For the 24 hours to 23:00 GMT, the EUR rose 0.09% against the USD and closed at 1.3709. However, the gains in the Euro-zone’s shared currency were capped after the ECB policymakers, Yves Mersch and Ewald Nowotny projected inflation rate in the Euro-zone economy to remain low for a prolonged period of time, further emphasising that they do not see signs of deflation in the economy. Additionally, Yves Mersch hinted that the likelihood of the ECB taking action at its next policy meeting in June was very high.

Separately, another ECB official, Jens Weidmann opined that it would be a “shortsighted” approach for the ECB to only consider the Euro exchange rate for its monetary policy decision while ECB’s Benoit Coeure indicated that the economy still has “a way to go” to bring an end to the impact of the financial crisis on the Euro-zone’s capital markets.

On the economic front, the Euro-zone construction output fell 0.6% (MoM) for first time in five months in March. Meanwhile, the Bundesbank in its monthly report projected the German economy to grow at a slower pace in the second quarter, after registering a 0.8% growth during the first three months of 2014.

In the US, the San Francisco Fed President, John Williams projected the first rate hike in the world’s largest economy to occur “probably in the next year or so,” while indicating that he did not expect the US central bank to modify the pace of tapering its bond buying programme unless there is a dramatic change in the economic outlook.

In a noteworthy event, the Moody’s Investors Service indicated that the outlook on the US banking system remains stable as strong recovery in the economy “would further support the US banks’ asset quality over the next 12-18 months.”

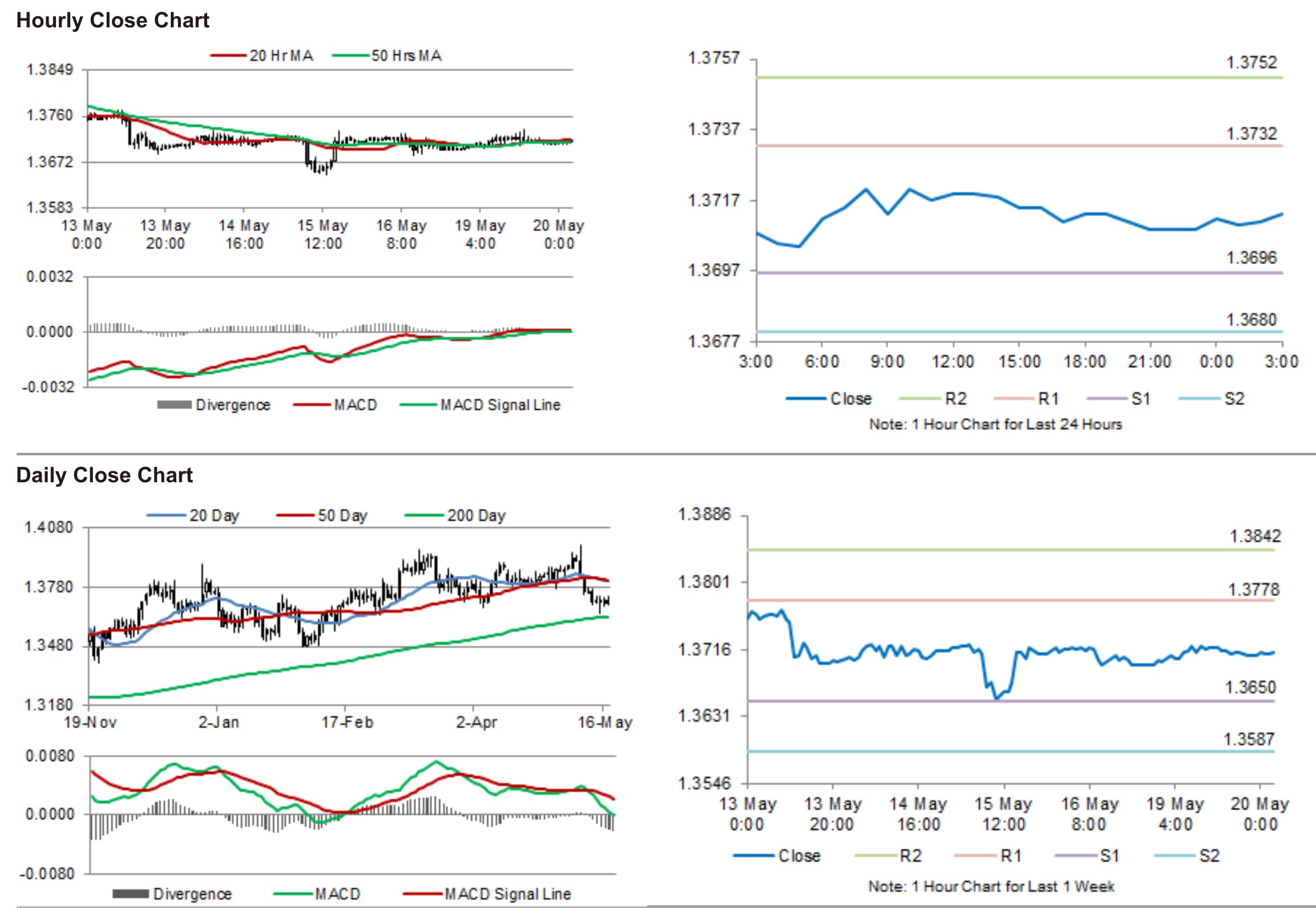

In the Asian session, at GMT0300, the pair is trading at 1.3713, with the EUR trading slightly higher from yesterday’s close.

The pair is expected to find support at 1.3696, and a fall through could take it to the next support level of 1.3680. The pair is expected to find its first resistance at 1.3732, and a rise through could take it to the next resistance level of 1.3752.

Traders are expected to keep a tab on Germany’s producer inflation and Italy’s industrial data, along with few planned speeches from Fed officials, William Dudley and Charles Plosser, due later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.