Gold prices traded higher by 0.21% against the USD in the 24 hour period ending 23:00GMT, at 1318.50 per ounce, as a weakness in the US equity markets and lingering geo-political tensions in Iraq, bolstered the demand-outlook of the precious metal. Separately, the latest batch of soft economic releases from the US and the German economy also lured investors to favour the safe-haven metal.

Reports from Iraq revealed that Iraqi parties pressurised Prime Minister, Nouri al-Maliki to step down and make provisions to form a new national government by 1 July 2014.

Elsewhere, media reports showed that Singapore would launch gold futures contract on Wednesday, a viable alternative to the metal’s global benchmark, which is currently under regulatory scrutiny.

In the Asian session, at GMT0300, Gold is trading at 1312.10, 0.49% lower from yesterday’s close.

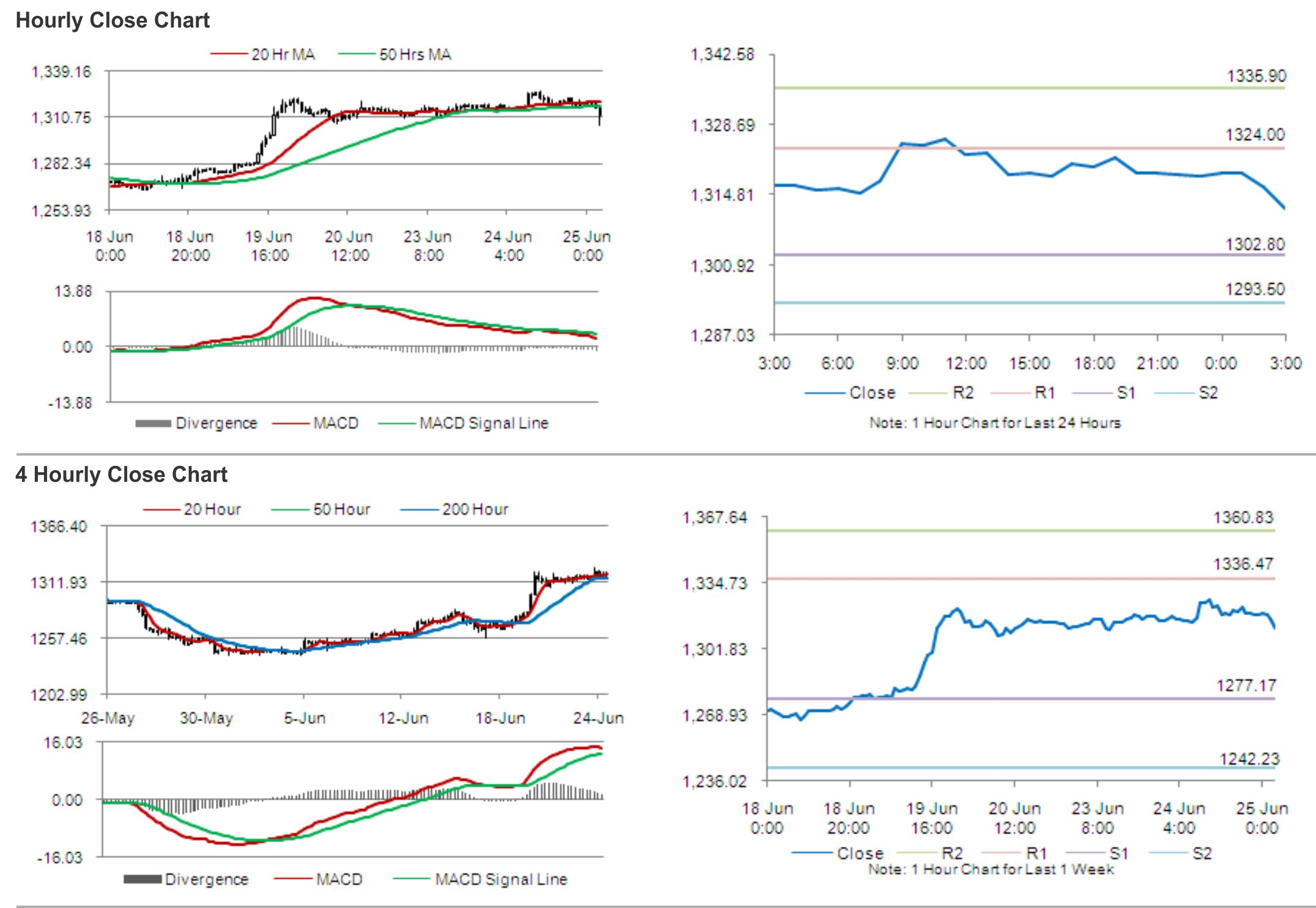

Gold is expected to find support at 1302.80, and a fall through could take it to the next support level of 1293.50. Gold is expected to find its first resistance at 1324.00, and a rise through could take it to the next resistance level of 1335.90.

The yellow metal is trading below its 20 Hr and 50 Hr moving averages.