For the 24 hours to 23:00 GMT, AUD strengthened 0.78% against the USD, on Friday, to close at 1.0686, following better than expected US jobs data and expectations that Australian interest rates may go up soon.

On Friday, the Reserve Bank of Australia (RBA) gave strong hints that it may need to tighten monetary policy further. In economic news, a monthly business survey by National Australia Bank (NAB) showed that the business conditions index fell 4 points to 5, while the business sentiment index shed 2 points to reach 7.

In the Asian session at 3:00GMT, the pair is trading at 1.0755, 0.65% higher from the New York session close.

LME Copper traded flat at $ 8,789.5/ MT. Aluminium prices dropped 2.7% or $71.3/MT to $ 2,609.3/ MT.

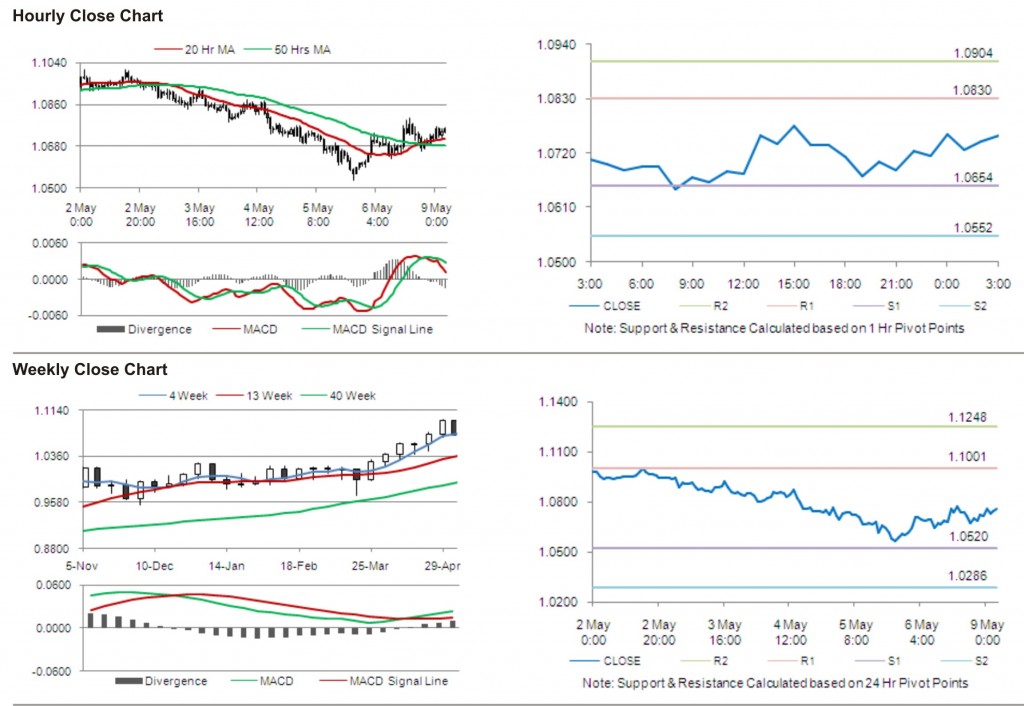

The pair is expected to find first short term resistance at 1.0830, with the next resistance levels at 1.0904 and 1.1080, subsequently. The first support for the pair is seen at 1.0654, followed by next supports at 1.0552 and 1.0376 respectively.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.