Crude Oil prices declined 0.33% against the USD for the 24 hour period ending 23:00GMT, closing at 101.60, as traders continued to mull the EIA’s latest weekly report that showed crude stockpiles in the US expanded as output climbed to the most since 1986, last week. Adding to the pressure was a report from Libya that showed oil production from the nation totalled 300,000 barrels per day as its El Feel oil field started operating at full capacity and Wafa oil field resumed operations after protests ended. However, oil prices found some support after the International Energy Agency (IEA) raised its forecast on global oil demand by 35,000 barrels per day to around 1.3 million barrels a day for 2014 and projected the need for the OPEC to pump additional 800,000 barrels of crude oil per day in the second half of 2014.

In the Asian session, at GMT0300, Crude Oil is trading at 101.98, 0.37% higher from yesterday’s close.

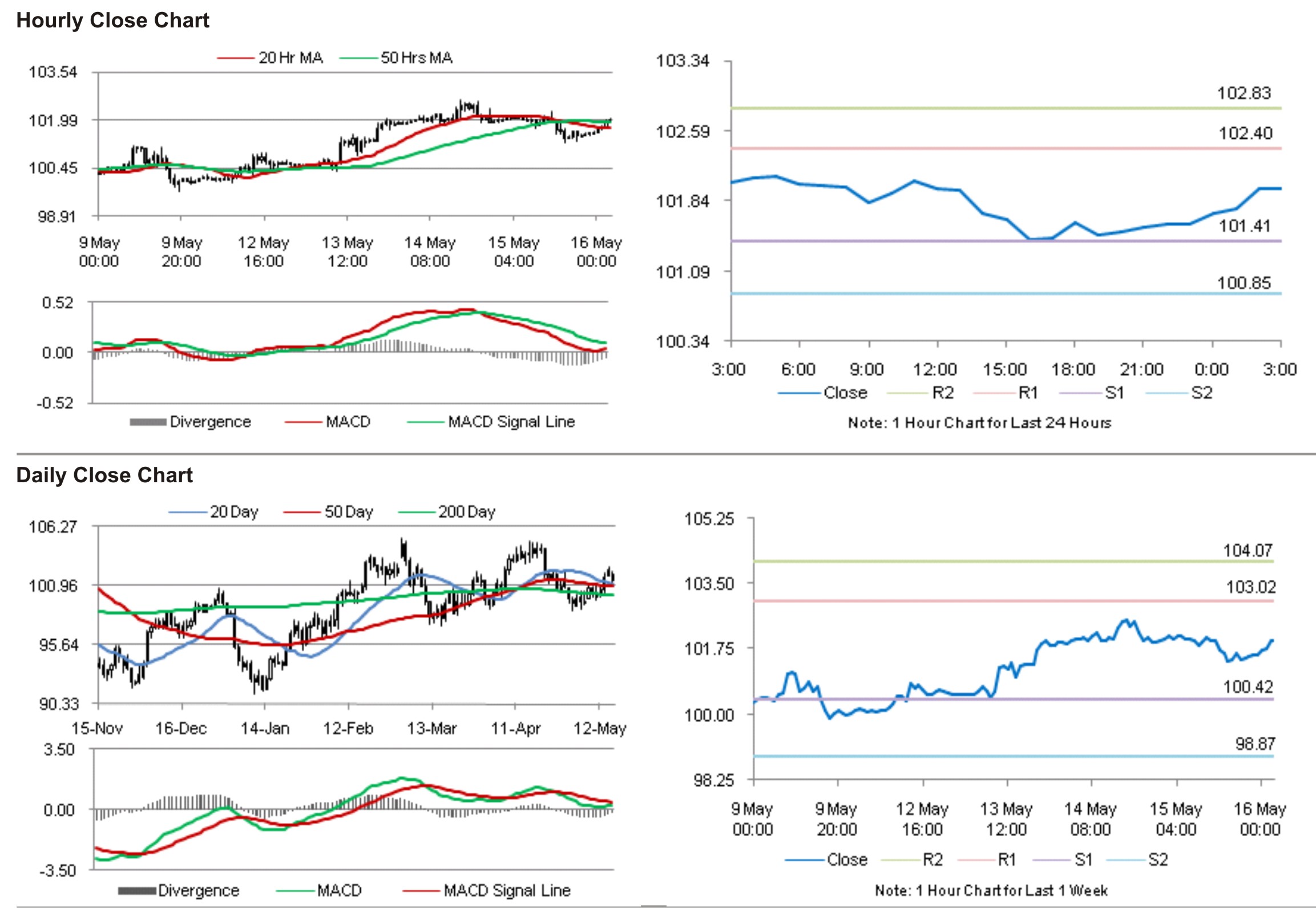

Crude oil is expected to find support at 101.41, and a fall through could take it to the next support level of 100.85. Crude oil is expected to find its first resistance at 102.40, and a rise through could take it to the next resistance level of 102.83.

Crude oil is trading above its 20 Hr moving average and is showing convergence with its 50 Hr moving average.