For the 24 hours to 23:00 GMT, the USD rose 0.20% against the CHF and closed at 0.8967, buoyed by the recent batch of strong economic releases from the world’s largest economy.

Meanwhile, the Swiss Franc came under pressure after official data revealed that Switzerland added less-than-expected 4.192 million jobs in the first quarter of 2014, after adding 4.189 million jobs in the previous quarter. However, Swiss trade surplus widened more than market expectations to CHF 2.425 billion in April, from a revised surplus of CHF 1.996 billion.

In the Asian session, at GMT0300, the pair is trading at 0.8968, with the USD trading a tad higher from yesterday’s close.

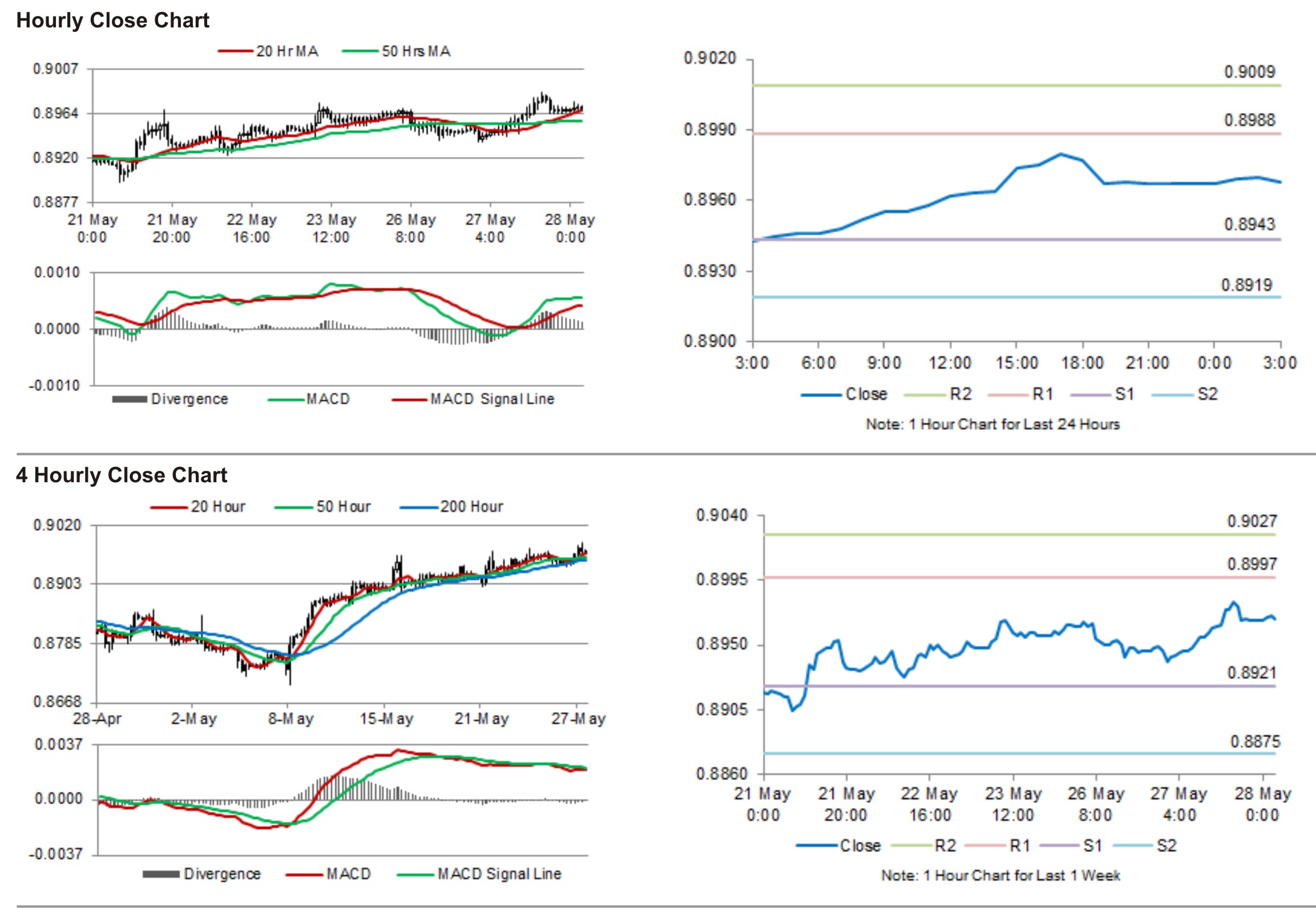

The pair is expected to find support at 0.8943, and a fall through could take it to the next support level of 0.8919. The pair is expected to find its first resistance at 0.8988, and a rise through could take it to the next resistance level of 0.9009.

Looking forward, traders would keenly eye the release of the Swiss GDP and the consumption indicator data for further cues in the Swiss Franc.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.