For the 24 hours to 23:00 GMT, the GBP fell 0.19% against the USD and closed at 1.6810, as the latest batch of encouraging economic data from the US spurred demand for the greenback.

Meanwhile, in the UK, the BoE Governor, Mark Carney, citing growing global inequality, urged both authorities and market participants to introduce fundamental reforms to eradicate the same. Furthermore, he highlighted the need for a clear and trustworthy financial system in his nation to help and support UK’s long-term prosperity.

On the economic front, the British Bankers’ Association (BBA) reported that UK banks approved 42,173 mortgages in April, the lowest number of mortgages since August 2013.

In the Asian session, at GMT0300, the pair is trading at 1.6813, with the GBP trading a tad higher from yesterday’s close.

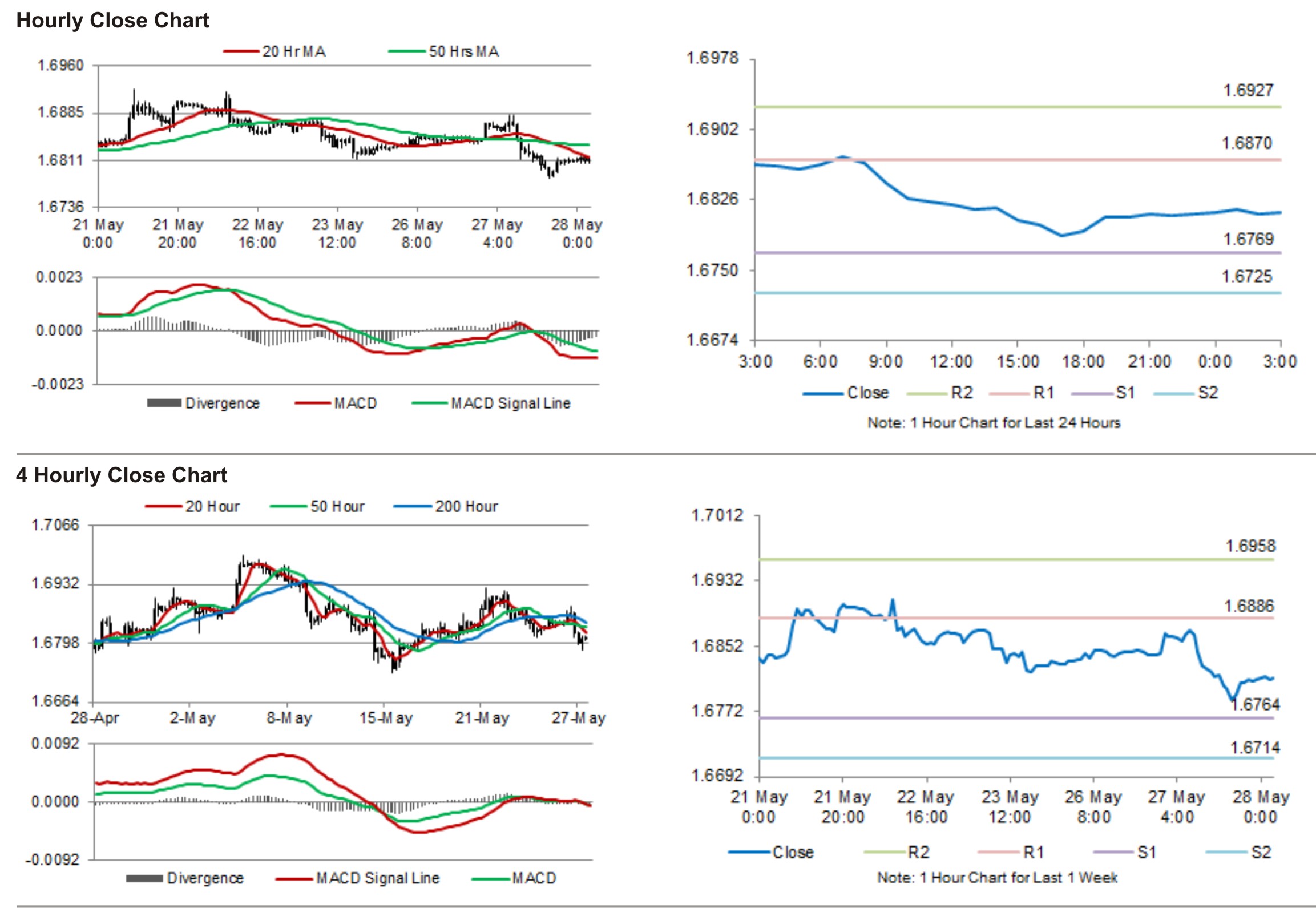

The pair is expected to find support at 1.6769, and a fall through could take it to the next support level of 1.6725. The pair is expected to find its first resistance at 1.6870, and a rise through could take it to the next resistance level of 1.6927.

Later today, the CBI is expected to report the UK distributive trades survey, an important indicator to gauge the short-term trends in the nation’s retail and wholesale distribution sector.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.