Gold prices traded lower by 0.11% against the USD in the 24 hour period ending 23:00GMT, at 1294.40 per ounce, as a rally in world equity markets and a stronger US Dollar weighed on the demand prospects of the safe-haven metal. Negative sentiment was also fuelled after report showed that the SPDR Gold Trust, the world’s top gold-backed exchange-traded fund, reported an outflow of 2.39 tonnes on Monday to 780.46 tonnes, the first outflow since 2 May 2014. However, lingering tensions over Ukraine crisis lent some support to the prices of yellow metal.

Meanwhile, a leading broking house slashed its one-month and three-month price forecast on gold to $1,250.00 and $1,300.00 per ounce, respectively, from its earlier price-estimate of $1,280.00 and $1,350.00.

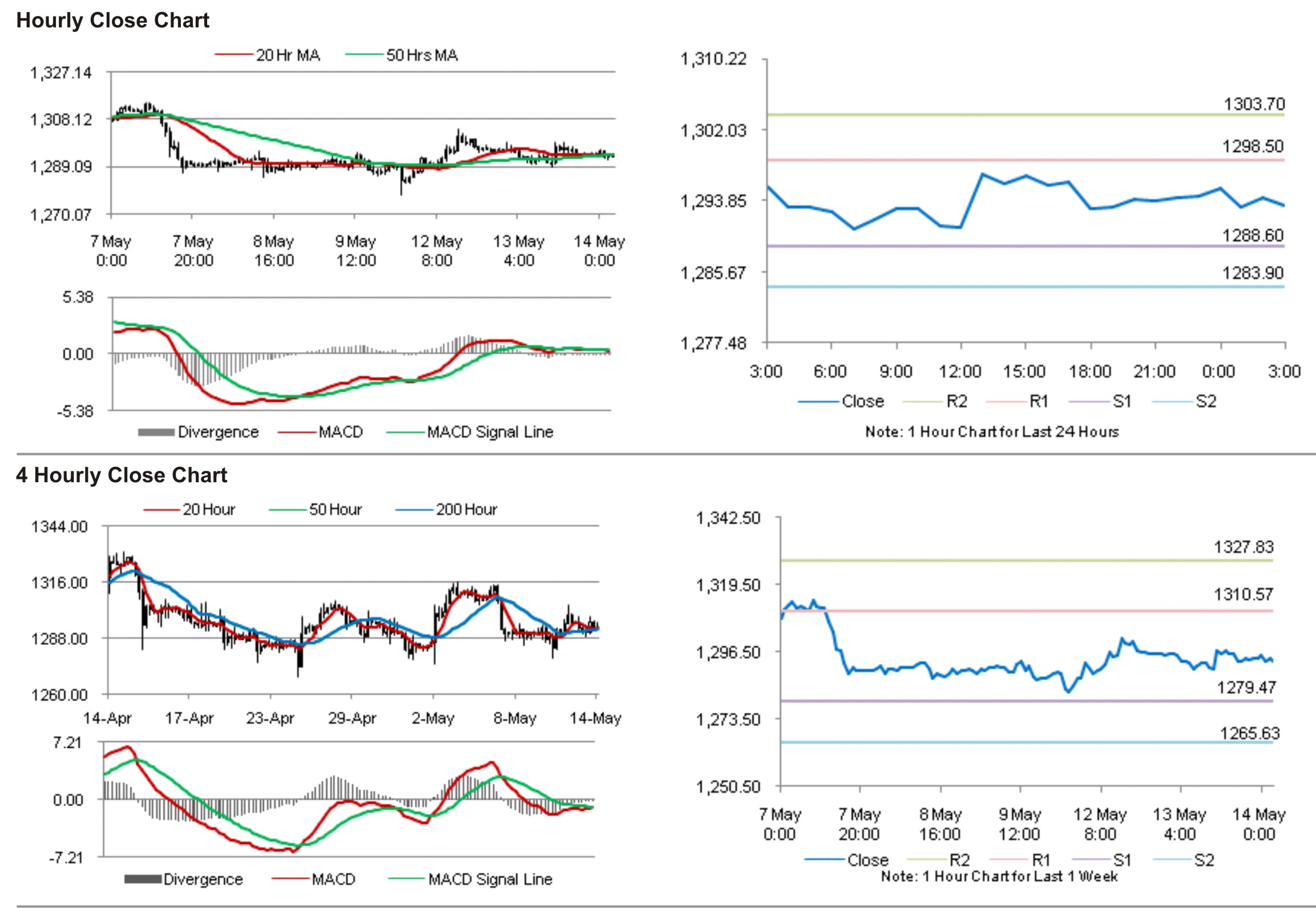

In the Asian session, at GMT0300, Gold is trading at 1293.30, 0.08% lower from yesterday’s close.

Gold is expected to find support at 1288.60, and a fall through could take it to the next support level of 1283.90. Gold is expected to find its first resistance at 1298.50, and a rise through could take it to the next resistance level of 1303.70.

The yellow metal is showing convergence with its 20 Hr and 50 Hr moving averages.