For the 24 hours to 23:00 GMT, the USD strengthened 0.32% against the JPY and closed at 101.77, buoyed by the recent batch of strong US manufacturing and housing data.

Yesterday, the BoJ, in its monthly economic survey, projected the Japanese economy to continue recovering at its current moderate pace despite a decline in demand following the recent sale-tax hike in April. Furthermore, the central bank forecasted exports from the world’s third largest economy to increase moderately in the near future with an improvement in Japan’s corporate profit and a moderate increase in domestic business fixed investment.

In the Asian session, at GMT0300, the pair is trading at 101.79, with the USD trading a tad higher from yesterday’s close.

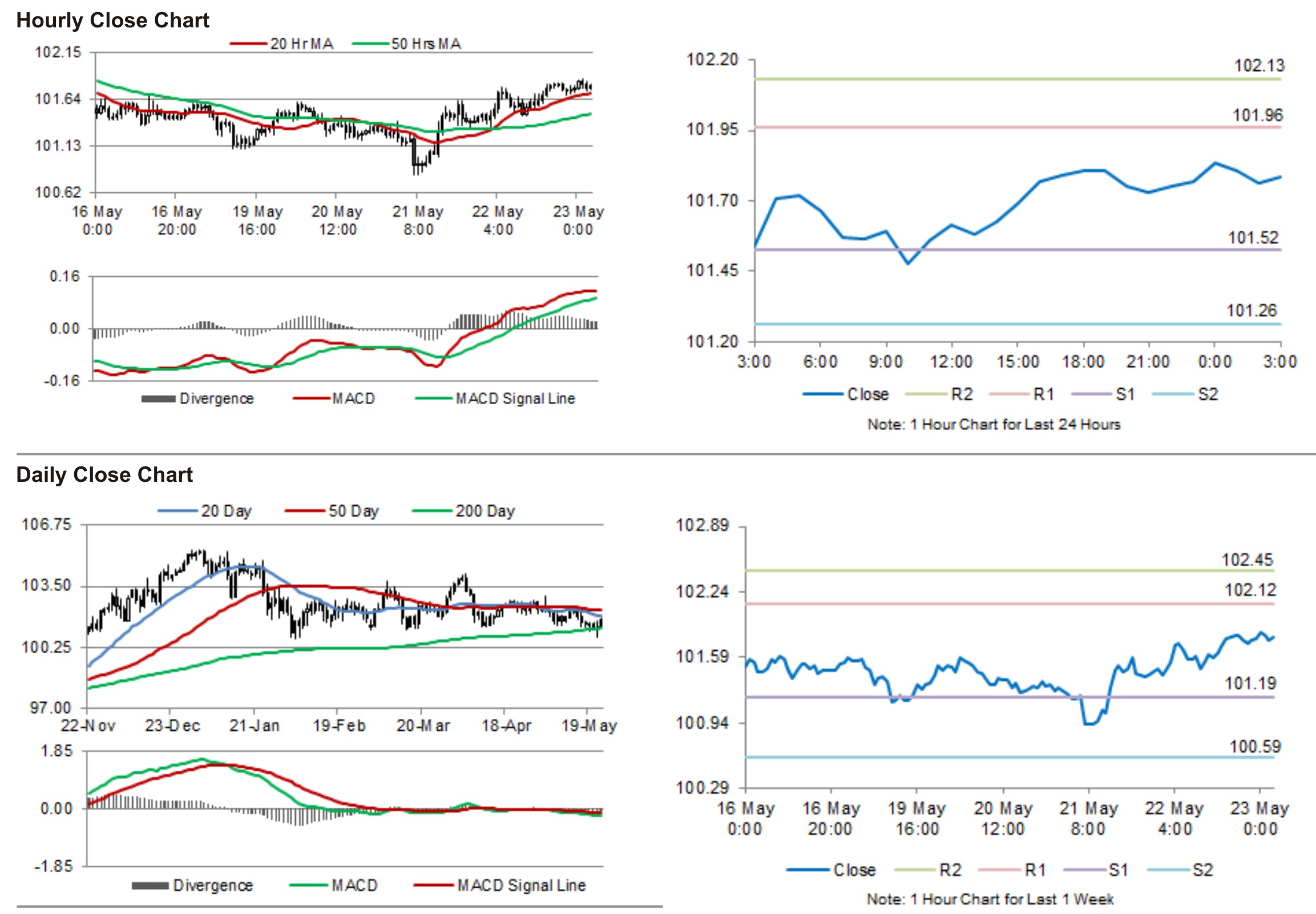

The pair is expected to find support at 101.52, and a fall through could take it to the next support level of 101.26. The pair is expected to find its first resistance at 101.96, and a rise through could take it to the next resistance level of 102.13.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.