Gold prices plunged 2.17% against the USD in the 24 hour period ending 23:00GMT, at 1264.10 per ounce, as a rally in the US equity markets and the latest batch of upbeat US economic releases increased investors’ risk-taking appetite and weighed on the demand-outlook of the safe-haven metal as an alternate investment. Negative sentiment was also fuelled after data showed that gold imports to China from Hong Kong slipped to a 14-month low level in April. However, holdings in the SPDR Gold Trust rose by 8.39 tonnes to 785.28 tonnes on Tuesday. Meanwhile, a separate report showed that dozens of pro-Russian separatists were killed by Ukraine government forces at a regional airport on Tuesday.

In the Asian session, at GMT0300, Gold is trading at 1264.8, 0.06% higher from yesterday’s close.

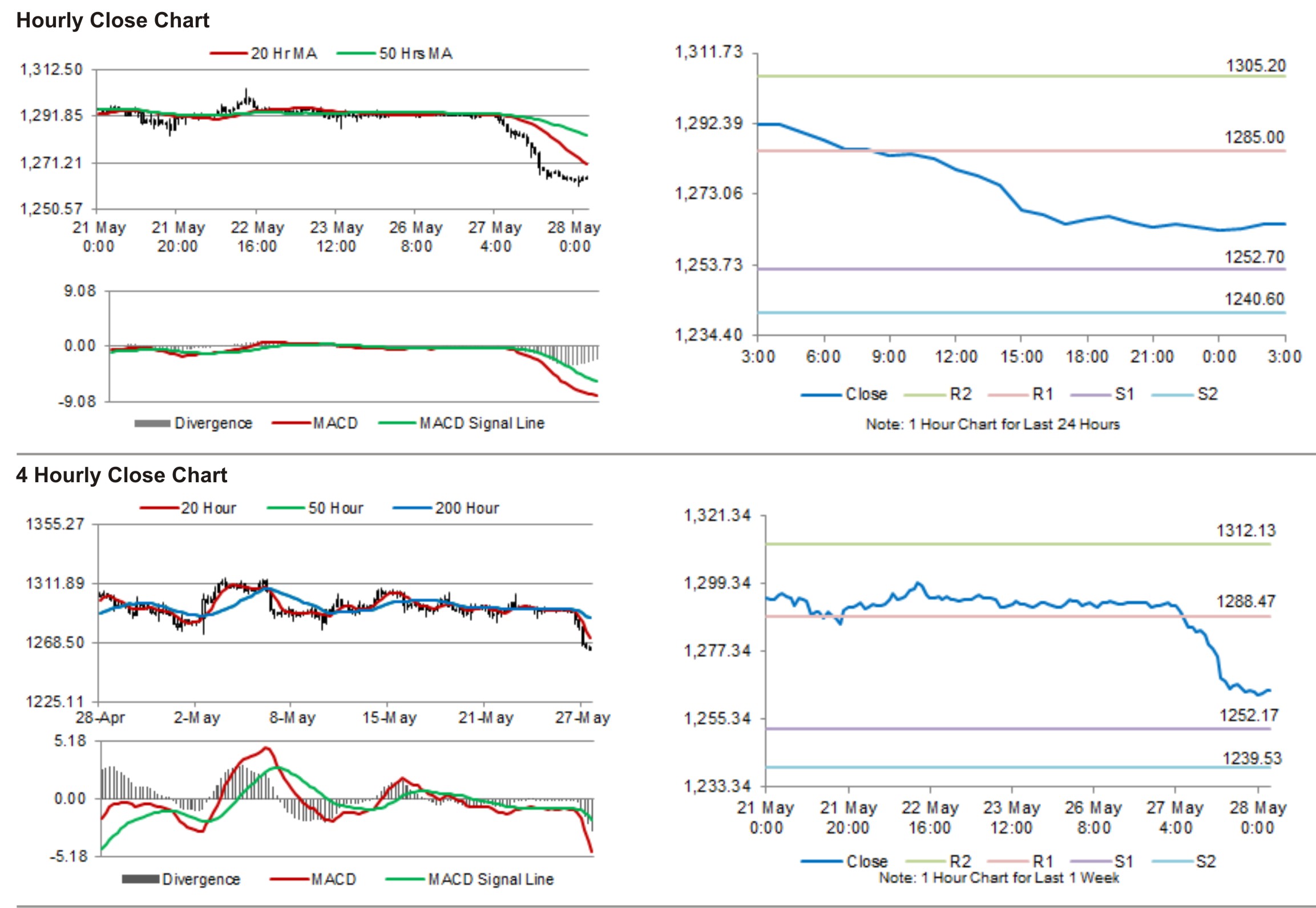

Gold is expected to find support at 1252.70, and a fall through could take it to the next support level of 1240.60. Gold is expected to find its first resistance at 1285.00, and a rise through could take it to the next resistance level of 1305.20.

The yellow metal is trading below its 20 Hr and 50 Hr moving averages.