair is expected to find its first resistance at 1.3944, and a rise through could take it to the next resistance level of 1.4050.

Amid a slew of economic releases from the Euro-zone’s member nations, later today, traders are expected to keep a tab on Germany trade balance and Italy’s industrial production data for March.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.