For the 24 hours to 23:00 GMT, the USD strengthened 0.06% against the JPY and closed at 101.99, following the recent batch of healthy economic releases from the US economy.

Meanwhile, in Japan, media reports showed that the BOJ was mulling an exit from its 13-month-old quantitative and qualitative monetary easing on the back of growing optimism on growth-outlook of the economy.

In the Asian session, at GMT0300, the pair is trading at 101.93, with the USD trading marginally lower from yesterday’s close. Earlier today, at a BOJ’s international conference, the BoJ Governor, Haruhiko Kuroda, highlighted the possibility for Japan’s central bank to implement easing measure even when “the policy rate is around 0.0%”

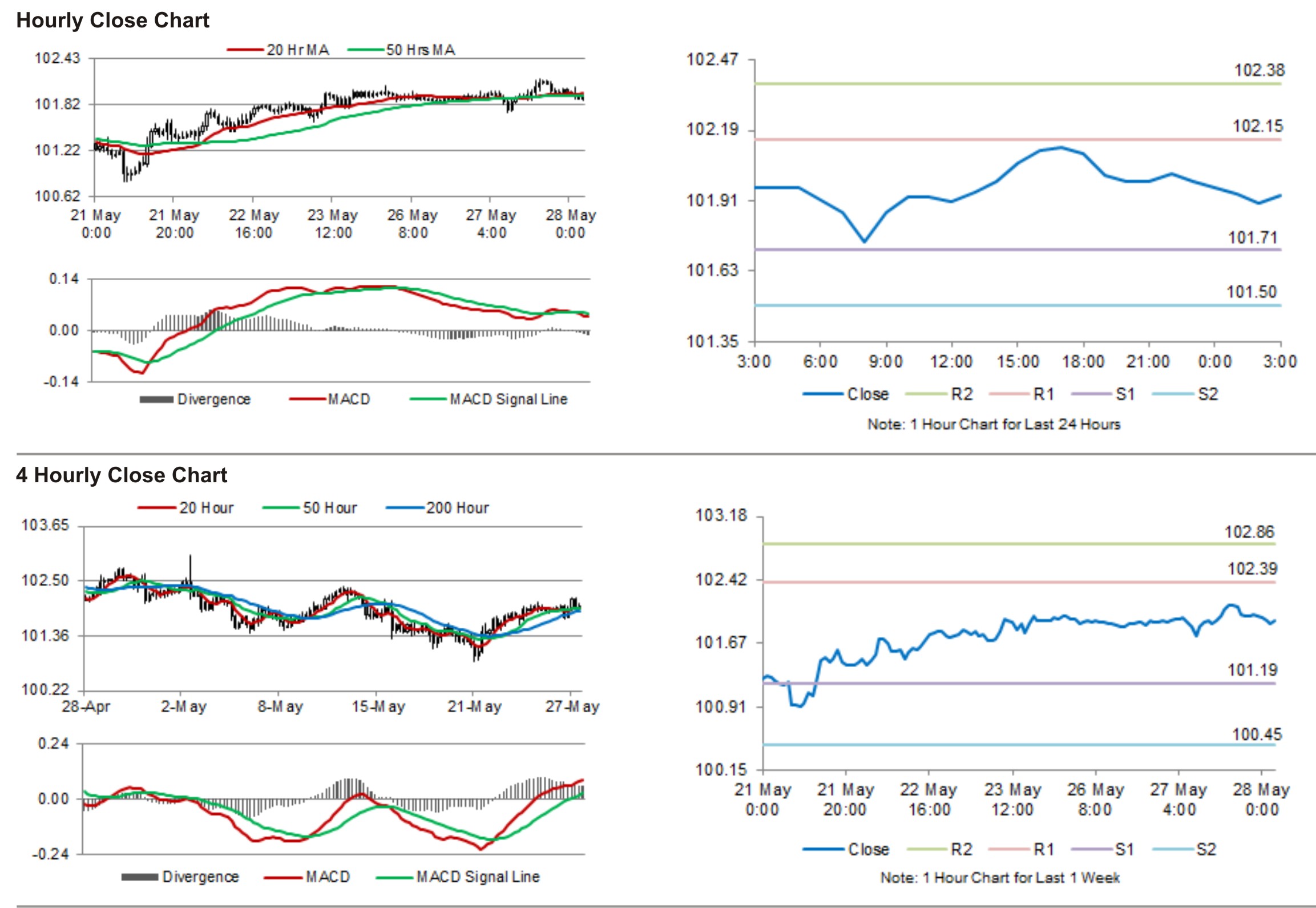

The pair is expected to find support at 101.71, and a fall through could take it to the next support level of 101.50. The pair is expected to find its first resistance at 102.15, and a rise through could take it to the next resistance level of 102.38.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.