For the 24 hours to 23:00 GMT, the GBP 0.16% against the USD and closed at 1.6794.

On Thursday, BoE’s Ben Broadbent acknowledged the fact that growth in the UK economy has gained momentum but at the same time also indicated that the economy would not witness an interest rate hike until it is well able to withstand the impact of policy tightening.

In economic news, the Conference Board reported that its leading economic index in the UK economy rose 0.3% in March, slower than the 0.4% pace of rise in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.6792, with the GBP trading marginally lower from yesterday’s close.

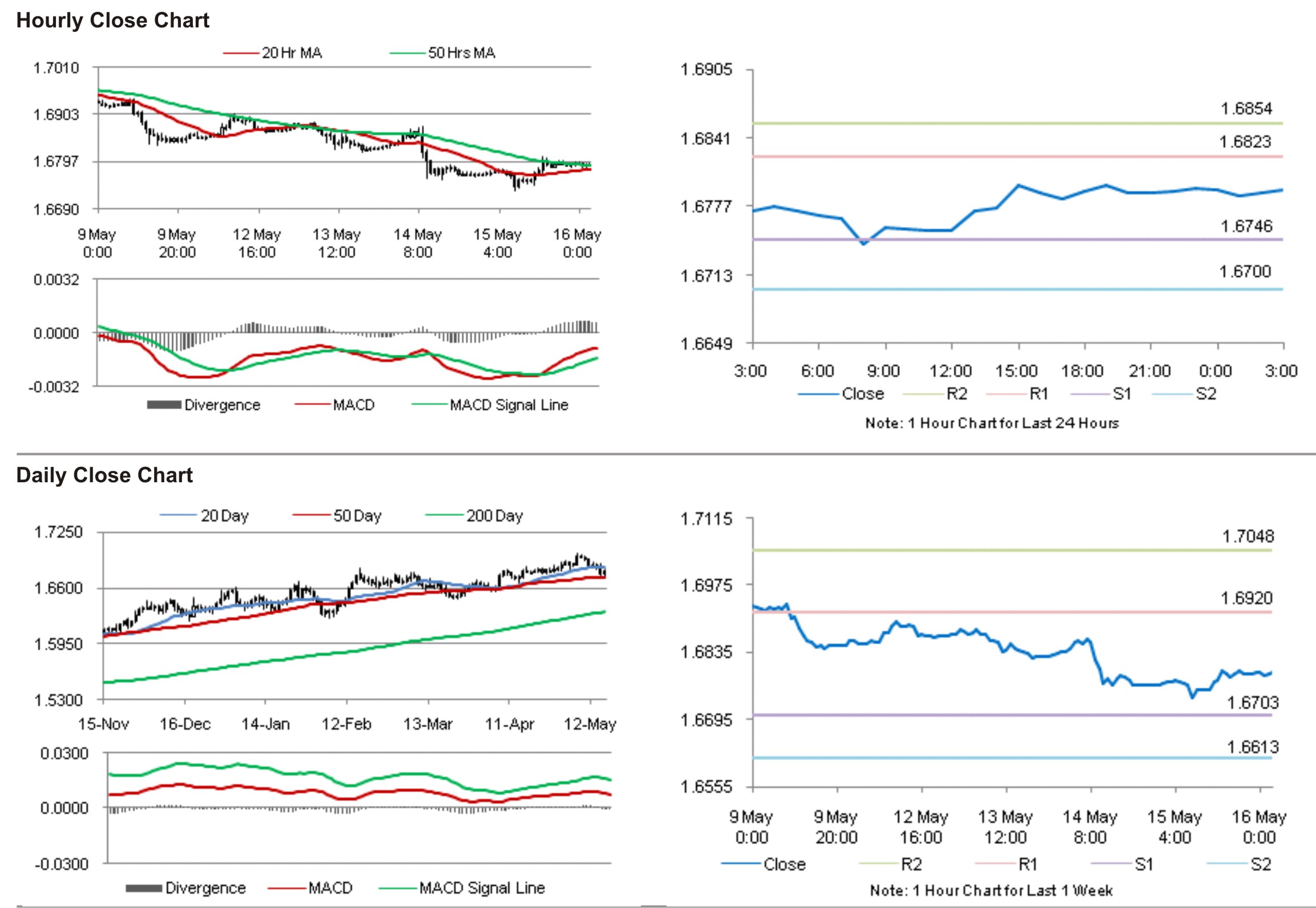

The pair is expected to find support at 1.6746, and a fall through could take it to the next support level of 1.6700. The pair is expected to find its first resistance at 1.6823, and a rise through could take it to the next resistance level of 1.6854.

Amid lack of major economic releases from the UK economy, later today, traders are expected to keep a tab on global economic news for further guidance in the currency pair.

The currency pair is trading just above its 20 Hr moving average and is showing convergence with its 50 Hr moving average.