For the 24 hours to 23:00 GMT, the EUR rose 0.13% against the USD and closed at 1.3645, recovering from its initial losses which were triggered by ECB President’s dovish remarks and following early results from the European Parliament elections.

ECB President, Mario Draghi, citing a likely threat from a prolonged period of low inflation and weak lending in the Euro-zone economy, reiterated that the central bank could consider policy tools such as a further cut to its record-low 0.25% interest rate or a QE programme, at its policy meeting next month. Negative sentiment for the Euro was also fuelled as victories of nationalist, Eurosceptic parties from France and Britain spurred concerns on the political stability of the Euro-zone. However, the Euro-zone’s shared currency received some support after the Gfk’s barometer on German consumer confidence remained unchanged at a 7-year high reading of 8.5 in June.

In a key development, on Friday, the S&P’s raised Spain’s credit rating by one level to “BBB” with a “Stable” outlook, citing optimism on the nation’s recovering economy.

In the Asian session, at GMT0300, the pair is trading at 1.3661, with the EUR trading 0.12% higher from yesterday’s close.

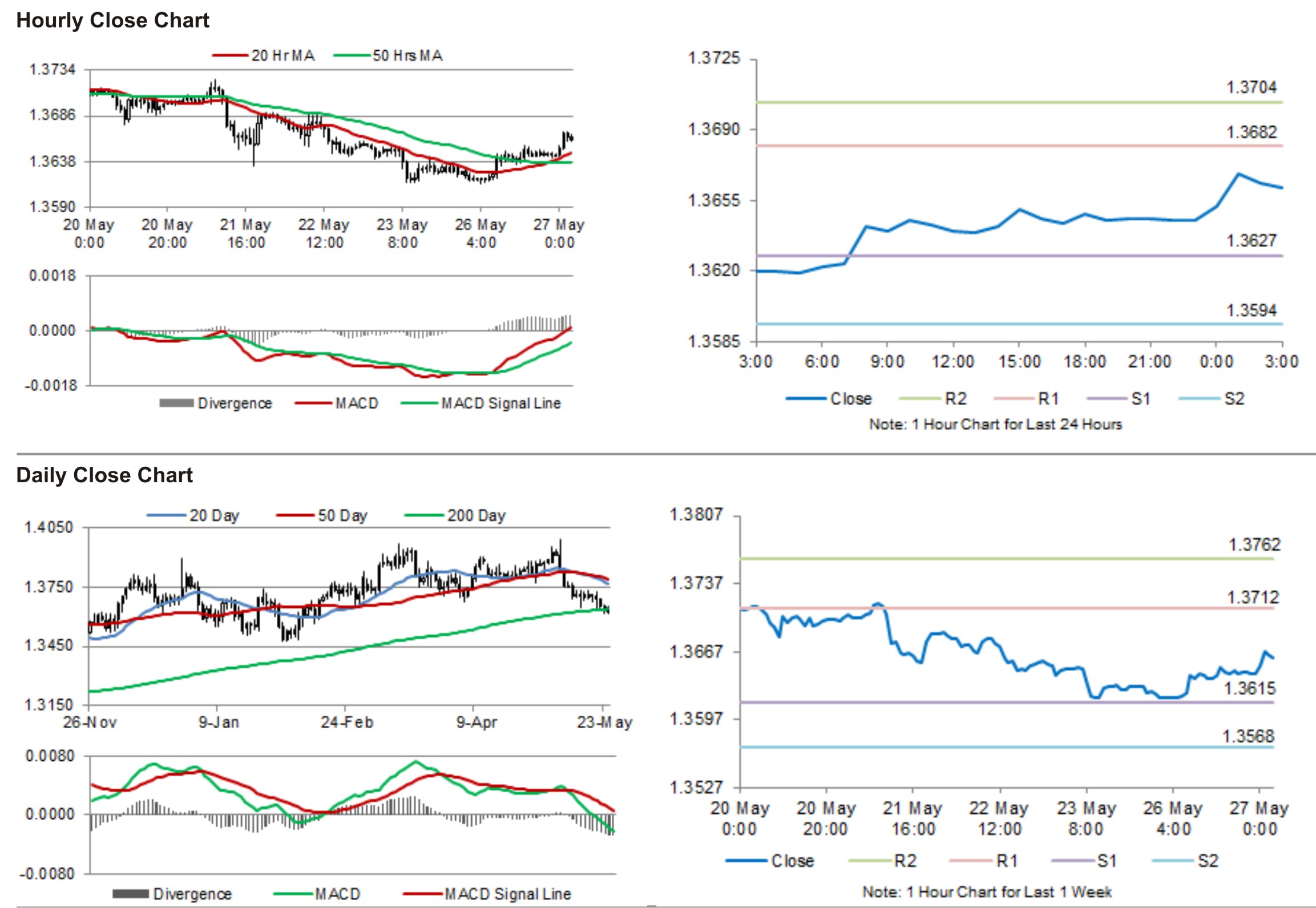

The pair is expected to find support at 1.3627, and a fall through could take it to the next support level of 1.3594. The pair is expected to find its first resistance at 1.3682, and a rise through could take it to the next resistance level of 1.3704.

Traders are expected to keep a close tab on a planned speech by the ECB President, Mario Draghi and consumer confidence data from France and Italy, due later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.