For the 24 hours to 23:00 GMT, the USD weakened 0.39% against the JPY and closed at 101.84, as escalating tensions in Ukraine bolstered the demand-prospect of the safe-haven Japanese Yen.

In a noteworthy development, Fitch Ratings affirmed Japan’s Long-Term Foreign and Local Currency Issuer Default Ratings at “A+” with a negative outlook.

In the Asian session, at GMT0300, the pair is trading at 101.84, with the USD trading flat from yesterday’s close. Earlier today, official data from Japan showed that GDP rose at a seasonally adjusted annual rate of 5.9% in the first quarter, far above a 0.3% rise recorded in the preceding quarter. However, the tertiary industry index in Japan failed to meet market expectations by registering a rise of 2.4% (MoM) in March to reach a score of 103.0.

Separately, the BoJ Governor, Haruhiko Kuroda, in his testimony before the Upper House Financial Affairs Committee expressed confidence in the world’s third largest economy achieving its 2% inflation goal in fiscal 2015, reiterating that the central bank stands prepared to alter its policy should risk materialise. Additionally, he highlighted his expectations for base wages to improve in the economy as companies have shifted its focus from “cut-rate competition to offering more value-added goods and services at higher price.”

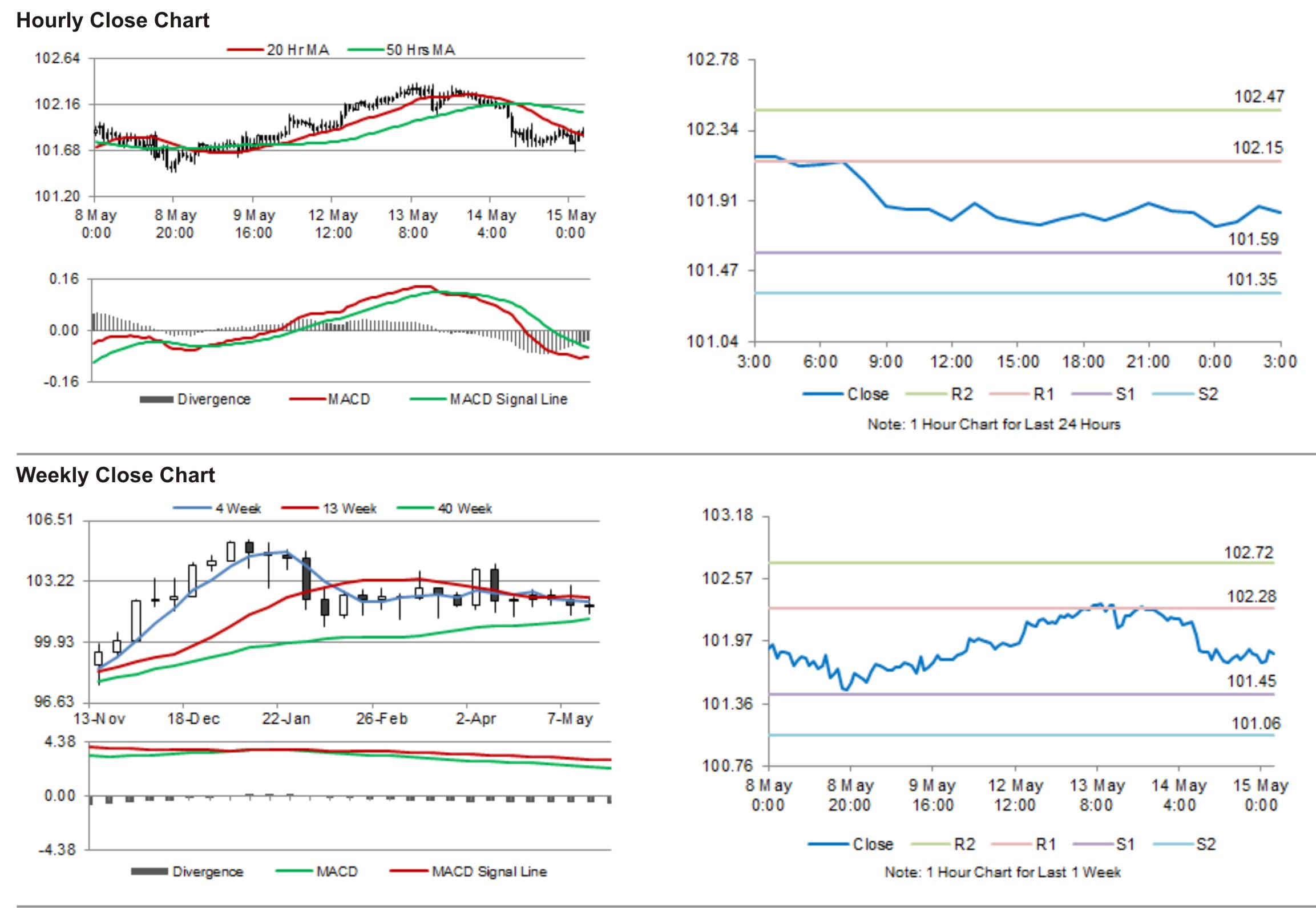

The pair is expected to find support at 101.59, and a fall through could take it to the next support level of 101.35. The pair is expected to find its first resistance at 102.15, and a rise through could take it to the next resistance level of 102.47.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.